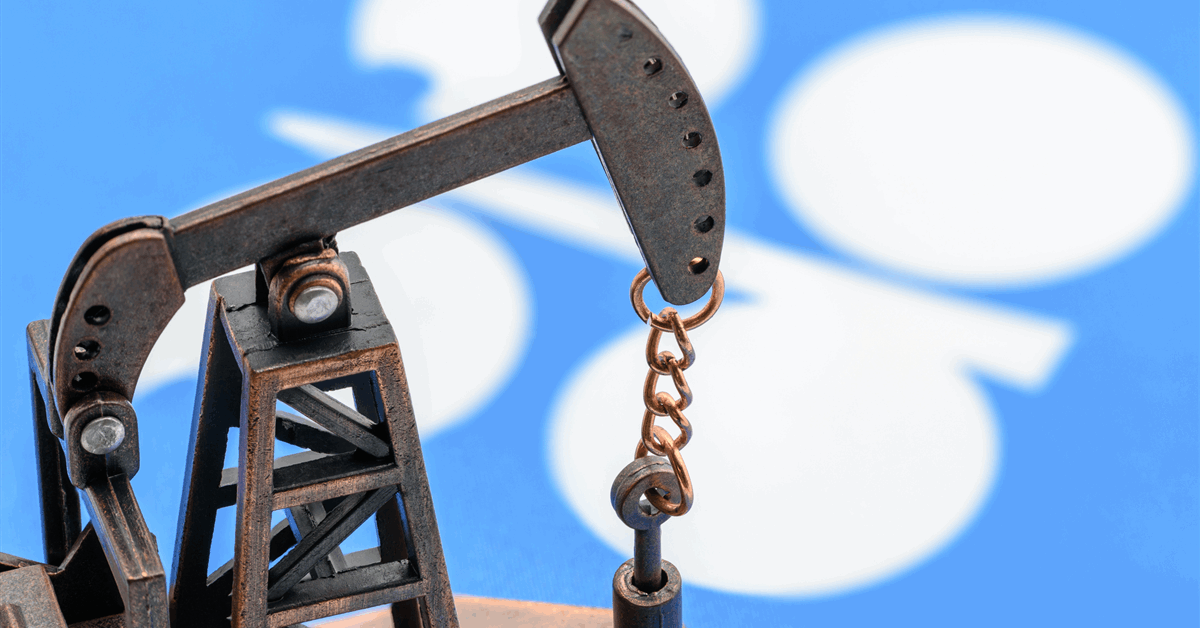

OPEC+ is considering accelerating its production increases by discussing a potential hike of more than 411,000 barrels a day for July as it seeks to recoup lost market share, according to people familiar with the matter.

Eight key members of the Organization of the Petroleum Exporting Countries and its partners, led by Saudi Arabia, are due to hold a video conference on Saturday to discuss output policy. Their last two calls resulted in super-sized production increases that drove down prices, and the cartel may go even further this time, the people said.

Some delegates among the eight nations said they were unaware of plans for an outsize boost and expected an increase closer to the 411,000-barrel-a-day hikes set for May and June. Yet the group’s deliberations are increasingly confined to a smaller group of its most powerful members, who sometimes only share decisions with their counterparts at short notice.

OPEC+ has made a radical policy shift from defending prices to actively seeking to drive them lower. It stunned traders in early April by announcing a supply increase that was three times the volume planned. The move came even as markets faltered amid slowing demand and President Donald Trump’s trade war, briefly dragging crude to a four-year low below $60 a barrel, and was repeated the following month.

Brent futures slipped to trade below $64 a barrel in London on Friday.

Kazakhstan’s Deputy Energy Minister Alibek Zhamauov had already alluded to the possibility of an bigger surge in comments to reporters on Thursday. “There will be a hike, but whether it will be 400, 500, 600, we don’t know — that will be announced on Saturday,” he said in Astana, according to the news agency.

Delegates have offered a range of explanations for the pivot by Riyadh. Some assert that OPEC+ is simply satisfying robust demand, while others say Saudi Arabia seeks to punish members like Kazakhstan and Iraq for cheating on their output quotas. Officials have also suggested the kingdom is trying to appease Trump, or to reclaim the market share relinquished to US shale drillers and other rivals. The ultimate motive may combine several of these objectives.

If Riyadh’s strategy was to discipline the cartel’s quota cheats through a “controlled sweating,” it doesn’t seem to be working.

Kazakhstan, the most blatant offender, continues to exceed its limits by several hundred thousand barrels a day and has publicly stated that it has no plans to atone. Energy Minister Yerlan Akkenzhenov told reporters on Thursday that the country can neither enforce cutbacks on international corporate partners, or dial back at state-run fields.

The strategy transition hasn’t been without a cost. While crude’s pullback offers relief for consumers and central banks grappling with stubborn inflation, it poses financial peril for oil producers in OPEC+ and around the world.

The International Monetary Fund estimates the Saudis need prices above $90 to cover the lavish spending plans of Crown Prince Mohammed bin Salman. The kingdom is contending with a soaring budget deficit, and has been forced to cut investment on flagship projects such as the futuristic city, Neom.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.