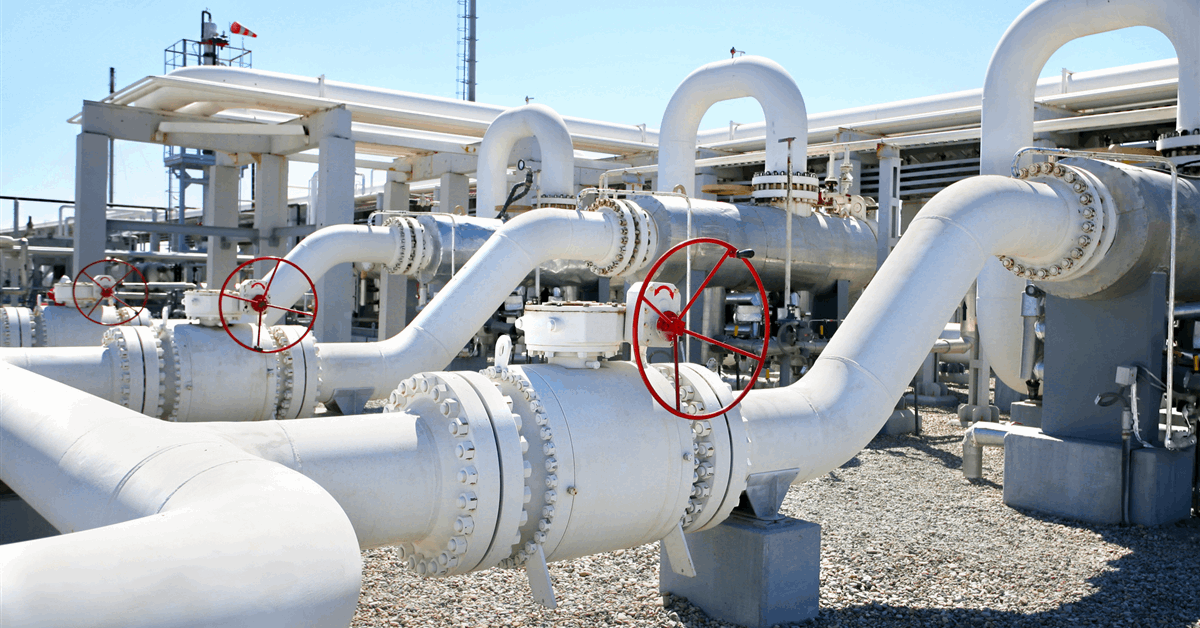

Enterprise Products Partners LP has sealed its purchase of a natural gas gathering affiliate of Occidental Petroleum Corp. operating in the Midland Basin for $580 million in cash.

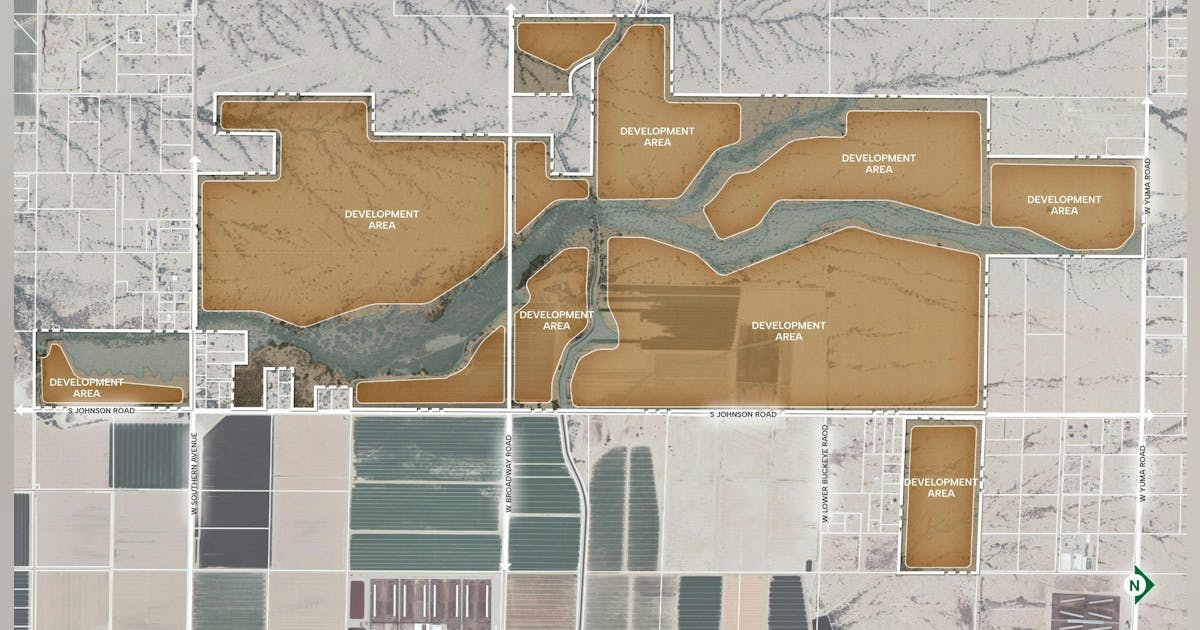

“The acquired assets include certain natural gas gathering systems in the Midland Basin, as well as approximately 200 miles of natural gas gathering pipelines that support Occidental’s production activities in the Midland Basin”, Houston, Texas-based Enterprise said in a statement online.

“With access to more than 1,000 drillable locations, these systems will immediately expand Enterprise’s natural gas gathering footprint in the Midland Basin and provide long-term development visibility”.

The sale, signed July and completed August, is part of Occidental’s divestment program aimed at keeping debt manageable following its acquisition of CrownRock LP in a $12.4 billion transaction completed last year.

“Since July 2024, Occidental has repaid $7.5 billion of debt, including proceeds from non-core Delaware Basin transactions that closed in April and July, and expects to apply an additional $580 million to debt reduction upon closing of the Midland Basin gas gathering divestiture”, the Warren Buffett-backed producer said August 6 announcing the deal with Enterprise.

“These transactions bring the total divestitures since the December 2023 announcement of the CrownRock acquisition to approximately $4 billion”, Occidental said.

Occidental launched a $4.5-$6 billion asset sale program when it announced its merger with CrownRock December 2023. Occidental said in its annual report for 2024 it had achieved its near-term debt repayment goal of $4.5 billion in 4Q that year.

At the end of 2Q 2025 it owed $433 million in current maturities from long-term debt. Occidental accrued total current liabilities of $8.56 billion as of June, according to a regulatory filing.

Meanwhile it had current assets of $8.98 billion including $2.33 billion in cash and cash equivalents.

Occidental reported $396 million in adjusted net profit attributable to common shareholders for 2Q 2025, down from $860 million for the prior three-month period due to weaker realized oil and gas prices. Sales volumes of 1.4 million barrels of oil equivalent remained largely flat compared to the prior quarter, consisting of over 700,000 barrels of oil, more than 300,000 barrels of natural gas liquids and 2.2 billion cubic feet of natural gas.

Adjusted net income per share was $0.39 assuming dilution, beating the Zacks Consensus Estimate of 28 cents.

Oil and gas pre-tax income was $934 million for 2Q 2025, compared to $1.7 billion for 1Q 2025. “Excluding items affecting comparability, the decrease in second quarter oil and gas income, compared to the first quarter of 2025, was due to lower commodity prices, partially offset by higher crude oil volumes and lower lease operating expense”, Occidental said.

Occidental’s chemicals segment contributed $213 million in pre-tax income for 2Q 2025, compared to $185 million for 1Q 2025. “Excluding items affecting comparability, second quarter OxyChem income was relatively unchanged compared to the first quarter of 2025 and reflected negative inventory adjustments, offset by improved export demand for caustic soda and polyvinyl chloride”, it said.

Midstream and marketing generated $49 million in pre-tax income for 2Q 2025, compared to a $77 million pre-tax loss for 1Q 2025. “Compared to the first quarter of 2025, the increase in second quarter midstream and marketing results reflected higher gas marketing margins from transportation capacity optimization in the Permian and higher sulfur prices at Al Hosn”, it said.

Occidental registered $3 billion in operating cash flow for 2Q 2025, which becomes $2.6 billion before working capital.

It declared a dividend of $0.24 per share, payable October 15 to stockholders of record as of the close of business on September 10.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR