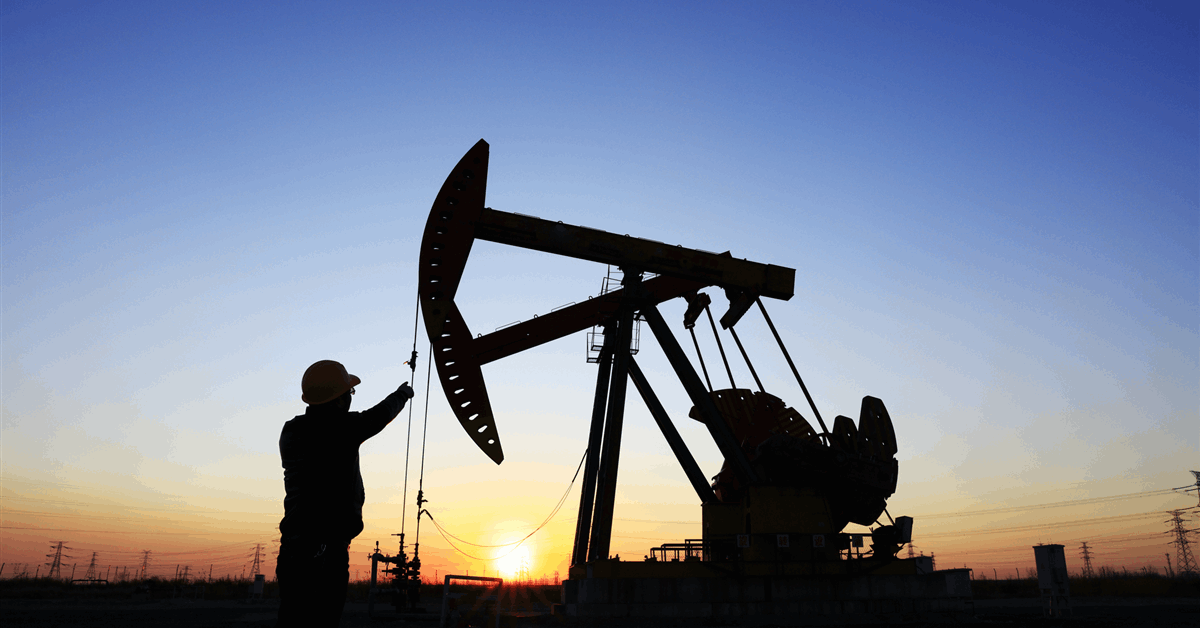

Oil edged higher after the US advised ships to steer clear of Iranian waters when navigating the Strait of Hormuz, reviving a risk premium that had ebbed in recent days amid nuclear talks.

West Texas Intermediate crude futures rose 1.3% to settle above $64 a barrel after the US Department of Transportation said in a maritime advisory on Monday that American-flagged ships should stay as far as possible from Iranian waters. The agency cited a recent incident in which Iran’s Islamic Revolutionary Guard Corps harassed a US-flagged tanker as it was transiting through the waterway last week.

The guidance stoked investor fears of a short-term disruption in the vital Hormuz chokepoint, through which about a third of the world’s oil flows, as well as a broader conflagration in the oil-rich Middle East region. Iran has threatened to close Hormuz during times of geopolitical tension.

The development reversed bearish momentum that followed pledges by Iran and the US to continue talks following what they described as positive discussions in Oman on Friday. Tehran said the session, aimed at defusing tensions over the Islamic Republic’s nuclear program, was “a step forward.”

US President Donald Trump, who has repeatedly threatened Tehran with airstrikes, said there would be another meeting this week. The US leader is also due to see Israeli Prime Minister Benjamin Netanyahu on Feb. 11, while preparing tariffs against countries doing business with Tehran.

Crude has pushed higher this year despite widespread concerns about a looming glut, with gains supported by geopolitical tensions as well as halts to some flows, including from Kazakhstan. Still, prices fell last week on signs of progress between Iran and the US.

India Flows

Traders were also looking at oil flows to India. The country’s imports of Russian oil are expected to drop by about half from already weaker recent levels, according to people with direct knowledge of the purchases, after Trump said the South Asian nation agreed to halt crude imports from Moscow as part of a trade deal.

However, New Delhi has yet to directly confirm the commitment, with the government emphasizing that energy security remains its top concern.

“If India stops Russian oil purchases following the US-India trade deal, we would need to see Russian oil discounts widening in an effort to find alternative buyers,” said Warren Patterson, head of commodities strategy at ING Groep NV. Failing to find other takers would ultimately mean a tighter balance, he said.

This week is likely to provide plenty of clues on the market outlook, with the official US forecaster, OPEC, and the International Energy Agency due to issue updated analyses.

Elsewhere, Mexico has halted its oil shipments to Cuba after Trump’s threat to sanction countries that supply it. Oil imports to the island reached zero in January for the first time since 2015. The pressure on fuel supplies is squeezing the Cuban economy, with residents facing shortages of everything from cooking gas to water and electricity.

Oil Prices

- WTI for March delivery rose 1.3% to settle at $64.36 a barrel in New York

- Brent for April settlement climbed 1.5% to settle at $69.04 a barrel

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.