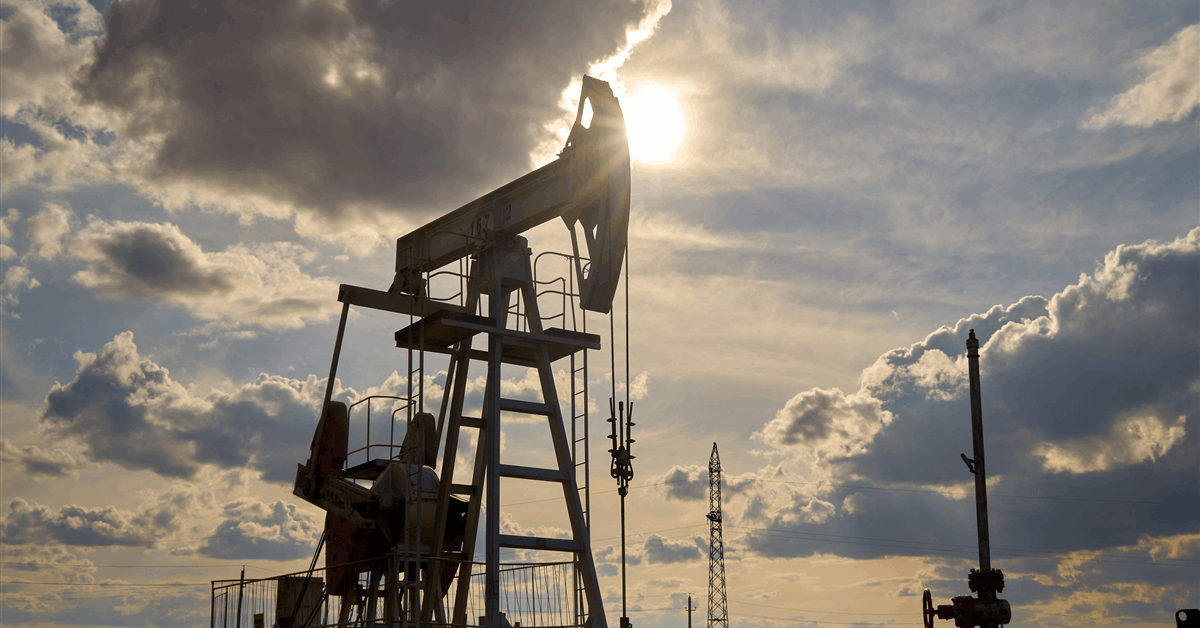

Oil plunged by more than 7% as Iran’s response to US military strikes spared energy infrastructure, allaying investor concerns that the conflict would severely disrupt supplies from the Middle East.

West Texas Intermediate slumped below $70 a barrel after Iran fired missiles at a US air base in Qatar in retaliation for President Donald Trump’s weekend airstrikes on three of its nuclear facilities. Traders had initially feared that Iran’s retaliatory response would involve a closure of the Strait of Hormuz chokepoint, through which about a fifth of the world’s oil passes. The barrage was intercepted and did not result in any casualties, Qatar said.

Prices traded in a $10-a-barrel range on Monday, first rising by more than 6% only to drop even more, underscoring just how on edge traders are and how critical every development in the region is to global energy markets.

“Crude is pulling back as the market digests signs that energy infrastructure is not Iran’s first choice for retaliation,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth Group. “There are indications the US may have had advance warning of the strikes, suggesting this was more of a face-saving move than a true escalation.”

The Middle East accounts for about a third of global crude production and there haven’t yet been any signs of disruption to physical oil flows, including for cargoes going through the Strait of Hormuz. Since Israel’s attacks began earlier this month, there have been signs that Iranian oil shipments out of the Gulf have risen rather than declined.

While prices may be cooling for now, significant supply threats linger as tensions remain high across the Middle East. Saudi Arabia condemned Iran’s attack on Qatar and said it was ready to support Qatar with any measures it takes.

Worries about demand are also starting to creep in as several countries including Kuwait, Bahrain, and Iraq said they temporarily closed airspace, roiling global air travel.

Iran’s move compounded earlier price weakness after Trump warned against rising oil prices in a social media post, urging the Energy Department to facilitate more drilling “now.” Energy Secretary Chris Wright replied, “We’re on it.”

The oil market has been gripped by an intensifying crisis since Israel attacked Iran more than a week ago, with crude benchmarks pushing higher, options volumes spiking, and the futures curve shifting to reflect fears of a near-term interruption to supplies.

US crude’s prompt spread — the difference between its two nearest contracts — first widened to as much as $2.24 a barrel in a bullish backwardation structure, from $1.18 on Friday. The closely followed metric then retraced much of that move.

The unprecedented US strikes were meant to hobble Iran’s nuclear program, and targeted sites at Fordow, Natanz, and Isfahan. Tehran warned earlier that the strikes would trigger “everlasting consequences.”

There remain multiple, overlapping risks for crude flows. The biggest of those centers on the Strait of Hormuz, should Tehran seek to retaliate by attempting to close the narrow conduit. About a fifth of the world’s crude output passes through the waterway at the entrance to the Persian Gulf.

Navies in the region have consistently warned about an elevated threat to tankers, though a liaison between the military and shipping said on Sunday that the continued passage of vessels through the Strait is “a positive sign for the immediate future.” Two supertankers U-turned away from the strait on Sunday, before subsequently resuming on their original course and heading to transit the chokepoint.

Iran’s parliament has called for the closure of the strait, according to state-run TV. Such a move, however, couldn’t proceed without the approval of Supreme Leader Ayatollah Ali Khamenei. Authorities may yet restrict flows in other ways.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.