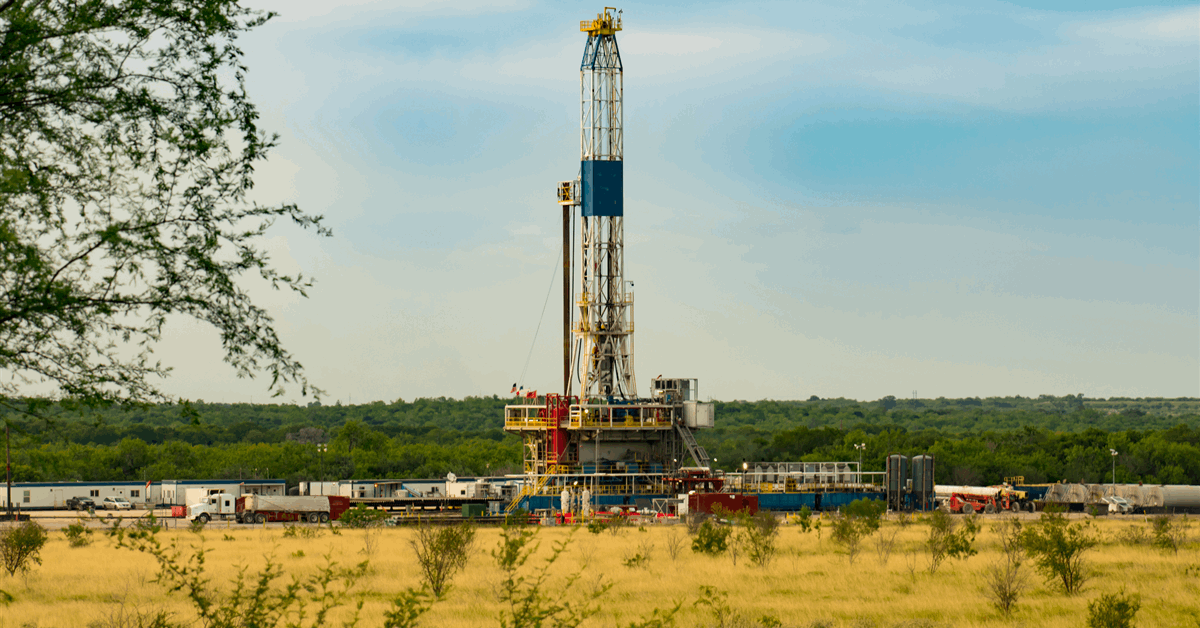

Mentor Capital Inc. has expanded its stake in the West Texas Permian Basin, snapping up eight new royalty interest lots in an all-cash deal.

The company said in a media release that the royalty streams it purchased pay out a portion of revenue from the oil and gas production “off the top”. The company has no obligation to pay the expenses of the underlying production.

With the purchase, Mentor increases its overall ownership of assets in the sector of oil and gas, coal, and uranium by 27.5 percent on a cost basis.

“The three major Permian Basin pooled oil and gas projects that Mentor currently participates in represent in total approximately 131 producing wells plus a number of development opportunities”, Mentor said. “This large combined oil and gas footprint is expected to have considerable life.

“As is now common in Permian oil fields, some existing and possible wells are projected to utilize multi-leg horizontal and directional drilling with parallel lateral lengths reaching out 2 to 3 miles”.

On a cost basis, the latest follow-on purchase increases Mentor’s portfolio of classic energy assets owned to 10.92 cents per Mentor common share, with 21,686,105 shares outstanding, the company said.

The acquisition follows Mentor’s purchase of a 25.127 net royalty acre portion of a producing 71-well pooled project in the West Texas Permian Basin in another all-cash transaction. Mentor said at the time its purchased royalty stream was the equivalent of 12.5 percent “off the top” of oil and gas revenues for its acreage, with no responsibility to pay any expenses.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR