- Consumer, which includes both mobile access and fixed access, including fixed wireless access.

- Enterprise and industrial, which covers wide-area connectivity that supports knowledge work, automation, machine vision, robotics coordination, field support, and industrial IoT.

- AI, including applications that people directly invoke, such as assistants, copilots, and media generation, as well as autonomous use cases in which AI systems trigger other AI systems to perform functions and move data across networks.

The report outlines three scenarios: conservative, moderate, and aggressive. “Our goal is to present scenarios that fall within a realistic range of possible outcomes, encouraging stakeholders to plan across the full spectrum of high-impact demand possibilities,” the report says.

Nokia’s prediction for global WAN traffic growth ranges from a 13% CAGR for the conservative scenario to 16% CAGR for moderate and 22% CAGR for aggressive. Looking more closely at the moderate scenario, it’s clear that consumer traffic dominates. Enterprise and industrial traffic make up only about 14% to 17% of overall WAN traffic, although their share is expected to grow during the 10-year forecast period.

“On the consumer side, the vast majority of traffic by volume is video,” says William Webb, CEO of the consulting firm Commcisive. Asked whether any of that consumer traffic is at some point served up by enterprises, the answer is a decisive “no.” It’s mostly YouTube and streaming services like Netflix, he says. In short, that doesn’t raise enterprise concerns.

Nokia predicts AI traffic boom

AI is a different story.

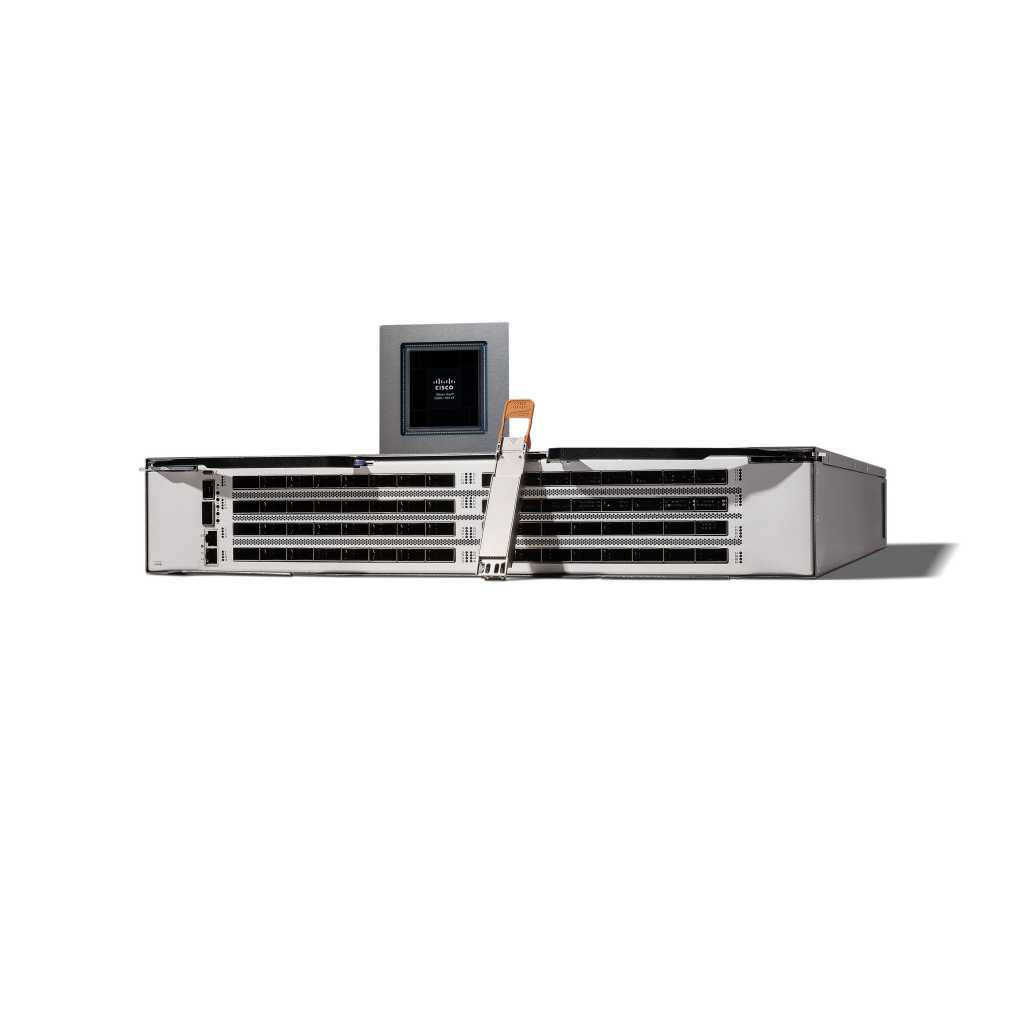

“Consumer- and enterprise-generated AI traffic imposes a substantial impact on the wide-area network (WAN) by adding AI workloads processed by data centers across the WAN. AI traffic does not stay inside one data center; it moves across edge, metro, core, and cloud infrastructure, driving dense lateral flows and new capacity demands,” the report says.

An explosion in agentic AI applications further fuels growth “by inducing extra machine-to-machine (M2M) traffic in the background,” Nokia predicts. “AI traffic isn’t just creating more demand inside data centers; it’s driving a sustained surge of traffic between them. AI inferencing traffic—both user-initiated and agentic-AI-induced M2M—moving over inter-data-center links grows at a 20.3% CAGR through 2034.”