Kent Global PLC has signed a binding agreement to buy Exceed Holdings Ltd., marking the integrated energy services company’s expansion into the decommissioning market.

“This acquisition positions Kent at the forefront of a market set to double in size over the next decade, with global offshore decommissioning spend expected to rise from $8 billion to $16 billion per year by 2035”, Dubai-based Kent said in a statement online.

Aberdeen-headquartered Exceed says it operates in over 40 countries and is one of only three licensed well operators in the United Kingdom.

Kent says it has a workforce deployed across 34 countries, totaling over 13,000 employees. It offers consulting, engineering, commissioning, and operations and maintenance services. Kent is present or investing in the sectors of onshore and offshore oil, refining, integrated gas, offshore wind, alternative fuels, energy storage, carbon capture, water, chemicals, plastics and industrial infrastructure.

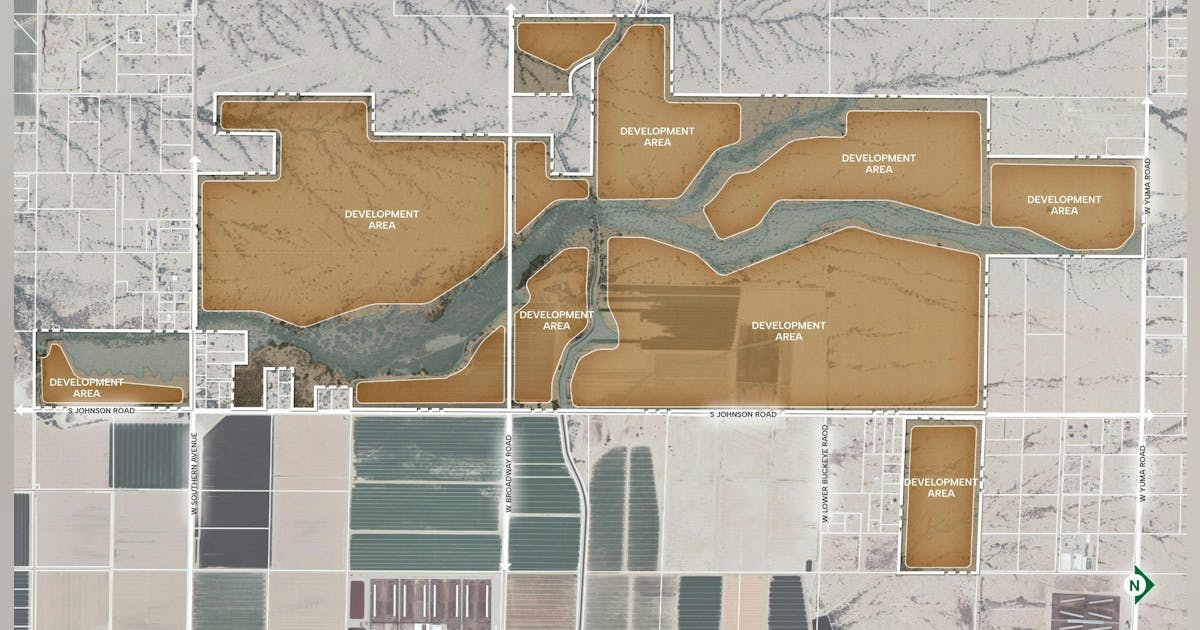

“The deal also unlocks significant opportunities in the energy transition space”, Kent added. “Exceed is already repurposing reservoirs for carbon capture and hydrogen storage projects, and combined with Kent’s existing expertise in this space will bring an unmatched offering to the marketplace”.

“Exceed’s specialist capabilities in well and reservoir management, coupled with their strong reputation in decommissioning, complement our vision of offering full lifecycle services to our clients”, said Kent chief executive John Gilley. “Together, we will be uniquely positioned to help the industry navigate energy security, net-zero mandates and the safe retirement of offshore assets”.

For Exceed, the merger “gives us the financial backing and global reach to scale our expertise to new markets and opportunities, while preserving the same culture, entrepreneurial spirit and values that define us”, Exceed managing director Ian Mills said.

The companies did not disclose the financial details of the transaction, which they expect to close this year.

Exceed is Kent’s second acquisition this year, after Sudlows Consulting. Kent completed the purchase of Sudlows, also domiciled in Dubai and with offices in India, Saudi Arabia and South Africa, in the first quarter.

“This milestone marks Kent’s strategic entry into the high-growth international data center engineering market and strengthens its commitment to sector diversification and sustainability”, Kent said February 25.

“The global data center sector has experienced extraordinary growth, with a 16 percent CAGR between 2017 and 2024, and forecasts indicating an 11 percent CAGR from 2024 to 2028”, Kent noted.

“This surge is fueled by global megatrends such as increasing data usage, cloud adoption, the rise of artificial intelligence and data sovereignty regulations mandating local data hosting. These trends present a non-cyclical growth opportunity expected to span decades”.

“Together, we will shape the future of data center engineering while advancing global security and reducing environmental impact”, Gilley said.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR