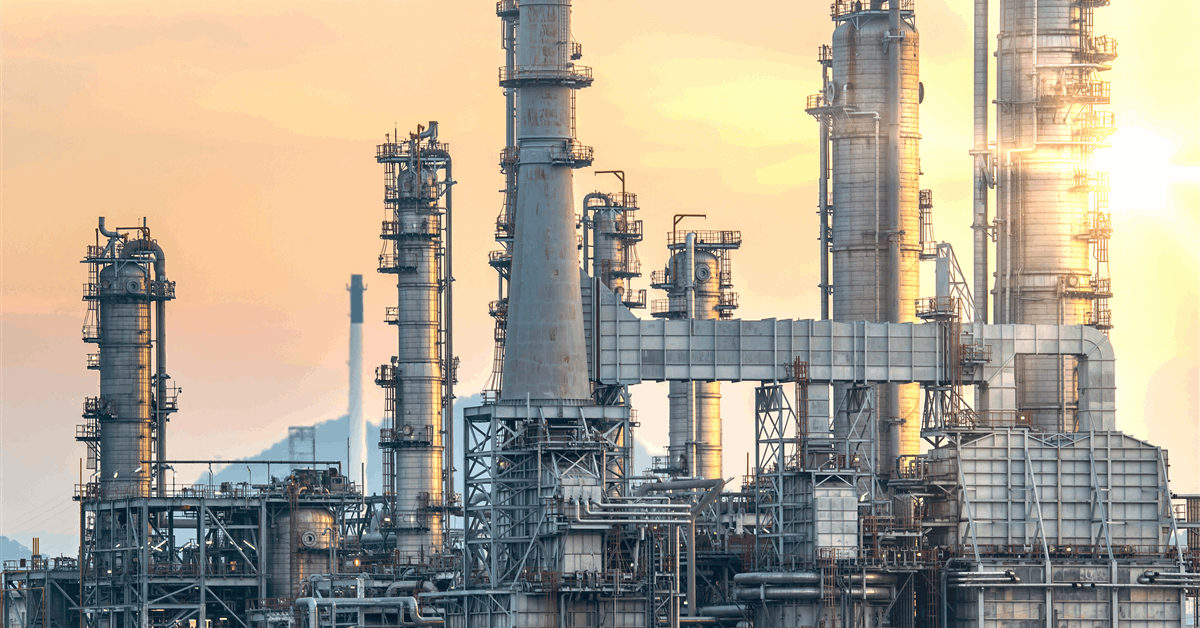

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) is aiming for an oil production of at least 2.1 million barrels a day (MMbd) for 2025, its chief executive told the senate.

Nigeria currently has 32 rigs, doubled from 2021, NUPRC Chief Executive Engr Gbenga Komolafe said before the Senate Committee on Appropriation when presenting the NUPRC’s achievements since its formation in 2021, according to a press release by the Commission.

On November 14, 2024, Nigerian National Petroleum Co. Ltd. (NNPC) said Nigeria’s hydrocarbon production ramped up to 1.8 MMbd of oil and 7.4 billion cubic feet per day of gas, with the possibility of crude production increasing to two MMbd by the end of 2024. The level grew from 1.43 MMbd last June, according to NNPC. The national oil and gas company put online several upstream projects last year.

It said May 12, 2024, it had started production at Oil Mining Lease (OML) 13 in the Niger Delta. OML 13 started up at a rate of 6,000 barrels of oil per day (bopd), expected to increase to 40,000 bopd before the end of May.

NNPC earlier said it had put online the Madu field and restarted production in the Awoba field, adding a combined 32,000 bpd to Nigeria’s output capacity. Both are also in the Niger Delta.

Madu is expected to average 20,000 bpd, NNPC said in a news release April 19, 2024. Meanwhile, Awoba restarted production at an initial rate of 8,000 bpd, expected to scale up to as much as 12,000 bpd within a few weeks, NNPC said April 23, 2024.

On September 9, 2024, NNPC said its joint venture with Chevron Corp. is targeting to reach production of 165,000 bopd by the end of 2024 after converting their licenses under the terms of the Petroleum Industry Act (PIA). NNPC and Chevron’s local arm Chevron Nigeria Ltd. expect the conversion to “significantly boost crude oil production”, NNPC said then.

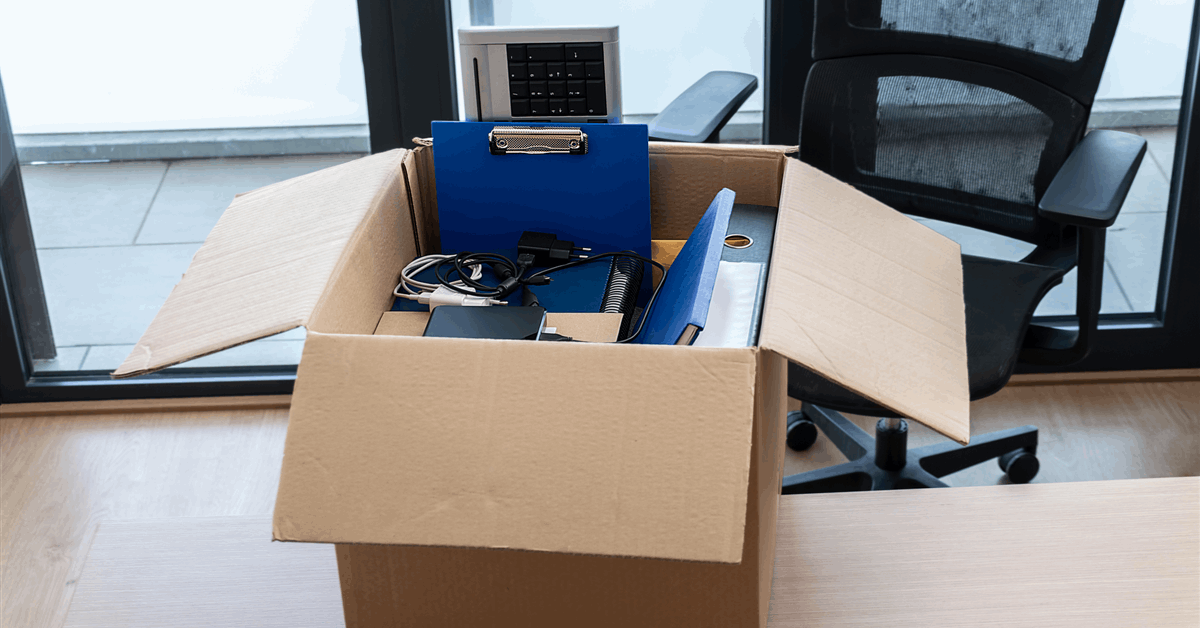

Nigeria, though, has seen an onshore exodus. Energy majors Eni SpA, Equinor ASA, Exxon Mobil Corp., Shell PLC and TotalEnergies SE divested or are in the process of completing divestments.

On December 6, 2024, Norway’s majority state-owned Equinor announced it had exited Nigeria altogether after the completion of a $1.2 billion divestment that included its 20.21 percent stake in the Agbami oil field. The world’s biggest oil discovery in 1998, Agbami holds an estimated 900 million barrels of potential recoverable volumes, according to online information from operator Chevron Corp.

TotalEnergies meanwhile announced July 17, 2024, it was selling its 10 percent stake in the Niger delta-focused SPDC Joint Venture. Shell said January 16, 2024, it was exiting the joint venture by selling the subsidiary that operates the JV but has failed to win regulatory clearance to close the transaction. On November 3, 2024, Financial Times reported the British company continued to engage with Nigerian authorities.

Eni said August 22, 2024, it had completed the sale of Nigerian Agip Oil Co. Ltd. (NAOC). However, the Italian state-controlled company has decided to retain NAOC’s five percent stake in the SPDC JV.

Seplat Energy PLC announced December 12, 2024, it had completed the acquisition of Mobil Producing Nigeria Unlimited from ExxonMobil.

This June, the NUPRC is scheduled to award new licenses under the licensing round launched May 2024.

To contact the author, email [email protected]