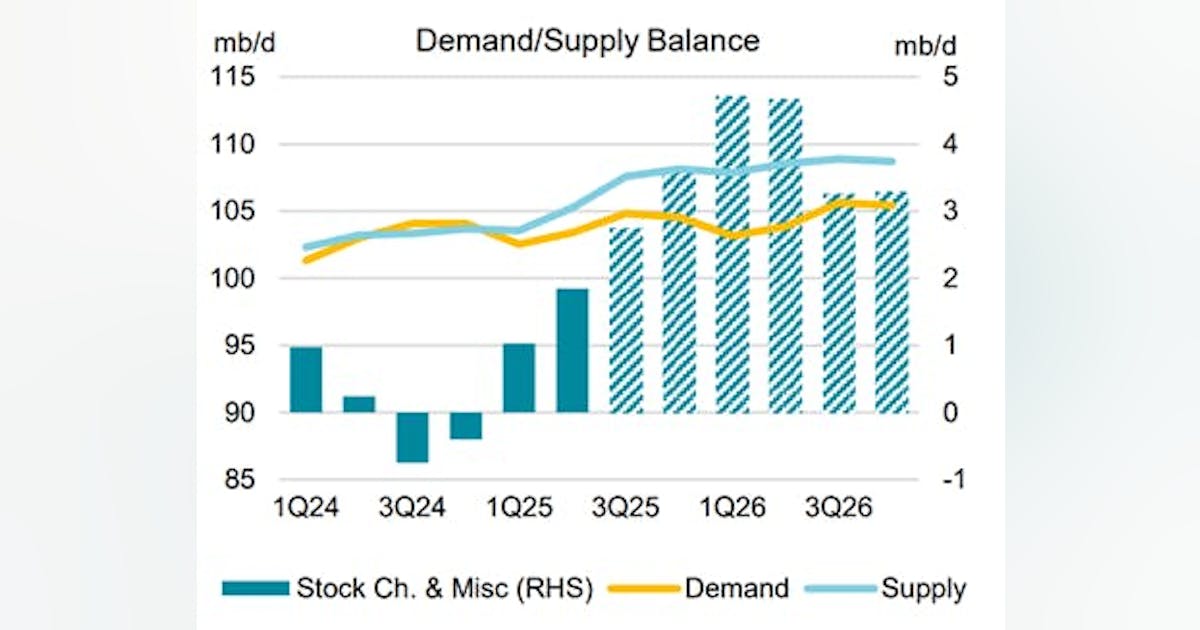

Oil rose after a technical guage signaled recent declines were overdone, while a US government report showing a drop in inventories offered some relief over concerns about oversupply.

West Texas Intermediate futures rose around 1% to settle above $58 a barrel, signaling a corrective phase following a roughly week-long stint in oversold territory on the relative strength index. Brent futures rose 2% to settle below $63.

The commodity received support from government data that showed total US petroleum stockpiles declined by about 4.2 million barrels to reach the lowest since late September. The no-surprises report was also generally in-line with a closely followed industry forecast by the API.

“While the release isn’t likely to change the broader consensus that large builds are imminent, it does help the market hold recent gains,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth Group. “That said, it’s not a strong catalyst for further upside, as many traders still believe sizable builds are just around the corner.”

Oil still remains on track for a third monthly loss as signs of a global surplus put downward pressure on prices, though that’s provided an opportunity for the Trump administration to buy crude for strategic reserves. The US plans to purchase 1 million barrels for delivery in December and January.

The commodity earlier perked up on a report the US and India are nearing a trade deal that could see the South Asian nation gradually reduce imports of Russian crude, which would boost demand for alternative supplies. India’s refiners have previously indicated they would trim, but not stop, the imports.

Adding to that bullish sentiment, European Union leaders are expected to greenlight a 19th Russia sanctions package at a summit on Thursday, after Slovakia dropped its objections. Russia on Wednesday launched multiple drone and missile strikes on Ukraine as the latest peace attempts by US President Donald Trump appeared to be floundering. The impact of these moves on Russian flows still remains uncertain.

The premium that front-month WTI futures command over the next month’s contract, known as the prompt spread, has narrowed over the past few months but still signals tight short-term supplies in a price structure known as backwardation. That’s also true for Brent crude.

Oil Prices

- WTI for December delivery rose 1.18% to settle at $58.50 a barrel.

- Brent for December settlement climbed 2% to settle at $62.59 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.