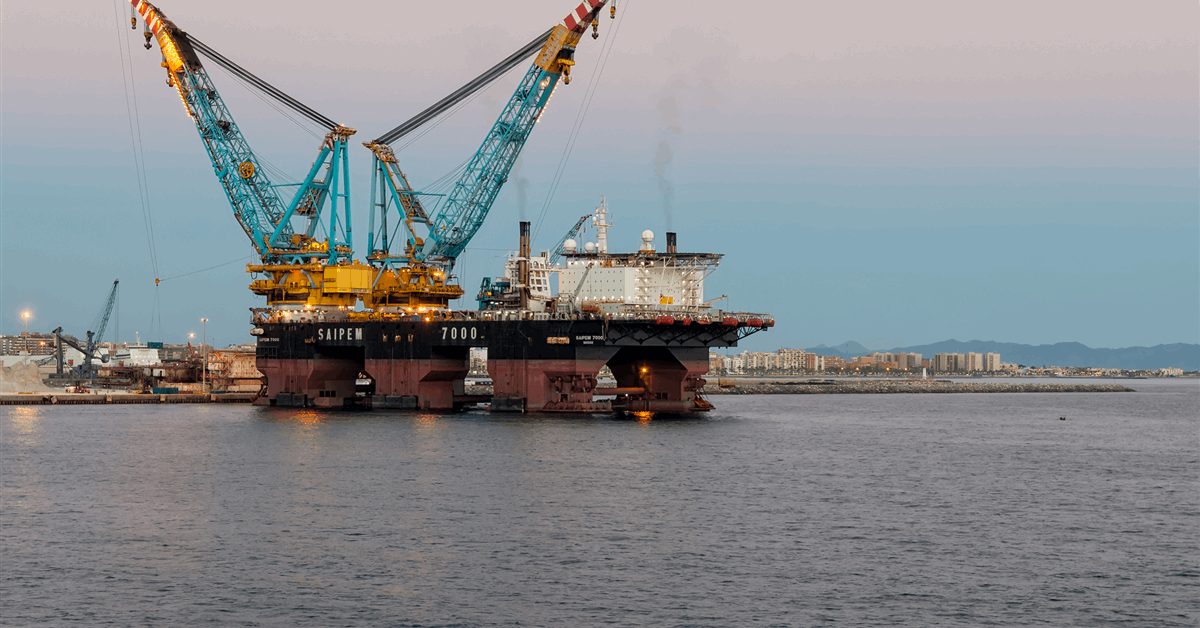

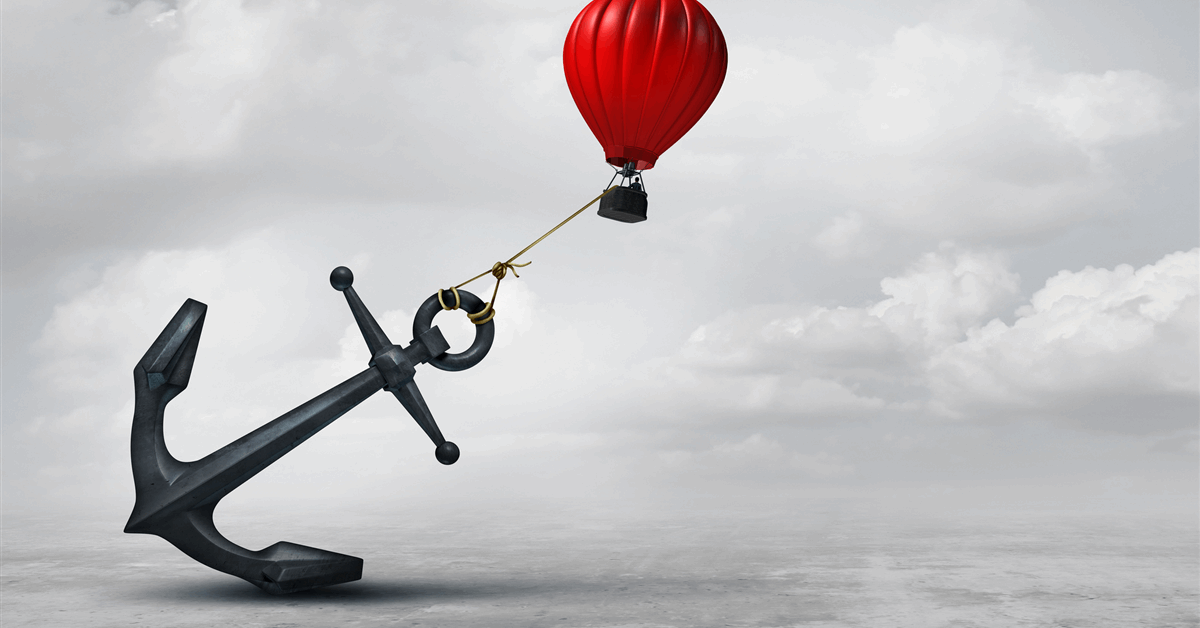

In a BMI report sent to Rigzone by the Fitch Group late Monday, analyst at BMI, a unit of Fitch Solutions, said “leading energy companies, such as BP, Shell, TotalEnergies, and Equinor” are “holding back renewables commitments to secure higher short-term return” but warned that a “bearish oil and gas price outlook will squeeze profit margins”.

The BMI analysts outlined in the report that, in recent years, “leading energy companies have set ambitious goals” for renewable energy investment and achieving net-zero emissions.

“BP aimed to cut oil and gas output by 40 percent by 2030 and invest $10 billion in renewable energy by 2030, while Shell committed to halving its carbon emissions by 2030 and reaching net-zero by 2050,” the analysts pointed out in the report, adding that “TotalEnergies had pledged to invest up to $5 billion annually in low-carbon energy”.

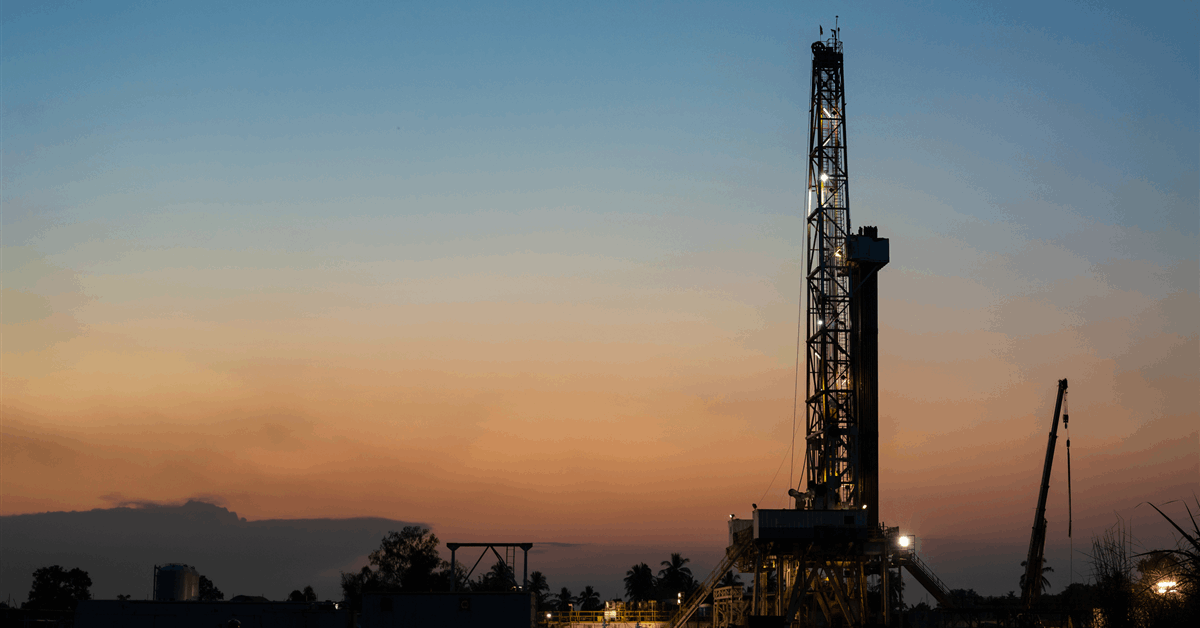

The BMI analysts noted in the report that these companies are now revising their strategies, scaling back renewable commitments and focusing more on fossil fuels to secure higher short-term returns.

“Equinor halved its low carbon investment from $10 billion to $5 billion. BP has abandoned its 2030 oil output reduction target and is divesting its U.S. onshore wind business. Shell has weakened its carbon reduction targets and is investing in Bonga North deep-water oil and gas project in Nigeria,” the BMI analysts said in the report.

“The primary drivers behind these strategic pivots include rising costs and supply chain disruptions of renewable projects, as well as the need to enhance energy security,” they added.

“Leading energy companies are shifting focus … [to] oil and gas business[es], which gives higher return in the short term in response to shareholder demand,” they continued.

The analysts warned in the report, however, that “oil and gas business profit margin is expected to decline”. They noted in the report that BMI’s oil and gas team holds a “bearish outlook for [the] oil and gas price in 2025 due to anticipated increase in supply from non-OPEC+ producers and the unwinding of the OPEC+ production cut agreement”.

“These leading publicly traded companies are expected to slow down capex in 2025 to prioritize shareholder returns over increased investment due to lower prices,” the analysts said in the report.

“Despite this outlook, companies are betting on oil and gas investments to yield better returns than renewable projects in the short term,” they added.

A BMI report sent to Rigzone by the Fitch Group on February 14 showed that BMI expected the front month Brent crude price to drop from an average of $79.9 per barrel in 2024 to an average of $76 per barrel this year, and the front month WTI crude price to drop from an average of $75.8 per barrel in 2024 to an average of $73 per barrel in 2025.

BMI saw the front month natural gas Henry Hub price rising from an average of $2.4 per million British thermal units (MMBtu) in 2024 to an average of $3.4 per MMBtu in 2025, according to the report, which revealed that the company saw the front month natural gas TTF price dropping from an average of EUR 34.6 per megawatt hour (p/MWh) in 2024 to an average of EUR 32.0 p/MWh this year.

Rigzone has contacted BP, Shell, TotalEnergies, and Equinor for comment on BMI’s reports. BP declined to comment. Shell, TotalEnergies, and Equinor have not responded to Rigzone at the time of writing.

BMI has a 40 year track record of supporting investors, risk managers, and strategists, Fitch Solutions’ website states. BMI has “in-depth data and research for over 200 markets and more than 20 industries”, according to the site.

To contact the author, email [email protected]