Oil and gas producer Ithaca has said it plans to launch a subsea construction campaign on the controversial North Sea field, Rosebank, next year and is also making plans to bring in a new partner for its Cambo project West of Shetland.

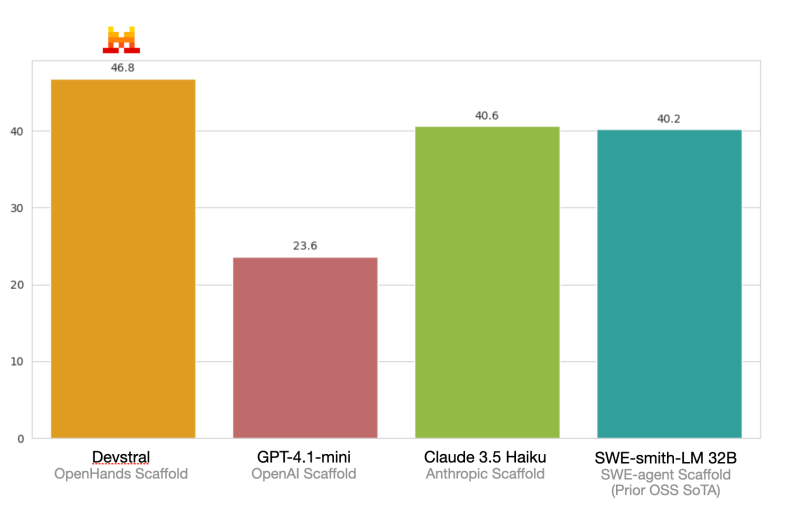

The firm, which recently combined North Sea assets with Italian energy giant Eni, reported its pre-tax profits had more than doubled to $367.2 million (£273m) in the first quarter of the year as it counted record production of 127.4 kboe/d in the three months to the end of March.

In its statement to the London Stock Exchange, it said:

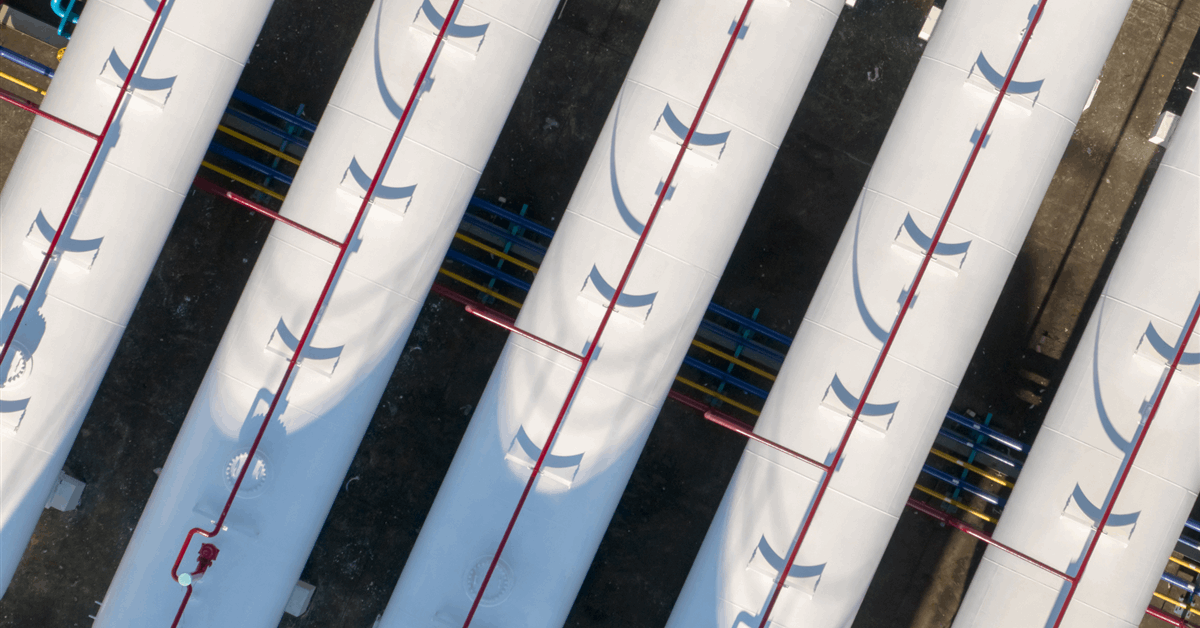

- Rosebank development project progressing as planned to multi-year development timeline with 2025 Subsea infrastructure installation campaign commencing in April 2025

- Cambo project technical refresh nearing completion, utilising technical capabilities of Eni, and supporting farm-out process and progression towards final investment decision (FID), subject to fiscal and regulatory certainty

Further, the firm said it had achieved approval from the North Sea Transition Authority (NSTA) for its plans to develop Fotla, a central North Sea field which it took over after buying Spirit Energy’s 40% stake in 2023. Ithaca said it submitted a draft field development plan to the NSTA during April and its “awaiting environmental impact assessment guidance ahead of issuing an environmental statement”.

Executive chairman Yaniv Friedman, said: “Our Q1 results demonstrate the transformational nature of the Eni UK combination, the successful integration, and operational efficiency across the portfolio.

“In the period we increased our interest in the high-quality, long-life Seagull asset to 50% via the acquisition of JAPEX UK, in line with our low-risk inorganic strategic growth ambitions.

“Yesterday, we announced a further acquisition of a 46.25% stake in the Cygnus field from Spirit Energy taking our operated working interest to 85%, increasing the gas weighting of our portfolio and strengthening our position as one of the largest gas producers in the UKCS.

“With a strong balance sheet, a record quarterly EBITDAX of $653.2 million and material hedging in place through to 2027, we are well placed to continue to grow the business and support shareholders through continued shareholder returns.”

More to follow.