MPLX LP said it has completed the $2.375 billion acquisition of Northwind Delaware Holdings LLC from Five Point Infrastructure LLC.

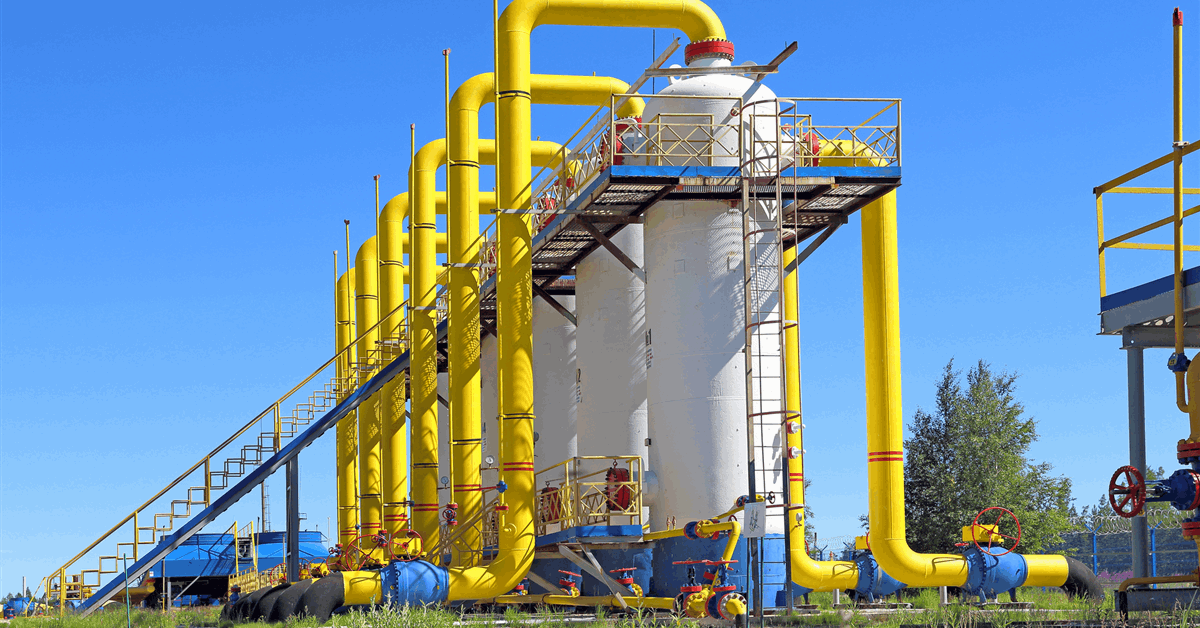

The acquisition of Northwind, which provides sour gas gathering, treating, and processing services in Lea County, New Mexico, will enhance its Permian natural gas and natural gas liquid (NGL) value chains, MPLX said in a news release.

The acquisition is expected to be immediately accretive to distributable cash flow, and inclusive of estimated incremental capital of $500 million, represents a 7x multiple on forecast 2027 EBITDA and an estimated mid-teen unlevered return, the company said.

The acquisition was financed and the incremental capital expenditures associated with in-process expansion projects will be funded by net proceeds from MPLX’s $4.5 billion senior notes issued in August, the company stated.

MPLX said that the acquired business is complementary and adjacent to its existing Delaware basin natural gas system. It consists of over 200,000 dedicated acres, more than 200 miles of gathering pipelines, two in-service acid gas injection wells at 20 million cubic feet per day (MMcfpd), and a third permitted well that will bring its total capacity to 37 MMcfpd, according to the release.

The system currently has 150 MMcfpd of sour gas treating capacity and in-process expansion projects will increase capacity to 440 MMcfpd, expected to be completed in the second half of 2026, the company said.

The system is supported by minimum volume commitments from “top regional producers,” MPLX said.

Last week, MPLX said it entered into a definitive agreement to divest its Rockies gathering and processing assets to a subsidiary of Harvest Midstream for $1.0 billion in cash consideration, subject to customary purchase price adjustments.

Harvest has contractually agreed to dedicate approximately 12 thousand barrels per day of NGLs from these assets to MPLX for a period of seven years starting in 2028, following the expiration of a pre-existing commitment, according to an earlier statement.

The assets included in the transaction are natural gas gathering and transportation pipelines and 1.2 billion cubic feet per day of processing capacity, which operated at 52 percent in 2024, MPLX said.

“Evaluating the competitive positioning of our portfolio is a strategic commitment,” MPLX President and CEO Maryann Mannen said. “The divestiture of these assets better positions our portfolio for growth, anchored in the Marcellus and Permian basins”.

The transaction is expected to close in the fourth quarter, subject to customary closing conditions, including clearance under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, according to the statement.

MPLX describes itself as a diversified, large-cap master limited partnership that owns and operates midstream energy infrastructure and logistics assets and provides fuel distribution services. The company’s assets include a network of crude oil and refined product pipelines, an inland marine business, light-product terminals, storage caverns, as well as refinery tanks, docks, loading racks, and associated piping and crude and light-product marine terminals.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR