The process of decommissioning North Sea wind turbines has already started as the earliest installations reach the end of their operational life.

By 2030, hundreds more will need to be removed.

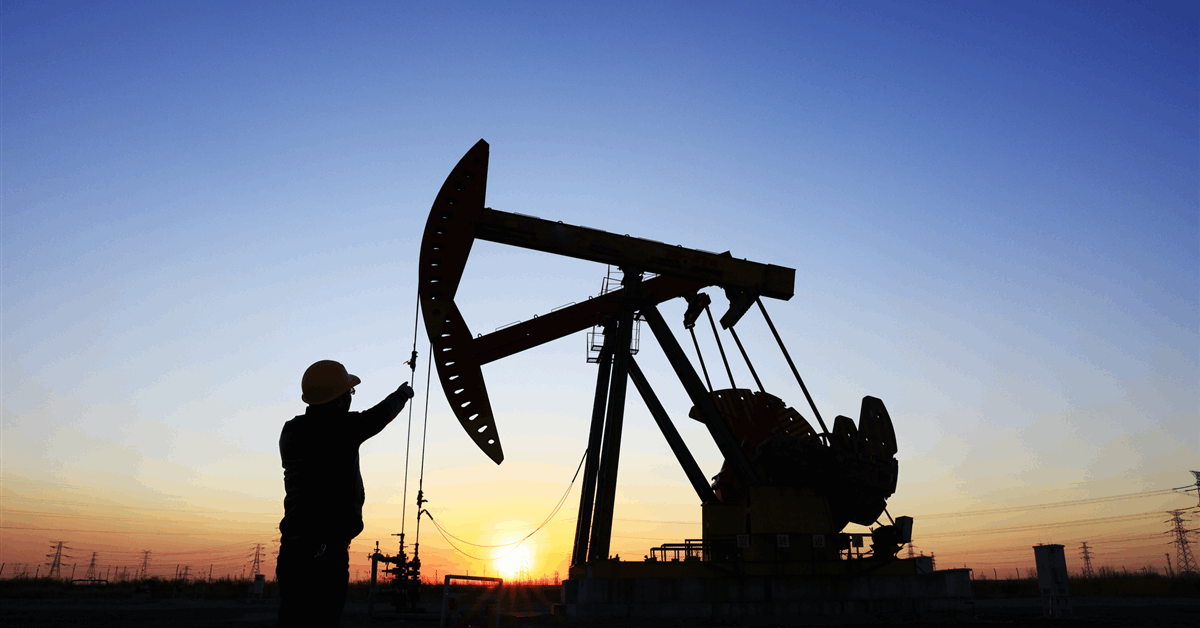

We have been decommissioning oil and gas installations in the North Sea for more than 20 years and the work is expected to go on for another 50 years.

We have built up an unrivalled body of world-leading expertise in this technically demanding sector and made the processes as efficient as possible.

We have used this knowledge to produce two new sets of guidelines for wind turbine decommissioning.

The first covers technical and practical management of data, projects and teams, plus a deep dive into the regulatory framework around the processes involved.

The document highlights the vital lessons learnt from the oil and gas sector and provide recommendations on how to apply this knowledge to offshore wind.

The second set covers work breakdown structure (WBS), mirroring the process used in the decommissioning of oil and gas installations.

That means benchmarking costings and ensuring streamlined project management and decommissioning execution.

The Oil & Gas WBS is an integral tool used globally in decommissioning projects.

Providing an offshore wind decommissioning equivalent will be vital to the sector’s success within the decommissioning space.

Removal of offshore wind turbines is an expensive undertaking.

Ensuring workforce safety and protection of marine life; assessing the structure’s potential for flotation and appropriate evaluation of the weight of modules, are all major challenges at end-of-life operations, but the methods used by the oil and gas sector for cutting and transporting large steel components can be equally applied to the process.

Currently, offshore wind turbines don’t have the same longevity as oil and gas platforms and improving the process is something we will come back to time and again.

We do know that delaying decommissioning without a considered maintenance plan can greatly increase costs and introduce risks.

The composition of a wind turbine is predominantly steel, cast iron, and copper which along with their concrete bases, account for much of the total weight.

These materials can be recycled and sold, but the remaining 5% or more of the turbine’s weight resides in the electronics, lubricants, coolants and polymers in the blades.

Although there is a move to more recyclable methods of construction, these remain problematic.

Blades are mostly shredded and incinerated or sent to landfill.

Additionally, offshore wind farms have extensive subsea cable networks comprising conductors and various insulating and protective layers.

The conductor components are primarily made from copper and aluminium, both of which are easily recyclable.

However, the insulating and protective layers involve a more complicated recycling process, if they can even be recycled at all.

Some materials may have to be treated as hazardous waste, so using knowledge and experience from the petrochemicals industry is essential.

To ensure maximum value, the offshore wind sector is now integrating end of use considerations into project design.

Wind farms of the future will be created on the basis that their end-of-life phase will be as integral as operational requirements.

Developing these guidelines has been a two-year project with a working party made up of advisors from member companies but also engagement from other member firms across the energy sector including oil and gas operators and an extensive array of supply chain companies as well as wind turbine specialists from OEUK’s 400-plus member companies, four out of five of which are supply chain organisations.

We have tried to address the themes that are most relevant and most useful now.

Wind decommissioning is using the same supply chain, the same knowledge and the same geography to bring infrastructure into the same yards that are already engaged in decommissioning of oil and gas platforms.

These guidelines show what we’re trying to hand over.

They demonstrate we are doing what we said we’d do to in the North Sea Transition Deal, and that we’re running a just energy transition.

It is imperative we keep North Sea energy production as environmentally aware and as safe and sustainable as possible.

Recommended for you

What would zonal electricity pricing mean for Scotland?