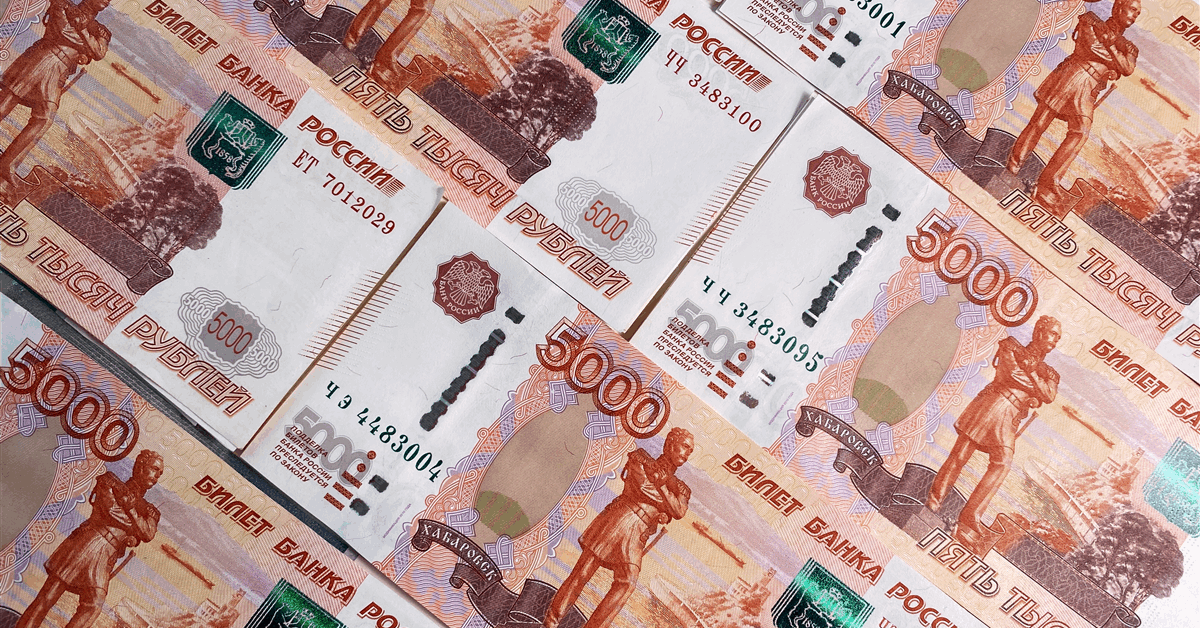

Sweeping US sanctions on Russia’s oil industry are unlikely to result in a “large hit” to production, as higher freight rates and the nation’s cheap crude support the trade, according to Goldman Sachs Group Inc.

Rising fees have encouraged non-sanctioned ships to move Russian crude, filling the gap left by blacklisted tankers, analysts including Callum Bruce wrote in a note dated Jan. 24. The deepening discount of ESPO oil also creates strong incentives for price-sensitive traders and refiners to keep buying.

Russia’s oil revenues have edged up modestly since the Biden administration implemented the sanctions earlier this month, and Western policymakers are expected to prioritize maximizing discounts rather than reducing volumes, according to Goldman. Total exports remain “fairly stable.”

Still, uncertainty around the impact of the sanctions is “high, especially because certain wind-down transactions are authorized through March 12,” the analysts wrote in the note.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR

Bloomberg