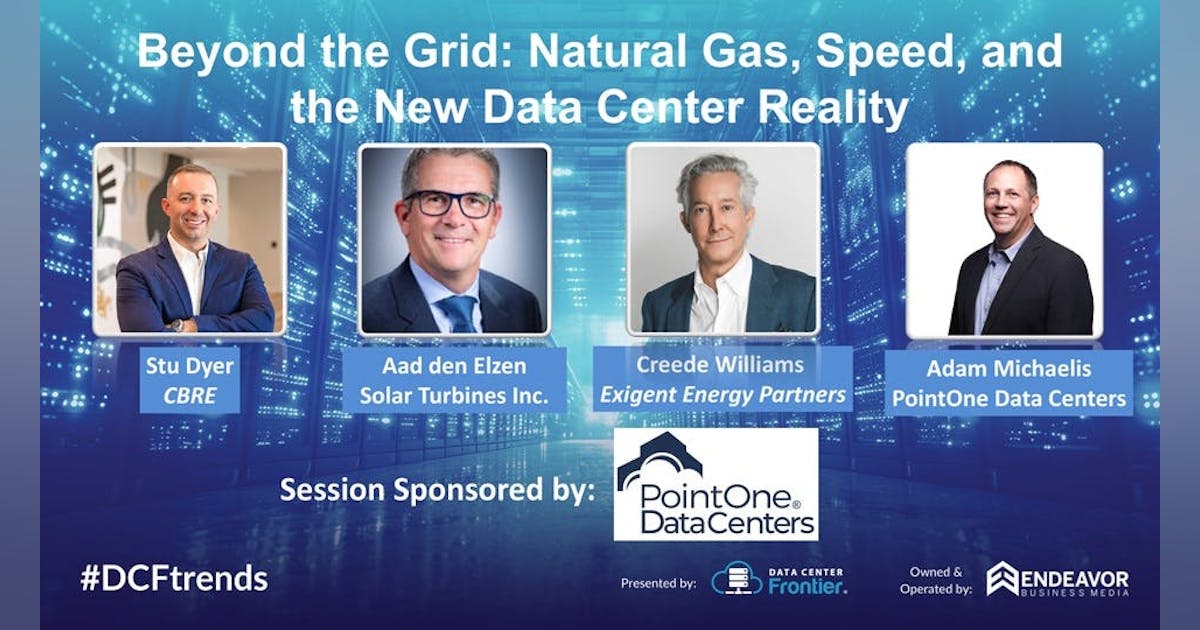

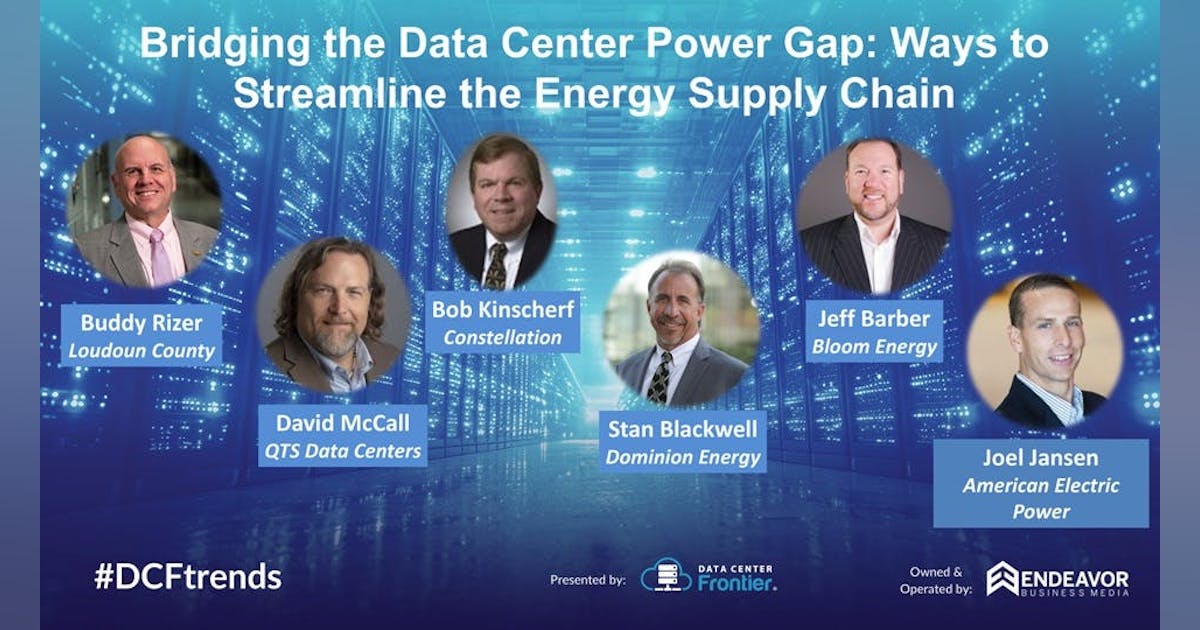

The second installment in our recap series from the 2025 Data Center Frontier Trends Summit highlights a panel that brought unusual candor—and welcome urgency—to one of the defining constraints of the AI era: power availability. Moderated by Buddy Rizer, Executive Director of Economic Development for Loudoun County, Bridging the Data Center Power Gap: Ways to Streamline the Energy Supply Chain convened a powerhouse group of energy and data center executives representing on-site generation, independent power markets, regulated utilities, and hyperscale operators: Jeff Barber, VP of Global Data Centers, Bloom Energy Bob Kinscherf, VP of National Accounts, Constellation Stan Blackwell, Director, Data Center Practice, Dominion Energy Joel Jansen, SVP Regulated Commercial Operations, American Electric Power David McCall, VP of Innovation, QTS Data Centers As presented on September 26, 2025 in Reston, Virginia, the discussion quickly revealed that while no single answer exists to the industry’s power crunch, a more collaborative, multi-path playbook is now emerging—and evolving faster than many realize. A Grid Designed for Yesterday Meets AI-Era Demand Curves Rizer opened with context familiar to anyone operating in Northern Virginia: this region sits at the epicenter of globally scaled digital infrastructure, but its once-ample headroom has evaporated under the weight of AI scaling cycles. Across the panel, the message was consistent: demand curves have shifted permanently, and the step-changes in load growth require new thinking across the entire energy supply chain. Joel Jansen (AEP) underscored the pace of change. A decade ago, utilities faced flat or declining load growth. Now, “our load curve is going straight up,” driven by hyperscale and AI training clusters that are large, high-density, and intolerant of slow development cycles. AEP’s 40,000 miles of transmission and 225,000 miles of distribution infrastructure give it perspective: generation is challenging, but transmission and interconnection timelines are becoming decisive gating factors.