Northern Oil and Gas Inc. (NOG) has reported adjusted earnings of $1.11 per share for the fourth quarter of 2024, compared with $1.61 per share in the previous-year quarter.

Revenue for the quarter was recorded at $515 million, compared with $793.5 million in the same period in 2023, the company said in an earnings release.

For full-year 2024, NOG reported adjusted earnings of $5.26 per share, compared with $6.58 in 2023. Revenue was $2.23 billion, compared with $2.17 billion in the previous year.

The company’s fourth-quarter production was 131,777 barrels of oil equivalent per day (boepd), a 15 percent increase from the prior-year period. Oil production was a record 78,939 barrels per day (bpd), an 11 percent sequential increase over the third quarter, and represented 59.9 percent of production in the fourth quarter, it stated. NOG had 25.8 net wells turned in line during the fourth quarter, compared to 9.5 net wells turned in line in the third quarter of 2024.

NOG said its fourth quarter benefited from “a full contribution of the Point acquisition as well as the contribution from the XCL acquisition and an increase in turn-in-line activity, offset by shut-ins and disruptions from forest fires, curtailments and numerous deferrals on completed wells from price-sensitive private operators in the Williston Basin, as well as material downtime from third-party crude takeaway in the Uinta Basin”.

Full year 2024 production was 124,108 boepd, a 26 percent increase from the prior year.

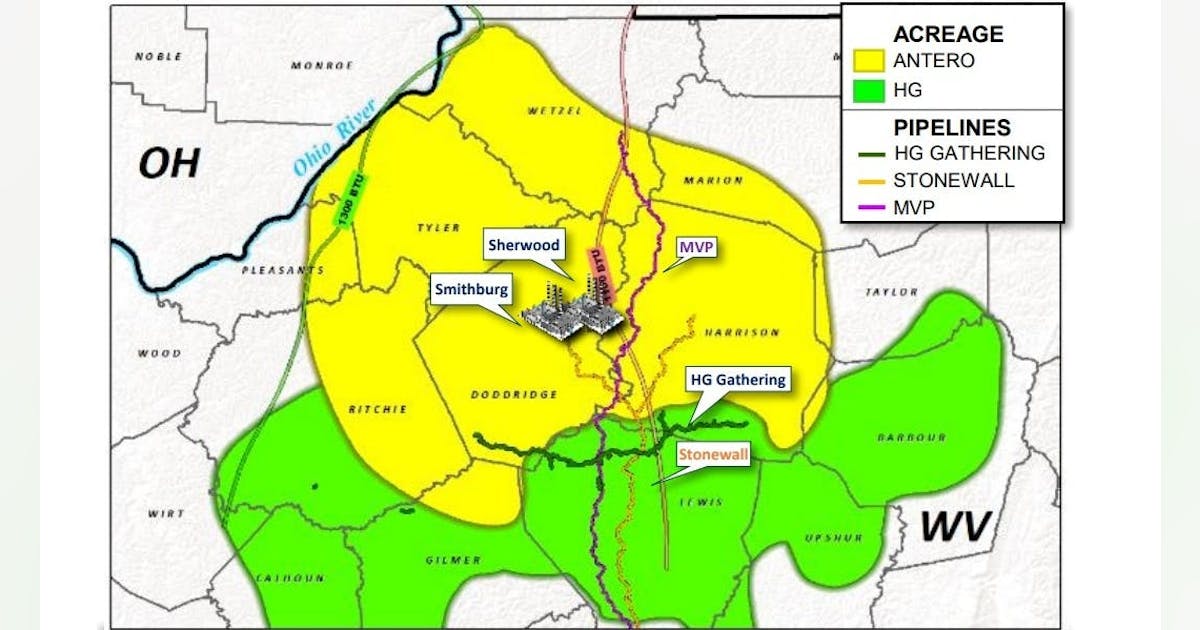

NOG anticipates approximately 130,000 to 135,000 boepd of production in 2025. NOG currently expects total capital spending in the range of $1.05 billion to $1.2 billion for the year, with approximately 66 percent of its 2025 budget to be spent on the Permian, 20 percent on the Williston, 7 percent on the Appalachian and 7 percent on the Uinta.

Earlier in the month, NOG said it entered into a definitive agreement to acquire assets in Upton County, Texas, with one of its existing private operating partners for an unadjusted purchase price of $40 million in cash, subject to customary closing adjustments.

The assets include approximately 2,275 net acres in the Midland Basin. NOG has entered into a joint development agreement on the properties, and it expects to close the transaction within 60 days. The associated 2025 development costs post-closing for these assets have been included in its initial capital expenditure guidance, the company said.

“NOG continues to raise the bar, delivering another year of cash flow, production and reserve growth, strategic investments in high-value assets, and the deliberate expansion of our internal infrastructure—all reinforcing our long-term ability to create shareholder value,” NOG CEO Nick O’Grady said.

“Building on the strong foundation laid in 2024, we have meticulously crafted a 2025 capital plan designed to drive growth in 2025, 2026 and beyond. We expect to execute a record number of SPUDs, building momentum throughout the year. Our diversified model positions NOG with substantial external opportunities to create additional value, further solidifying our commitment to delivering both top-tier relative and absolute returns,” he said.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR