Oil rose 1.3% to settle above $64 a barrel as tightening US crude and fuel inventories eased investor fears about a looming supply glut.

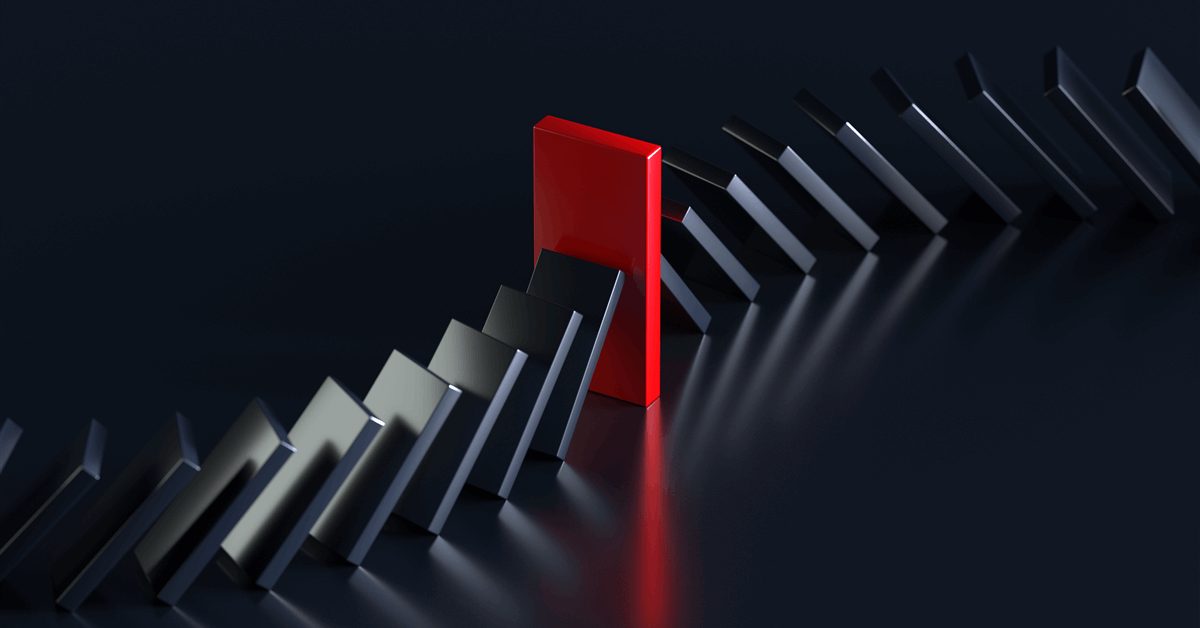

While prices continue to trade within a $5 band this month, West Texas Intermediate’s so-called prompt spread — a measure of supply tightness — strengthened to the widest in more than a week. The move followed a US government report showing stockpiles at the key Cushing, Oklahoma, storage hub fell for the first time in eight weeks while national crude inventories declined by 2.4 million barrels, more than expected.

Fuel supplies also contracted, suggesting demand remains robust despite tariffs weighing on longer-term consumption expectations. The bullish data belies a worsening global trade backdrop that has contributed to a 12% drop in US oil futures this year.

The US on Wednesday raised its tariff on some Indian goods to 50% — the highest levy applied to any Asian nation — to punish the country for buying Moscow’s oil. But Indian processors plan to maintain the bulk of their purchases, suggesting the trade limits won’t ease investor worries about a global supply surplus, Arne Lohmann Rasmussen, chief analyst at A/S Global Risk Management. With OPEC+ unwinding output curbs, the International Energy Agency has warned of a record glut next year.

Trump, meanwhile, has lauded falling oil prices, saying Tuesday that crude futures would break $60 a barrel “pretty soon.”

Oil Prices

- WTI for October delivery rose 1.4% to settle at $64.15 a barrel in New York.

- Brent for October settlement added 1.2% to settle at $68.05 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.