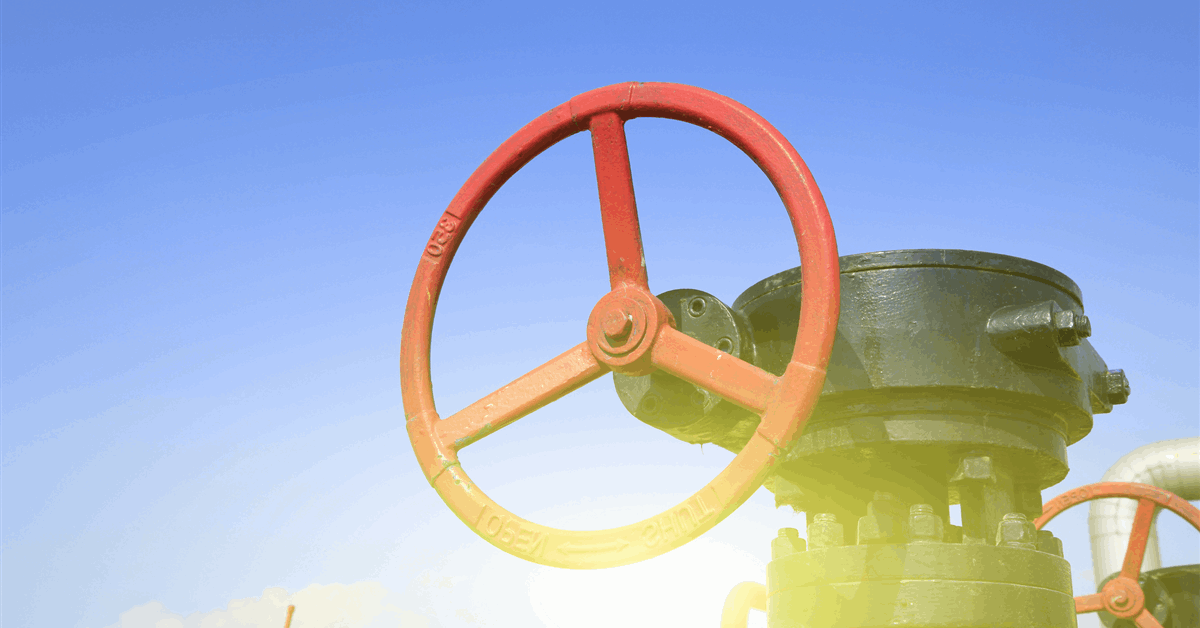

Russian energy giant Lukoil PJSC dissolved the supervisory board of its international business, the latest sign of how US sanctions — the first of which begin on Friday — are affecting the firm.

As part of the dissolution, the Moscow-based firm “recalled” Sergei Kochkurov, chief executive officer of the parent company, as well as Evgeny Khavkin and Gennady Fedotov. The step, taken during an Oct. 28 board meeting, was posted by Lukoil International GmbH on Austria’s corporate register on Friday.

The US Treasury’s Office of Foreign Assets Control announced on Oct. 22 that it was sanctioning Lukoil and fellow Russian giant Rosneft PJSC. The measures start today although some actions against Lukoil assets have been delayed until Dec. 13.

The move stressed the firm globally: Russian oil prices plunged, its international trading business Litasco has shed staff and wound up at least some operations. Lukoil’s share of revenue from the West Qurna 2 oil field in Iraq has been frozen by Baghdad and western suitors are circling the firm’s global assets.

The decision to dissolve the board and recall Lukoil International’s overseers will leave the company’s managing director Alexander Matytsyn in charge. The company is still fully owned by Lukoil.

On Wednesday, the Vienna-based unit also published its fully audited group report for 2022 — taking about two years longer than normal to do so. The move offered a first detailed view of how the company fared in the first year of Russia’s invasion of Ukraine.

According to those accounts, completed by KPMG on Oct. 9 this year, Lukoil International booked €95 billion of revenue and a net income of €7.8 billion in 2022 — a period that reflected the height of the European energy crisis.

Some of the world’s largest energy companies, including Exxon Mobil Corp., Chevron Corp. and Abu Dhabi National Oil Co., as well as US private equity giant Carlyle Group have shown interest in acquiring the assets, Bloomberg reported.

It’s not unusual for Russian companies to hold international assets through Austrian holding companies due to Vienna’s traditional close ties to Russia and a favorable legal environment. Sberbank PJSC was forced to wind down its European operations there in 2022 due to a liquidity crunch prompted by sanctions.

Khavkin and Fedotov were listed as members of Lukoil PJSC’s executive body in 2021, filings show. It’s not clear what roles they hold now.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.