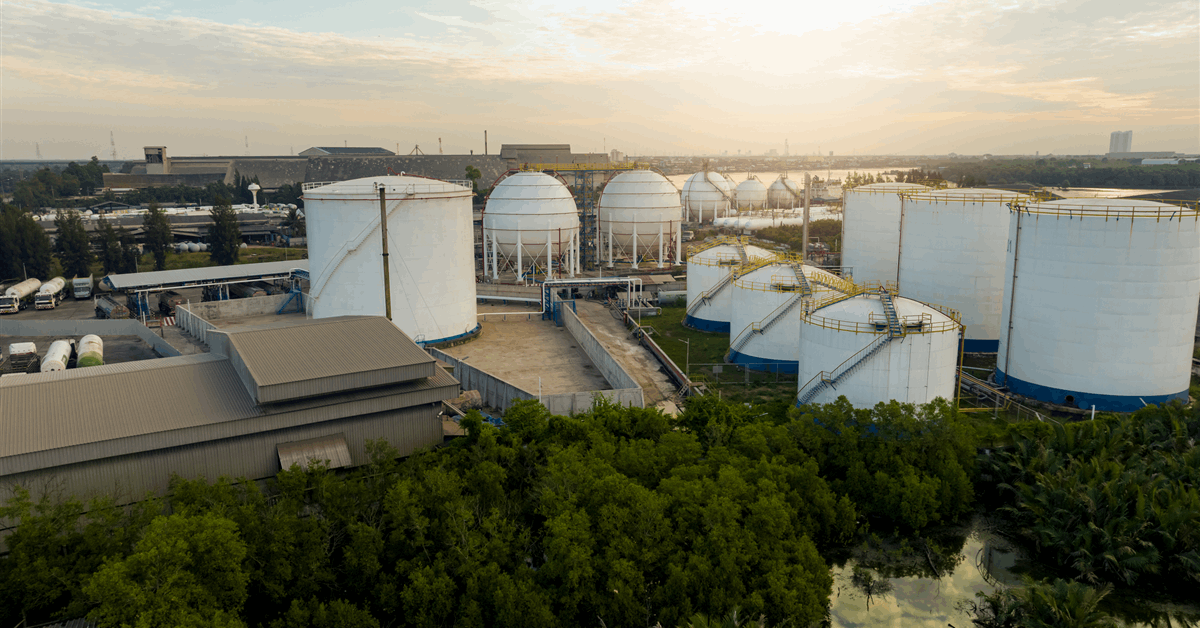

ONEOK, Inc. and MPLX LP are forming a joint venture that aims to build a large-scale liquefied petroleum gas (LPG) export terminal and pipeline in Texas.

The LPG terminal, to be constructed in Texas City, Texas, will have a capacity of 400,000 barrels per day (bpd) and will connect to ONEOK’s Mont Belvieu storage facility via a new 24-inch pipeline, the midstream operator said in a news release. The facility will handle primarily low ethane propane (LEP) and normal butane (NC4), with ONEOK and MPLX each contractually reserving 200,000 bpd for their respective customers.

The joint venture Texas City Logistics LLC (TCX) will be 50/50 owned by ONEOK and MPLX. The two companies will contribute $700 million each in investment, for a total of $1.4 billion.

MPLX will construct and operate the facility, which is expected to be completed in early 2028. The terminal will leverage MPLX parent Marathon Petroleum Corporation (MPC)’s existing location and infrastructure, “providing construction timing and cost benefits,” according to the release.

Meanwhile, the pipeline joint venture MBTC Pipeline LLC is owned 80 percent by ONEOK and 20 percent by MPLX, and the former will construct and operate the pipeline. ONEOK’s and MPLX’s share of the total investment in the pipeline is expected to be approximately $280 million and $70 million, respectively, for a total of $350 million.

ONEOK said its share of capital investment in the projects will be approximately $1.0 billion.

“We are excited to collaborate with MPLX on these strategically located projects which expand and extend our NGL value chain providing additional optionality and value to our customers,” ONEOK President and CEO Pierce Norton II said. “Given our high expectations for future growth and demand for more energy infrastructure, including export capacity, these projects with MPLX complement our disciplined capital allocation strategy”.

MPLX describes itself as a diversified, growth-oriented master limited partnership formed in 2012 by MPC to own, operate, develop and acquire midstream energy infrastructure assets. The partnership provides services in the midstream sector across the hydrocarbon value chain.

EnLink Midstream Acquisition Closed

Meanwhile, ONEOK announced the closing of its acquisition of EnLink Midstream, LLC.

ONEOK acquired all of the outstanding publicly held common units of EnLink for $4.3 billion in ONEOK common stock. The transaction was announced in November 2024.

EnLink unitholders, other than ONEOK, received 0.1412 shares of ONEOK common stock for each outstanding EnLink common unit. EnLink common units will no longer be publicly traded on the New York Stock Exchange.

ONEOK issued approximately 37.0 million shares in connection with the transaction, representing approximately 6.0 percent of the total ONEOK shares outstanding.

“The completion of this acquisition further enhances ONEOK’s integrated midstream business and provides exceptional value to all stakeholders, including EnLink unitholders who we now welcome as ONEOK shareholders,” Norton said in a separate statement.

“We welcome EnLink’s employees to the ONEOK team,” Norton said. “We look forward to the many benefits this acquisition can provide”.

In October 2024, ONEOK completed its acquisition of Global Infrastructure Partners’ (GIP) entire interest in EnLink for a total cash consideration of approximately $3.3 billion.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR