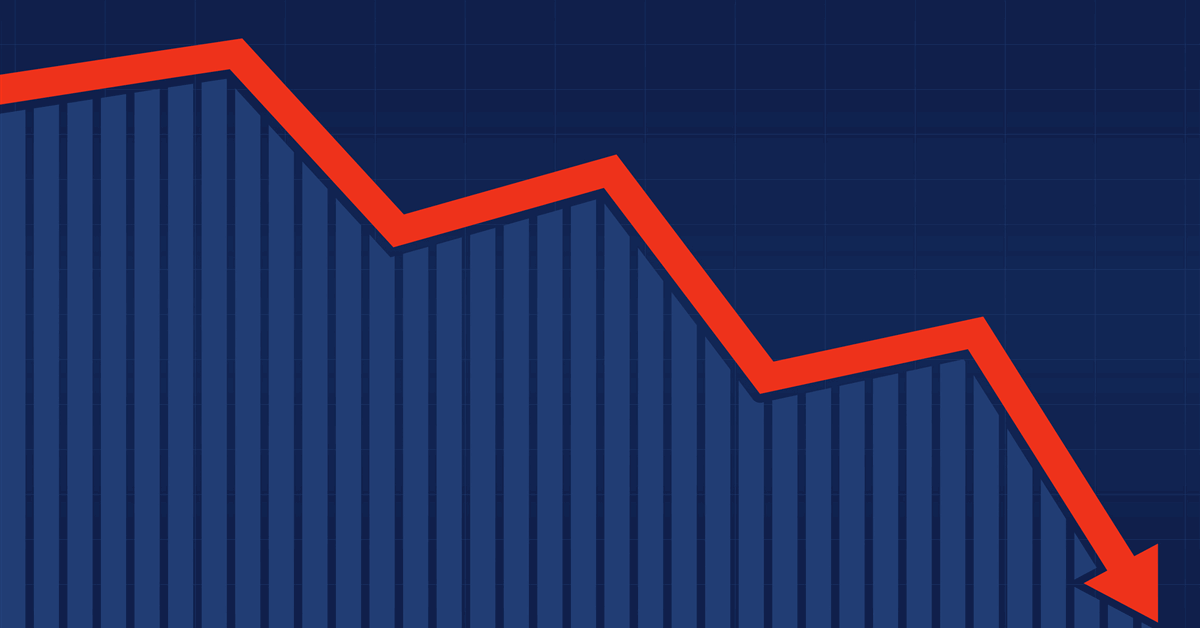

Preliminary official figures showed Norway produced 339.8 million standard cubic meters a day (MMscmd) of natural gas in April, down for the second consecutive month by both sequential and year-on-year comparisons.

The figure beat the forecast by 1.3 percent or 4.2 MMscmd, according to the figures published online by the Norwegian Offshore Directorate.

The Nordic country sold 10.2 billion standard cubic meters (Bscm) last month. That is down by 700 MMscm from March.

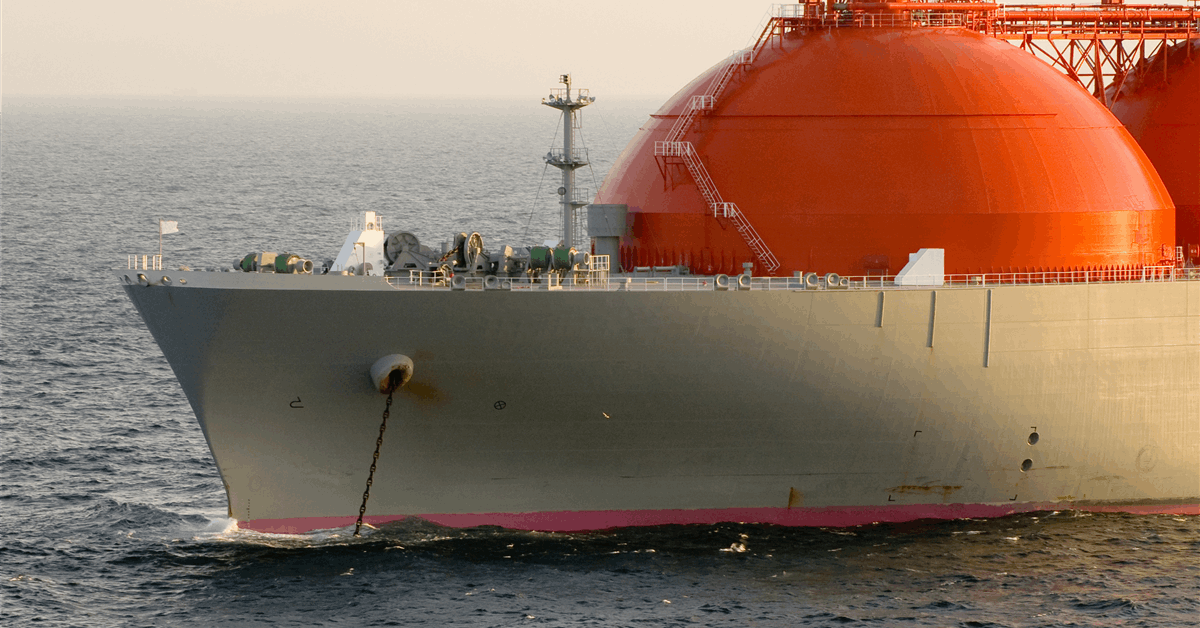

According to the European Commission’s latest quarterly gas market report, Norway accounted for 50 percent of gas imported into the European Union by pipeline in the fourth quarter of 2024.

In March Equinor ASA said it has put onstream the Halten East field in the Norwegian Sea, increasing Norway’s capacity to export gas to Europe. Halten East, a tie-in to be developed in two phases, holds about 100 million barrels of oil equivalent recoverable reserves, according to the Norwegian majority state-owned energy company.

“We are starting up Halten East at a time where piped gas from Norway is in high demand and important for energy security”, Geir Tungesvik, executive vice president for projects, drilling and procurement at Equinor, said in an online statement March 17.

Earlier this month the European Commission released a roadmap to end all imports of Russian gas by 2027.

Meanwhile Norway’s oil production in April averaged 2.03 million barrels per day (MMbd), up both month-on-month and year-over-year. The figure also exceeded the projection by 1.2 percent.

In late March Equinor started producing oil at the Johan Castberg field in the Barents Sea, growing Norway’s production capacity by 220,000 barrels per day (bpd) at peak. Recoverable volumes are estimated to be 450-650 million barrels according to Equinor.

“The Johan Castberg field will contribute crucial energy, value creation, ripple effects and jobs for at least 30 years to come”, Tungesvik said March 31.

“Johan Castberg opens a new region for oil recovery and will create more opportunities in the Barents Sea”, added Kjetil Hove, Equinor executive vice president for exploration and production in Norway. “We’ve already made new discoveries in the area and will keep exploring together with our partners.

“We’ve identified options to add 250-550 million new recoverable barrels that can be developed and produced over Johan Castberg”.

Twelve of Johan Castberg’s 30 wells “are ready for production”, enough to achieve the expected peak volume in the second quarter, Equinor said.

It is the third field developed on Norway’s side of the Barents Sea after Snøhvit, which went online 2007, and Goliat, which began production 2016.

Estimated resource volumes on the Norwegian continental shelf rose 36 million standard cubic meters of oil equivalent (scmoe) to 15.61 billion scmoe – before accounting for production – as of year-end 2024, the Directorate reported February 20, 2025.

The total figure consisted of 8.73 billion scmoe produced, 2.26 billion scmoe of reserves, 651 million scmoe of contingent resources in fields, 472 million scmoe of contingent resources in discoveries and 3.5 billion scmoe of undiscovered resources.

The produced volume rose 239 million scmoe from 2023, while reserves fell 205 million scmoe. Total contingent resources dropped 17 million scmoe against 2023. Undiscovered resources grew 20 million scmoe against 2023.

The increase in undiscovered resources came from opened areas, with no change in undiscovered resources in unopened areas. “This change results from a reduction in undiscovered resources in the North Sea, coupled with increases in the Barents Sea and in the Norwegian Sea”, the Directorate said.

“Large areas in the Barents Sea have yet to be opened for petroleum activity, and this is where the greatest expected value for undiscovered resources can be found”, it noted.

To contact the author, email [email protected]