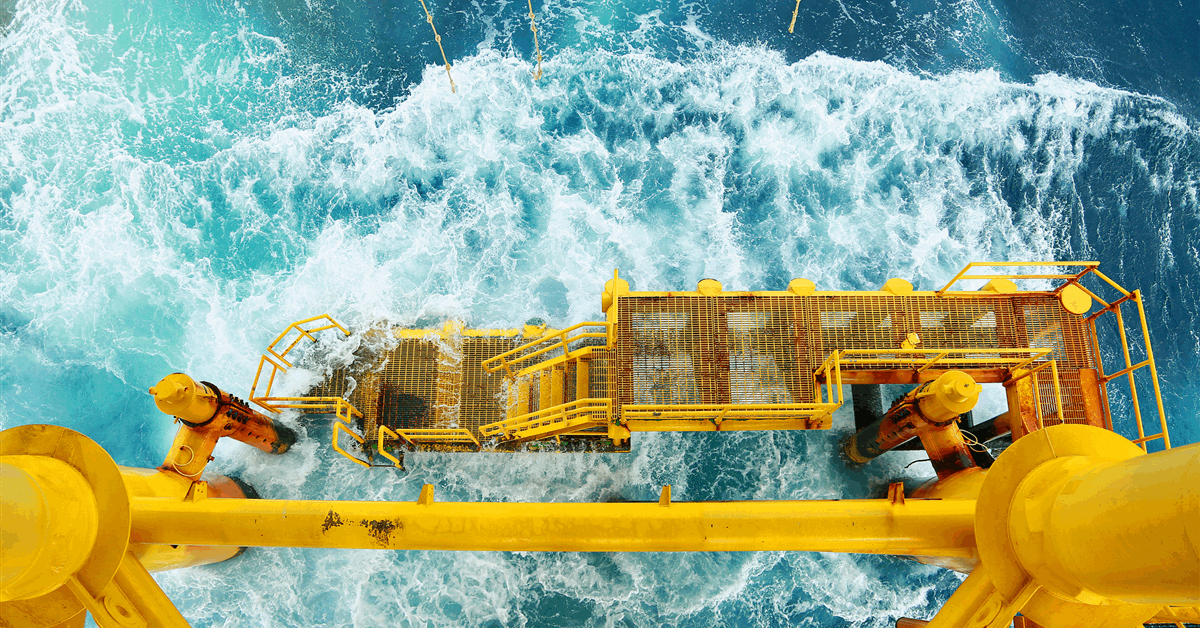

Crude oil prices have fallen sharply, Nadir Belbarka, an analyst at XMArabia, said in a statement sent to Rigzone on Friday, highlighting that Brent was at $62.67 per barrel and WTI was at $58.29 per barrel.

“The decline reflects rising expectations of oversupply, fading geopolitical supply risks, and growing coverage of reported progress toward a U.S.-endorsed Russia-Ukraine peace agreement,” Belbarka said in the statement.

“Upcoming data – including today’s flash PMIs across the U.S., UK, Germany, and France, along with remarks from ECB President Lagarde – will direct near-term sentiment,” Belbarka added.

“Weak readings could heighten recession fears and deepen demand destruction before triggering a technical rebound. Positive surprises could strengthen the dollar and reinforce downward pressure on crude,” the XMArabia analyst continued.

Belbarka went on to state that, “in the absence of major inventory drawdowns or a significant supply shock, crude is likely to remain constrained within its new trading range through year-end, awaiting meaningful geopolitical or macroeconomic catalysts”.

“Close attention to inventories, IEA [International Energy Agency] and OPEC forecasts, and dollar performance remains essential,” Belbarka warned.

In a separate market comment sent to Rigzone on Friday, Eric Chia, Financial Markets Strategist at Exness, noted that crude oil prices “were under pressure today, extending this week’s downside bias as the market digested the potential for geopolitical de-escalation and structural oversupply”.

“WTI prices were trading below $58 per barrel, down roughly two percent intraday and set for weekly losses of more than three percent,” Chia added.

“The emergence of a Russia-Ukraine peace framework could weigh on the oil market as the prospect of future normalization of Russian crude exports tempered the impact of new U.S. sanctions on Rosneft and Lukoil,” Chia said.

“Higher Russian oil exports could also add to the current oversupply narrative. However, a failed deal could help lift oil prices,” Chia added.

The Financial Markets Strategist at Exness went on to state that fundamentals remain bearish.

“While U.S. crude inventory data was mixed, the IEA projects a surplus of about four million barrels per day in 2026 driven by strong non-OPEC supply growth, which could continue to drive downside risks for oil,” Chia noted.

“A firmer U.S. dollar and fading hopes of an immediate Fed rate cut add to the pressure,” Chia added.

Rigzone has contacted the White House, the Department of Information and Press of the Russian Ministry of Foreign Affairs, and the Press Office of the Ministry of Foreign Affairs of Ukraine for comment on Belbarka and Chia’s statements. At the time of writing, none of the above have responded to Rigzone.

In a BMI report sent to Rigzone by the Fitch Group late Thursday, BMI analysts stated that “market sentiment remains tilted towards oversupply for oil as prices showed a soft easing throughout November”.

In this report, BMI, which is a Fitch Solutions company, projected that the front-month Brent Crude price will average $68.50 per barrel overall in 2025. The company also forecast in the report that the front-month WTI Cruce price will average $65.50 per barrel this year.

A report sent to Rigzone by the Standard Chartered team on Tuesday showed that Standard Chartered was expecting the ICE Brent nearby future crude oil price to average $65.00 per barrel in the fourth quarter of this year and $68.50 per barrel overall in 2025. This report also projected that the NYMEX WTI basis nearby future crude oil price will average $61.50 per barrel in the fourth quarter of 2025 and $65.40 per barrel overall this year.

To contact the author, email [email protected]