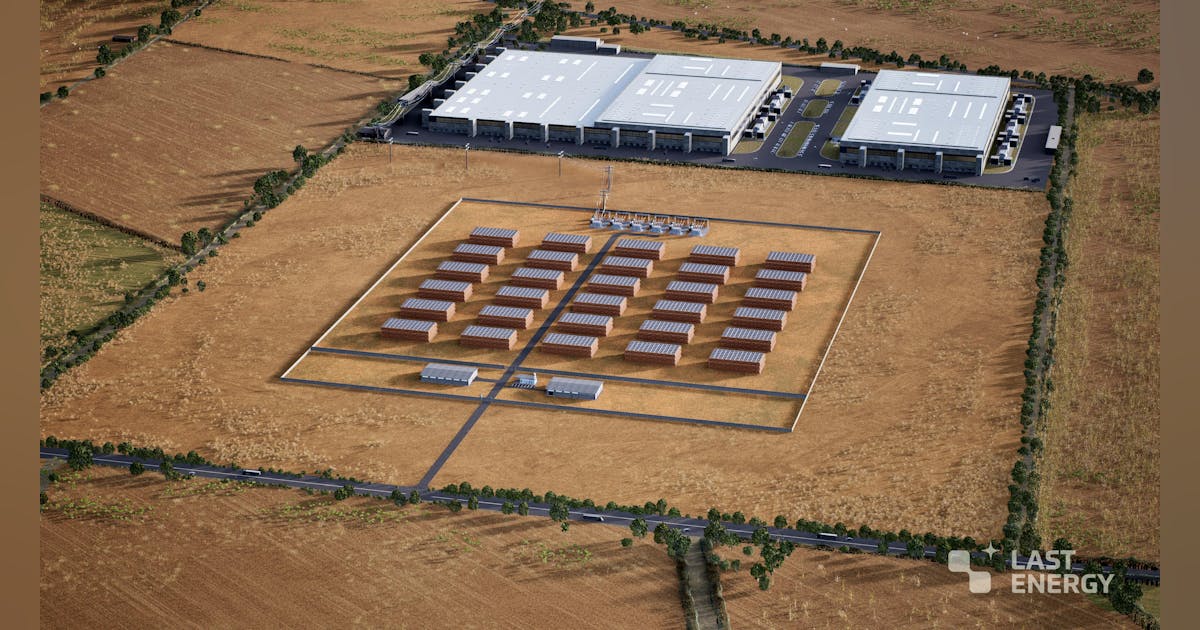

As the demand for data center power surges in Texas, nuclear startup Last Energy has now announced plans to build 30 microreactors in the state’s Haskell County near the Dallas-Fort Worth Metroplex. The reactors will serve a growing customer base of data center operators in the region looking for reliable, carbon-free energy. The plan marks Last Energy’s largest project to date and a significant step in advancing modular nuclear power as a viable solution for high-density computing infrastructure.

Meeting the Looming Power Demands of Texas Data Centers

Texas is already home to over 340 data centers, with significant expansion underway. Google is increasing its data center footprint in Dallas, while OpenAI’s Stargate has announced plans for a new facility in Abilene, just an hour south of Last Energy’s planned site. The company notes the Dallas-Fort Worth metro area alone is projected to require an additional 43 gigawatts of power in the coming years, far surpassing current grid capacity.

To help remediate, Last Energy has secured a 200+ acre site in Haskell County, approximately three and a half hours west of Dallas. The company has also filed for a grid connection with ERCOT, with plans to deliver power via a mix of private wire and grid transmission. Additionally, Last Energy has begun pre-application engagement with the U.S. Nuclear Regulatory Commission (NRC) for an Early Site Permit, a key step in securing regulatory approval.

According to Last Energy CEO Bret Kugelmass, the company’s modular approach is designed to bring nuclear energy online faster than traditional projects. “Nuclear power is the most effective way to meet Texas’ growing energy demand, but it needs to be deployed faster and at scale,” Kugelmass said. “Our microreactors are designed to be plug-and-play, enabling data center operators to bypass the constraints of an overloaded grid.”

Scaling Nuclear for Digital Infrastructure

This project follows Last Energy’s expansion into Europe, where the company has agreements to deliver 39 microreactors to data centers. Texas marks the company’s first major U.S. deployment, positioning nuclear as a key player in data center energy strategies.

Last Energy’s modular microreactors offer several advantages:

- Faster deployment: Units can be delivered within 24 months, compared to the decade-long timeline of conventional nuclear plants.

- Scalability: Facilities can expand incrementally to meet growing energy demand without requiring massive upfront infrastructure investments.

- Grid independence: Private-wire options allow data centers to sidestep grid constraints and price volatility while adding local energy capacity.

Leading up to the present announcment, the company has already demonstrated its technology in Texas. In June 2023, Last Energy fabricated a full-scale, nine-module prototype. By February 2025, the company co-founded the Texas Nuclear Alliance, a coalition aimed at accelerating nuclear deployment in the state.

The Role of Nuclear in Texas’ Energy Future

Texas has long been a leader in energy production, but its power grid has struggled to keep pace with demand. The state’s rapid population growth and industrial expansion—especially in power-intensive sectors like AI and cloud computing—have exposed vulnerabilities in ERCOT’s ability to deliver consistent electricity.

Traditionally, Texas has relied on a mix of natural gas, wind, and solar to meet its growing power needs. However, wind and solar face certain intermittency issues, while natural gas prices remain volatile. Nuclear power provides a stable, zero-carbon alternative, yet the U.S. has traditionally been slow to approve new nuclear developments. That, of course, is changing, as evidenced by moves such as last year’s ADVANCE Act, intended to boost nuclear reactor deployment across the country, explicitly involving microreactor technologies.

Microreactors like Last Energy’s PWR-20 are designed to bypass many of the regulatory and construction bottlenecks that have historically delayed nuclear projects. By shifting nuclear from a large-scale construction project to a mass-manufactured product, Last Energy is positioning its technology as a key enabler of Texas’ digital economy.

A Model for the Future of Energy and Data Centers

With Texas aiming to become both a global data center hub and a leader in next-generation nuclear energy, Last Energy’s project represents a crucial test case. If successful, it could serve as a model for deploying microreactors across the U.S. to support industrial-scale energy users.

The company’s decision to develop this project using purely private financing also underscores the commercial viability of small-scale nuclear solutions. By aligning with data center operators—one of the fastest-growing power consumers in the world—Last Energy is not only addressing an urgent industry need but also demonstrating a pathway for scaling nuclear in the U.S.

With site control secured, regulatory engagement underway, and commercial demand accelerating, moves such as Last Energy’s bet on nuclear-powered data centers could reshape the energy landscape for high-density computing.

In the video below, Last Energy’s SVP, Commercial, Michael Crabb, explains the company’s modular microreactor platform to attendees of Data Center World 2023.