Oil held steady as traders weighed a large gain in US crude stockpiles against fresh US efforts to crimp Iranian crude exports.

West Texas Intermediate swung between gains and losses before settling above $68 a barrel, narrowly extending a winning streak to a third day. US crude stockpiles rose 7.1 million barrels last week, the biggest gain since January, the Energy Information Administration said Wednesday. At the same time, the US Treasury Department sanctioned 22 foreign entities for their roles in facilitating the sale of Iranian oil.

“Despite a material drop in imports week-on-week, a tick lower in refining activity and subdued exports have encouraged a sizeable crude inventory build,” said Matt Smith, Americas lead oil analyst at Kpler.

The sanctions helped to soothe investors’ uncertainty surrounding US policy on Iranian exports, just weeks after US President Donald Trump baffled markets by encouraging China to carry on buying Tehran’s crude. Those surprise remarks represented a reversal of years of US sanctions and briefly allayed concerns that the Israel-Iran conflict would severely disrupt supplies.

Still, sanctions news will have limited upside until the market sees a material loss of barrels, said Joe DeLaura, global energy strategist at Rabobank.

“It’s all kayfabe,” he said. “By the end of the week, all those sanctioned companies will exist under new names in new locations, and the oil will flow.”

Renewed Houthi attacks on cargo ships in the Red Sea — a key trade route for oil — have also notably failed to inject a risk premium into oil prices. The attacks have so far killed at least three crew members and sank two vessels.

“Most ships are already avoiding the Red Sea,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth Group. The developments “indicate some escalation, but do not really change the supply-demand picture.”

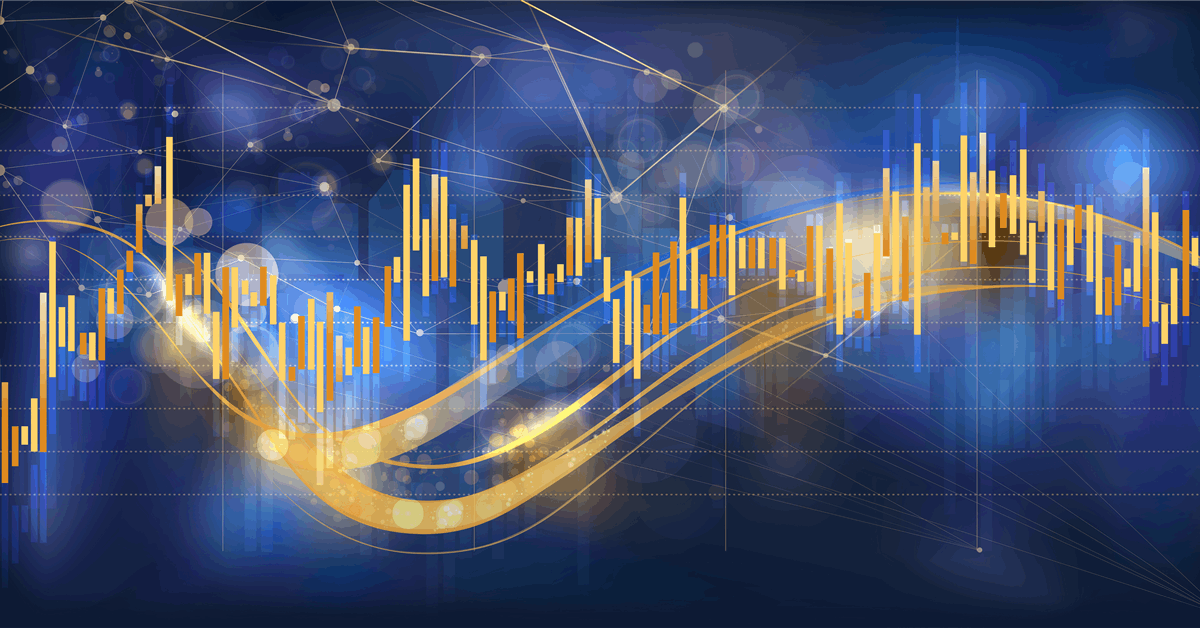

Oil surged during the Israel-Iran conflict, with Brent topping $80 a barrel, but prices have since retreated sharply. Attention has now shifted to OPEC+ supply and US trade policy, with multiple analysts highlighting near-term market tightness.

The EIA data somewhat undermined earlier comments by UAE Energy Minister Suhail Al Mazrouei that a lack of major inventory buildups shows the market needs the production that OPEC+ is reviving, while Saudi Aramco sees healthy global demand despite trade challenges and tariffs. Kuwait’s state energy company said OPEC+’s latest super-sized supply hike and recent interactions with customers suggest persistent demand growth beyond the summer driving season.

Another side of the US government report, meanwhile, revealed that diesel reserves are sitting at the lowest seasonal level since 1996, as well as the lowest total level since April 2005. Saudi Aramco expects global oil demand to rise by about 1.2 million to 1.3 million barrels a day for the rest of the year, after growing by around 1.5 million in the first quarter.

Oil Prices

- WTI for August delivery rose 5 cents to settle at $68.38 a barrel in New York.

- Brent for September delivery advanced 4 cents to settle at $70.19 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.