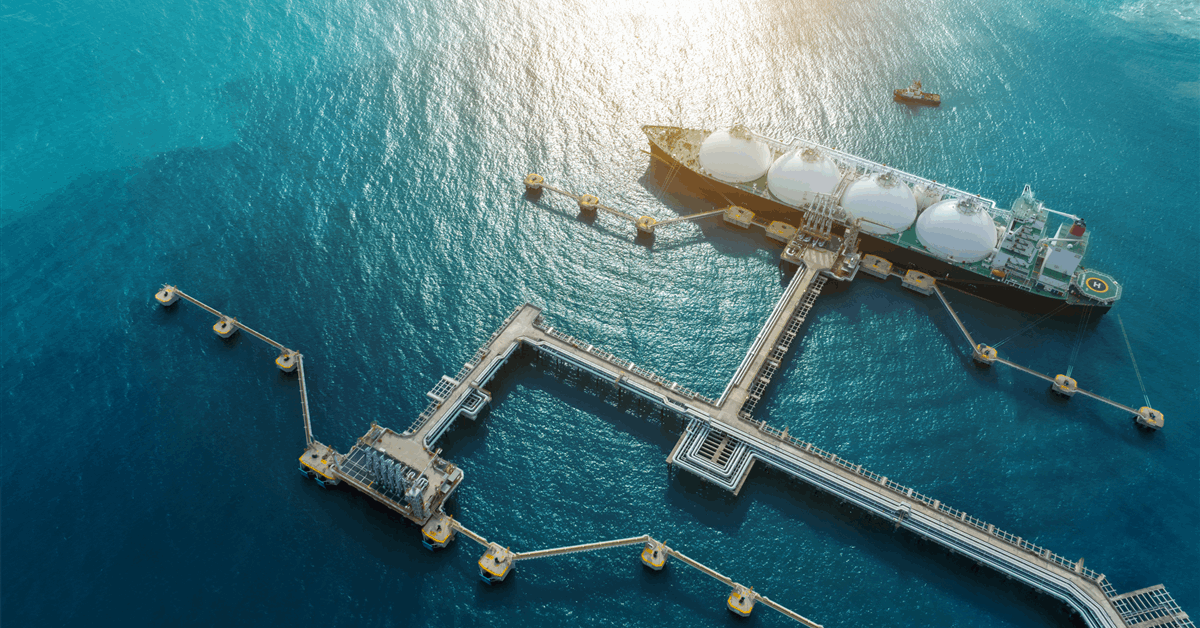

Four years after terrorist attacks halted a massive liquefied natural gas project in Mozambique, momentum behind $57 billion in facilities that will export the fuel is picking up.

TotalEnergies SE and Eni SpA have readied contractors and signed agreements for preliminary work on projects to add capacity. In addition, the French major’s Chief Executive Officer Patrick Pouyanne was scheduled to meet Mozambican President Daniel Chapo on Thursday, according to people with knowledge of the matter who asked not to be identified because the information is not public.

Revenue from gas exports could be significant for the southern African nation, one of the world’s poorest. At the same time, developers must weigh the risk of renewed terrorist attacks, which prompted Total to halt its $20 billion facility in 2021 in the northern province of Cabo Delgado.

Mozambique has deployed its army, police, mercenaries and regional armed forces to end the attacks by the Islamic State-linked insurgents. But they have not been stamped out.

“Activity by the insurgent group will remain a threat to LNG timelines and the operating environment across Cabo Delgado province,” said Ryan Cummings, director at Cape Town-based Signal Risk. “A near-term resumption of LNG-related activity could be a trigger for renewed attacks.”

Fighting intensified in June, with Islamic State claiming what would be among its deadliest single assaults on security forces.

Chapo said in an interview last week that Total’s 2021 declaration of force majeure would remain in place indefinitely “if we’re waiting for Cabo Delgado to be a heaven.” He described business as proceeding as usual in the district of Palma, where attacks occurred that precipitated shuttering the project.

Over the last few months, Total received approval for key financing from the US Export-Import Bank. Pouyanne has likened remaining obstacles to “more a question of paperwork,” while sticking to a goal of first production by 2029.

Eni’s floating facilities are located far offshore and relatively unexposed to security issues, though their capacity is a fraction of what’s planned onshore by Total and Exxon Mobil Corp.

Most conditions have been met for Total’s work to resume, despite lingering risks, according to Gustavo Plácido, an analyst at Horizon Engage in Lisbon. “Chapo is clearly pushing for the project to restart, but security developments make things tricky,” he said.

Before the US Export-Import Bank decided to lend $4.7 billion to the project, concern about Islamist militants was flagged in due diligence the bank undertook. The analysis found that assaults could damage facilities, increase security costs and discourage local participation.

The militants, who’ve been fighting since 2017, launched their biggest attack in March 2021, just as Total announced it was resuming work on the project after violence prompted an earlier freeze.

After Total declared a force majeure, Mozambique called in Rwanda’s forces following the exit of mercenaries including Russia’s Wagner Group. The Rwandans are still there.

Floating LNG

Mozambique started its first LNG production in 2022 with Eni’s Coral South floating project, out of reach from insurgents. The Italian explorer is planning Coral North, which along with the earlier project will have a combined capacity of 7 million tons a year.

Eni this week awarded a contract for preliminary work to Samsung Heavy Industries Co. for the latest floating platform, according to people familiar with the information.

In his interview, as Chapo added up the tens of billions set to pour into Mozambique’s gas export projects, he also highlighted the need to diversify into other industries to create jobs.

The young population – whose median age is around 18 – is angry over the lack of work, contributing to deadly protests after October elections. Such resentment is also seen aiding recruitment to the insurgency.

“Lots of people think growth means development but it’s not true,” said Chapo. “Development implies the human component, the social issue, that money reaches the citizens pocket.”