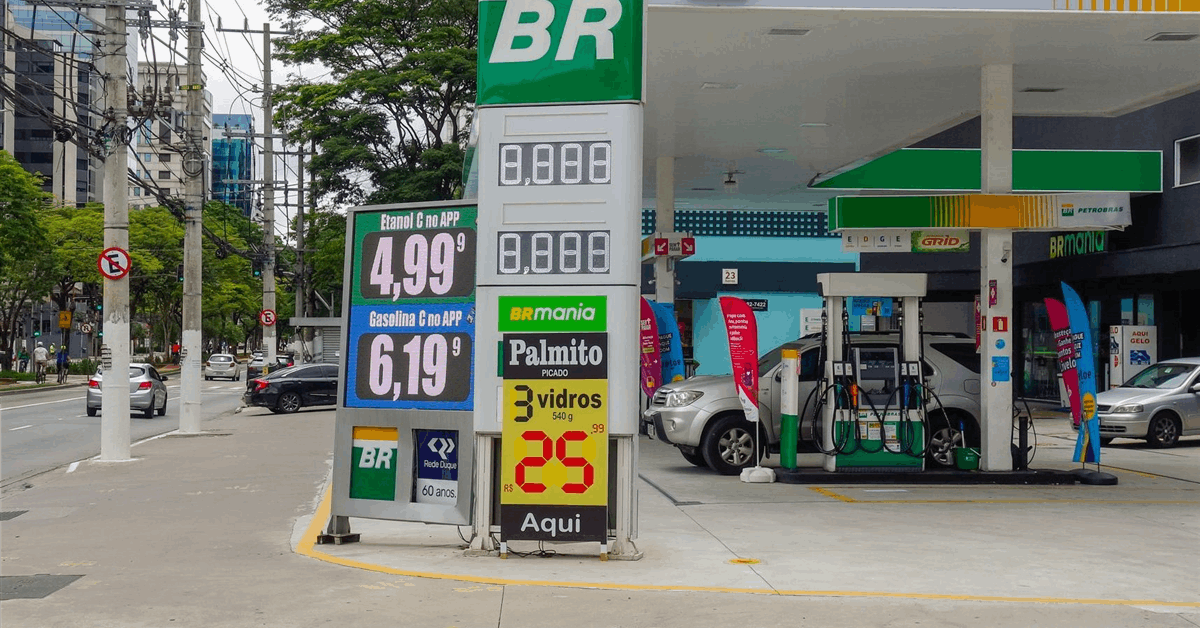

Oil rose amid signs of tighter supplies in the near term and on stronger demand signals in the US.

West Texas Intermediate crude rose 1.7% to settle above $67 a barrel, snapping a three-day losing streak. Equity markets advanced — typically a bullish indicator for commodities — after better-than-expected US economic data allayed some fears of oil demand deterioration.

Prices also found support from indications of a tighter near-term physical crude market on Thursday. US crude inventories slid last week and Iraq has lost about 200,000 barrels a day of oil production due to drone attacks on several fields in Kurdistan. Chevron Corp. said it was on the cusp of reaching a production plateau in the largest US oil field.

“While inventories globally have built very significantly, stocks in the pricing centres – especially in the US – are still quite low,” Daan Struyven, head of oil research at Goldman Sachs, said on Bloomberg Television. Market focus has shifted to “downside risks to supply,” he said.

Limiting the rally, Iraq approved a plan for its semi-autonomous Kurdish region to resume oil exports that have been halted since March 2023. The Kurdistan Regional Government will supply Iraq’s state oil marketer SOMO at least 230,000 barrels a day for export, the federal government said.

Supply concerns were also reflected in the forward curve for crude. It is currently trading in backwardation, where a premium is paid for sooner delivery over longer-dated contracts.

In the US, distillate stockpiles remain at the lowest seasonal level since 1996 even after last week’s increase.

Oil Prices

- WTI for August delivery gained 1.7% to settle at $67.54 a barrel in New York.

- Brent for September settlement climbed 1.5% to $69.52 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.