“The writing is on the wall for the North Sea,” observed Amjad Bseisu, chief executive of operator EnQuest.

Mergers such as that announced by Shell and Equinor and moves by North American firms Apache and Canadian Natural Resources (CNRL) to decommission their assets early and go back home represent a “pull back” from the basin, he said, as a result of the UK’s hostile fiscal environment.

Bseisu was speaking the same day north sea rival Repsol revealed it was also joining the mania for mergers and acquisitions.

The Madrid-headquartered firm announced it would be putting its UKCS assets into a new joint venture with Neo Energy, a small North Sea operator owned by Norwegian private equity firm, HitecVision. The new entity will be called Neo Next and will be 45% owned by Repsol and 55% owned by Neo.

The tie up is yet another example of the tectonic shifts taking place in the North Sea as oil and gas producers grapple with attacks on fiscal, political and regulatory fronts: the Energy Profits Levy (EPL), the UK ban on new drilling and licensing and the long, fallow pause on guidance on how to assess emissions from of oil and gas used by consumers – known as “scope 3”.

© Bloomberg

© BloombergThe Repsol / Neo vehicle is the third major proposed merger after the so-called “Shequinor” deal, which will be the joint owner of the Rosebank and Jackdaw fields, and last year’s £754 million marriage of Israel’s Ithaca and Italy’s Eni.

A fourth – which is set to be either confirmed or scrapped in coming days – is Serica’s plan to combine with EnQuest, which Bseisu declined to speak about before it was officially struck.

Nevertheless, his observation backs recent findings of the North Sea Task Force that “confidence is draining from the North Sea”, with fears this will continue to erode before clean energy production in the form of offshore wind and hydrogen can fill the gap.

In the blustery days before Easter, the industry awaited direction from the government on its scope 3 responsibilities after a judge ruled government approvals for plans were “invalid”.

There is also faint hope for some support for carbon capture investment in the Treasury’s spending review due in June, not to mention a holding of breath for what benefits another industrial strategy and fiscal plan, due sometime soon, might entail following an industry consultation.

Mergers are also reducing the pool of customers for the supply chain. Neil Carr, director of Aberdeen-based AMS Global Group, which provides marine services for several North Sea operators, has noted the market has already felt subdued, with more doldrums set to follow as the number of firms issuing tenders dwindles. “It makes it a much tougher commercial market,” he said.

© EnQuest

© EnQuestNevertheless, while UKCS sellers are voting with their feet, the recent transactions have also hinted at a new shape taking place based on current commercial realities and around three key North Sea fields.

This is perhaps a harbinger of fresh winds of change and a more positive change of tune as focus narrows on what works.

AIM-listed Serica has emerged as one of the North Sea’s main buyers, taking an “opportunistic” approach to building its business that takes advantage of the UK’s complex approach to taxation.

The Serica-EnQuest proposal, announced early in March, would represent a business combination by way of a reverse takeover. This would leave Serica’s investors holding the largest proportion of shares in the new entity, alongside a “substantial” return of capital, according to analysis by Panmure Liberum.

Serica said the deal would increase its “scale and diversification”, providing a “stronger platform for further growth”.

This would include EnQuest’s recent geographical diversification in more promising oil and gas basins in South East Asia through acquisitions in Malaysia and Vietnam, but would also see Serica move from the junior market to the London Stock Exchanges’ main market.

The deal would add to other recent moves made by Serica. This includes the £14 million acquisition announced in December of two licences from Parkmead.

The EnQuest deal would also widen Serica’s pool of assets that bring with them “tax synergies” with both firms having large pools of tax losses that “affray the impact of the penal UK fiscal regime”, Ashley Kelty of Panmure Liberum has identified.

The third-largest oil and gas field

Meanwhile, as Neo agreed the long speculated-upon deal with Repsol, it, alongside its partners Serica and Jersey Oil and Gas (JOG), is now free to focus on another significant North Sea development 93 miles from Aberdeen.

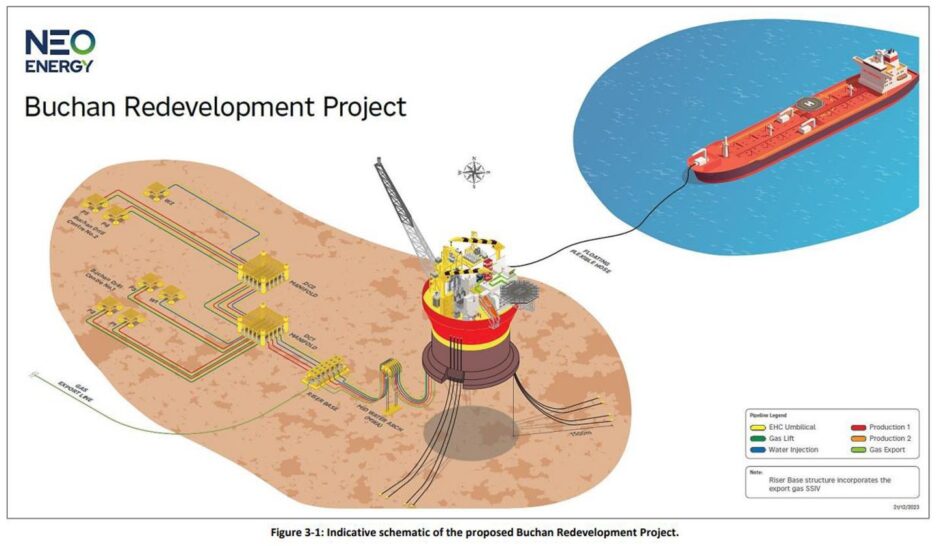

The Buchan Horst is the redevelopment of a former Repsol Sinopec field in the Moray Firth. Behind Rosebank and Cambo, it is the third-largest pre-financial investment decision (FID) project in the UKCS, with an estimated 162m barrels of oil equivalent.

© Supplied by NEO Energy

© Supplied by NEO EnergyNeo took over as operator of Buchan Horst alongside Serica and JOG in 2023. The investors were keen to dangle the $900m Buchan investment in front of policy makers in efforts – largely unsuccessful – to stave off major impacts from the scope 3 Finch ruling, not to mention the EPL.

Neo announced it had paused development on the field, but it could soon come back once guidance on required environmental impact assessments is finally revealed.

Buchan could also be an emblem of how North Sea oil and gas is a lynchpin of the North Sea’s future, with its promise of “just transition” for workers and investment in clean energy, as a potential customer of floating offshore wind projects.

Success for Buchan Horst could also be essential to the future of nearby INTOG offshore wind farms, including as a potential customer of the 560MW Green Volt floating offshore wind farm.

This is widely seen as being the UK’s front-runner floating offshore wind farm which won support in the UK’s most recent contracts for difference pricing scheme, allocation round 6 (AR6).

It is being developed by Flotation Energy and Vårgrønn – the Norwegian firm which is also part-owned by Neo’s owners, HitecVision.

Second and first largest

These movements come after Ithaca revealed it has “revitalised” plans for Cambo, the UK’s second largest untapped oil and has field.

The firm said it has applied to the North Sea Transition Authority (NSTA) extend the licence a further 18 months, “reflecting the fiscal and regulatory uncertainty faced by the sector”.

Playing the most bullish note, it recently told investors it is poised to play a “pivotal role” in further North Sea consolidation.

“The North Sea has got a bit more life,” said Kelty. “As gloomy as it was this time last year ahead of the election, I think everyone is feeling a little bit more optimistic.

“Grangemouth closing was quite helpful in terms of getting the unions all fired up, and that is helping in terms of focusing government ministers’ minds.”

© Supplied by Teekay/Sevan SSP

© Supplied by Teekay/Sevan SSPHe added: “I think everyone, apart from Ed Miliband, now sees the green economy will not generate the sufficient jobs to replace all those lost in oil and gas.”

Ithaca owns a 20% stake in Rosebank, which along with Cambo, represents vast potential for production in the West of Shetland.

Both are already licenced by the UK government, hence recent warm words about clearing the way for Shequinor’s Rosebank and Jackdaw also signal good news for Cambo.

In 2023, Shell walked away from its 30% stake in the field as environmental campaign pressure made it seem untenable.

The tie-up with Eni – creating the UK’s largest oil and gas firm – has further derisked the project. But as Ithaca renews focus on Cambo and seeks a new partner, it is a possibility that there’s one already right next door in the Shell/ Equinor joint venture.