Oil climbed as the market assessed the risk of additional US sanctions on Russia and the chance that nuclear talks with Iran will fail to produce an agreement.

West Texas Intermediate rose 1.6% to settle near $62 a barrel after President Donald Trump said Russian President Vladimir Putin was “playing with fire” by escalating attacks on Ukraine. The US is weighing additional sanctions on the country after aggressive measures against Russia’s oil industry earlier this year sent crude rallying past $80 a barrel. The commodity eased off of intraday highs on news that Russia-Ukraine talks will be held in Istanbul on June 2.

Elsewhere, the New York Times reported that Israeli Prime Minister Benjamin Netanyahu is pressing on with threats to disrupt talks between Washington and Tehran by striking Iran’s nuclear facilities. A wrong turn in the negotiations stands to crimp flows from the OPEC member.

Still, bearish forces loom in the background. OPEC+ on Wednesday ratified group-wide production quotas this year and next, ahead of a decision by eight key members over the weekend on whether to bolster output again in July. Members held preliminary talks last week on making a large production hike for a third consecutive month, according to delegates.

The early conference likely stifled any remaining hope among the broader group of OPEC+ members for a slower-than-anticipated production unwind, said Robert Yawger, director of the energy futures division at Mizuho Securities USA.

“Now, the market is at the mercy of OPEC on Saturday,” he said.

The ramp-up of idled production by OPEC and its allies has stoked fears about oversupply and added to the pressure on prices. Parts of the futures curve for Brent are in contango — a bearish structure that signals ample supply.

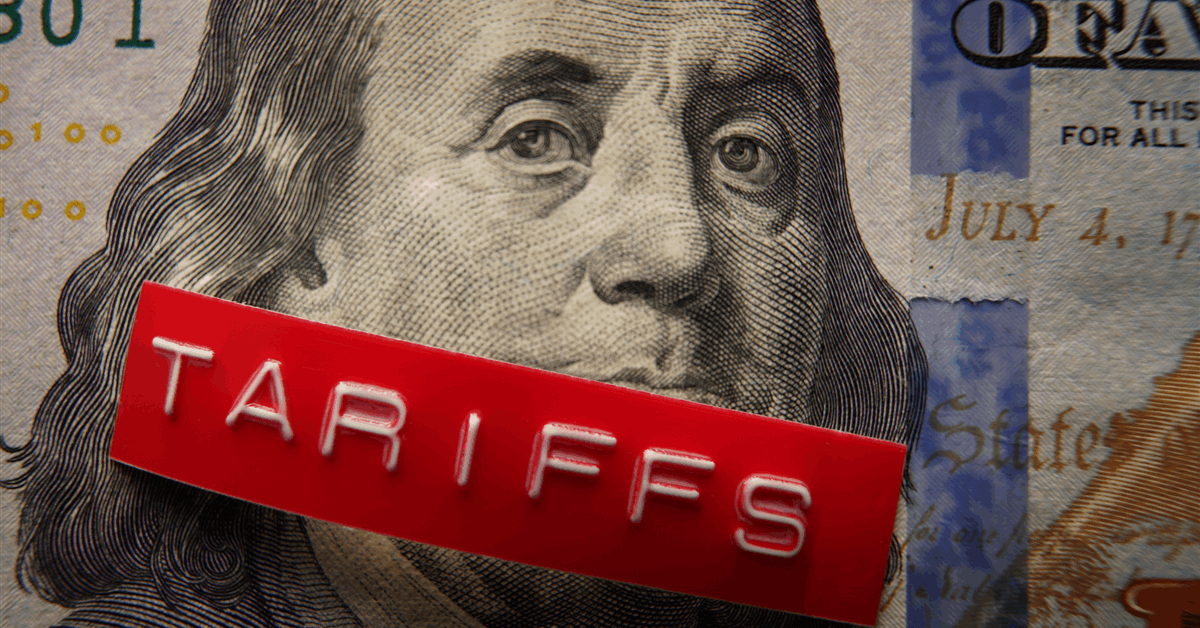

Oil has trended lower since mid-January, with sweeping tariffs from the Trump administration and retaliatory measures from targeted countries raising concerns about an economic slowdown. However, there has been some signs recently of easing trade tensions.

Oil Prices

- WTI for July delivery gained 1.6% to settle at $61.84 a barrel in New York.

- Brent for July settlement rose 1.3% to settle at $64.90 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.