For the first time in more than a year, Petroleos Mexicanos has swung to a profit, a positive signal for the embattled state oil driller as President Claudia Sheinbaum’s administration seeks to raise as much as $12 billion to help pay down the company’s massive debts.

Pemex’s results were boosted by currency moves in the second quarter, thanks to a strengthening in the peso. Lower cost of sales and stronger performance among some financial assets contributed.

The positive report comes as Sheinbaum’s administration seeks to sell as much as $12 billion in securities to international investors in a bid to raise financing to help pay Pemex’s roughly $100 billion in debt. The profits could help to make the financing round go more smoothly.

Pemex posted a net income of 59.52 billion pesos ($3.2 billion) for the second quarter, compared with a 273.3 billion peso loss a year prior. Pemex reported about $30 billion in losses in 2024.

Crude and condensate production slumped to 1.63 million barrels per day, down 8.6% from a year earlier, the company said. Natural gas output was almost 3.6 billion cubic feet per day, a 3.7% drop from a year prior. Crude processing climbed.

The debt offering, disclosed in a filing July 22, will consist of dollar-denominated debt maturing August 2030, in the form of amortizing pre-capitalized securities, or P-Caps, a type of instrument used in asset-backed finance.

Mexico’s finance ministry has said the operation would allow Pemex to address short-term financial and operational needs, while keeping the liabilities off Pemex and Mexico’s official balance sheets. Pemex said on Monday the proceeds would be used in part to refinance the company’s short-term bank debt.

Pemex will also publish a comprehensive business plan in the coming weeks, which will include further guidance on future debt operations. Pemex’s total financial debt stood at $98.8 billion at the end of the second quarter.

Sheinbaum’s administration has been working on a broad plan to shore up the struggling oil producer, which has seen output slump to a four-decade low as its aging refineries bleed cash.

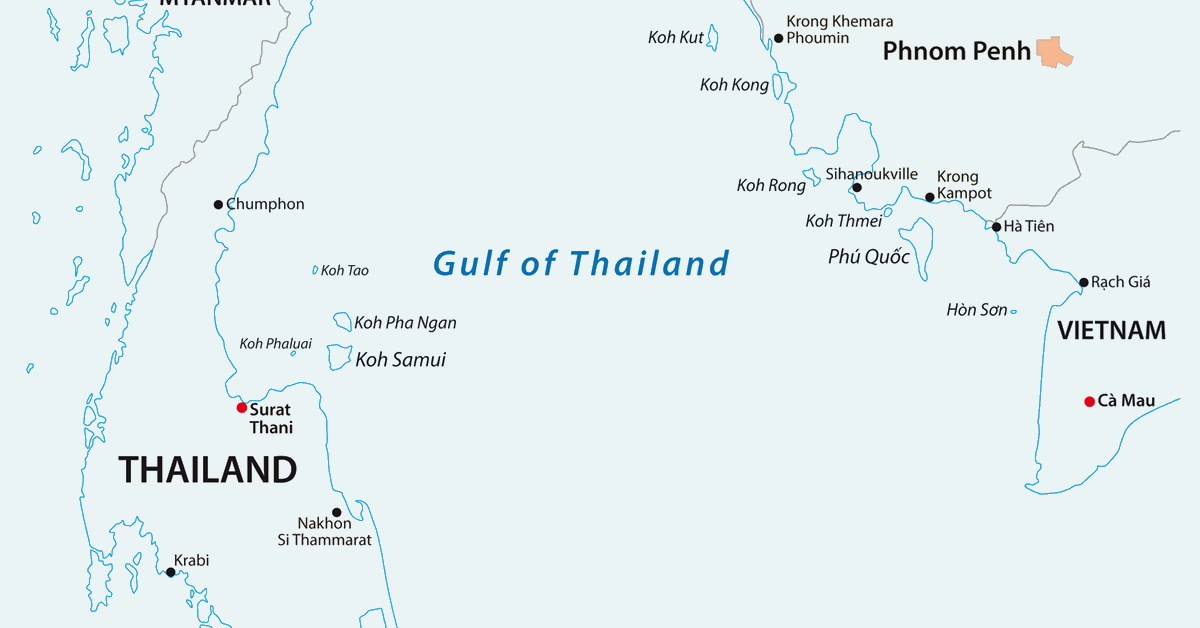

As part of the plan, Pemex will open some key oil and gas fields to joint investment projects with private sector partners in a bid to boost production. The company has attracted partnerships from Mexican billionaire Carlos Slim’s Grupo Carso SAB and Australia’s Woodside Energy Group Ltd. to develop offshore gas assets.

Some oil majors and a number of mid-sized companies have expressed interest in partnerships to develop 11 key extraction projects, Pemex’s exploration and production chief Angel Cid said during a conference call Monday, adding that more details will be announced soon.

Pemex is also looking for solutions to pay back the roughly $20 billion it owes its oilfield contractors as payment delays have begun in recent months to impact production. The company paid a total 230 billion pesos to service providers in the first half of the year, and is seeking to increase that over the next two quarters, Chief Financial Officer Juan Carlos Carpio said during the call.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.