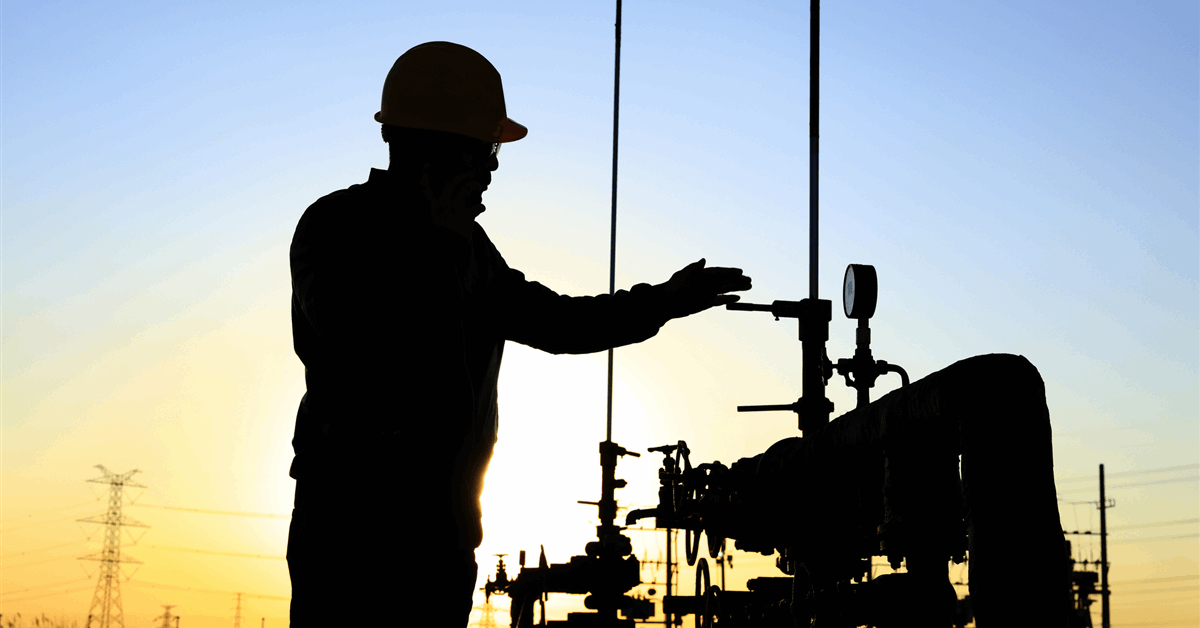

Mach Natural Resources LP said it closed its acquisition of certain oil and gas assets from Sabinal Energy, LLC, as well as entities owning oil and gas assets managed by IKAV Energy Inc.

Mach paid a combined purchase price of about $1.3 billion, funded through the combination of borrowings under the company’s credit facilities, as well as the issuance of Mach common units, the company said in a news release.

The Sabinal assets, located in the Permian Basin, include approximately 130,000 net acres, with first-quarter average production of approximately 11,000 barrels of oil equivalent per day (boepd), of which 98 percent was liquids and 2 percent was natural gas.

The assets of IKAV San Juan, located in the San Juan Basin, include approximately 570,000 net acres, with first-quarter average production of approximately 60,000 boepd, of which 6 percent was liquids and 94 percent was natural gas.

After completing the transactions, Mach said it has approximately 168 million common units outstanding, including around 19 million units issued to the sellers of Sabinal and about 31 million units issued to the sellers of IKAV San Juan as consideration for the transactions.

Mach CEO Tom Ward said, “Today marks an important step forward for Mach. With the successful completion of these two acquisitions, we have advanced our strategic pillars by nearly doubling production, establishing meaningful positions in the Permian and San Juan Basins, and creating a more balanced, multi-basin portfolio”.

In an earlier statement, Mach said it will operate across three distinct regions: the Mid-Continent, Permian, and San Juan basins. The combined company will have a diversified production base of approximately 152,000 boepd, in addition to a total of 2.8 million net acres that will “support development activity for the foreseeable future,” the company said.

Mach said that positive amendments have been made to its credit facility, resulting in its borrowing base increasing to $1.45 billion from $750 million. The amendments include the upsizing of its revolving credit facility from $750 million to $1.0 billion and the issuance a new term loan of $450 million.

Second Quarter Results

In the second quarter, Mach reported average oil equivalent production of 83,600 boepd, which consisted of 23 percent oil, 53 percent natural gas and 24 percent natural gas liquids (NGLs).

Mach’s production revenues for the quarter from oil, natural gas, and NGLs sales totaled $219 million, composed of 51 percent oil, 31 percent natural gas, and 18 percent NGLs, the company said in its most recent earnings release.

The company said it spud nine gross, or eight net, operated wells and brought online 11 gross operated wells in the second quarter.

Ward said, “Our second quarter results reflect continued strong execution of our 2025 plan. A steady adherence to the four pillars of our disciplined business model allows us to announce a distribution of $0.38 per common unit for the period”.

Commenting on the acquisition, Ward said the transactions “lay the groundwork for sustainable long-term growth and underscore our commitment to maximizing unitholder value”.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR