Petroliam Nasional Berhad (Petronas) has formalized several key agreements with the Sabah government, focusing on the responsible development of the state’s energy resources.

Petronas said in a media release the event marked a significant milestone in Sabah’s energy growth with the official handover of the Sabah Gas Strategy, a project led jointly by Petronas and the state government. Guided by the Sabah Joint Coordination Committee, the strategy was crafted by a Joint Task Force including Petronas, SMJ Energy Sdn. Bhd., Sabah Energy Corp. Sdn. Bhd., the Energy Commission of Sabah, and the Ministry of Industrial Development and Entrepreneurship.

Petronas added that the partnerships build on the Commercial Collaboration Agreement it signed with the state government in 2021. This agreement is a blueprint for securing a reliable natural gas supply for the state’s domestic demand, Petronas said.

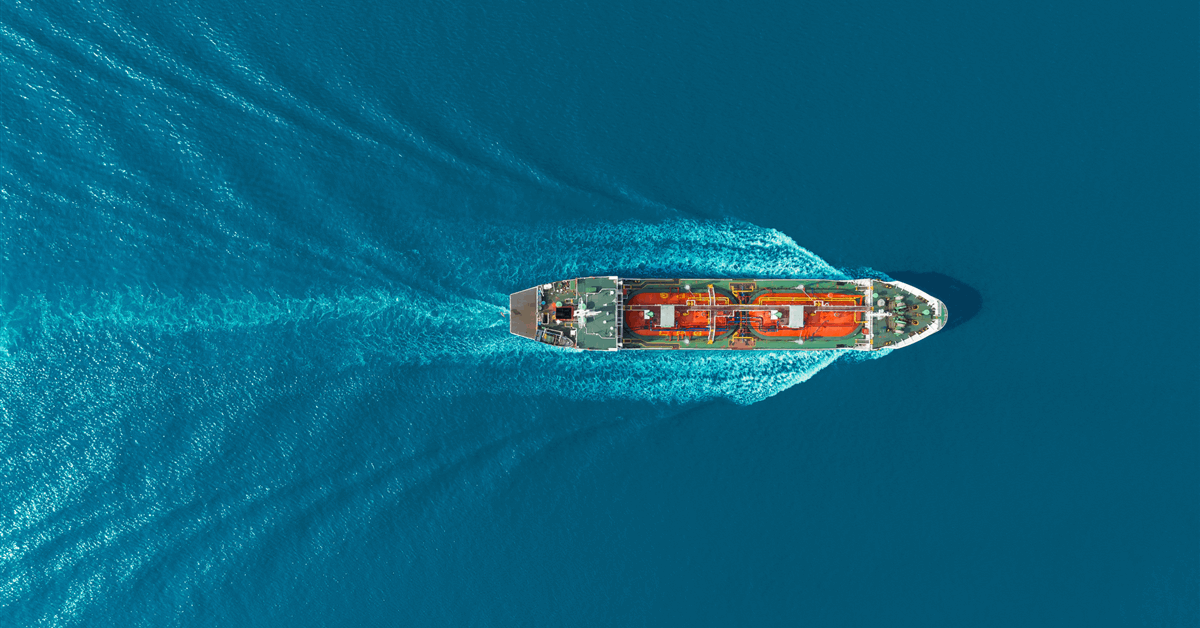

Additionally, Petronas said that it has entered into a Technical Evaluation Agreement concerning the Layang-Layang Basin off the coast of Sabah, a frontier basin covering roughly 44,500 square kilometers (17,180 square miles). The TEA, which was established with ConocoPhillips Malaysia New Ventures Ltd. and Pertamina Hulu Energi (Pertamina), facilitates subsurface research, which includes regional geological evaluations and in-depth prospectivity assessments, according to Petronas.

To further strengthen exploration and production cooperation, Petronas formalized a Memorandum of Understanding (MoU) with Dialog Resources Sdn. Bhd. (DIALOG) to advance the development of the Mutiara Cluster off Sabah’s East Coast.

Under the Malaysia Bid Round 2025, the Mutiara Cluster Small Field Asset Production Sharing Contract was awarded to Dialog in June. This cluster provides an opportunity to monetize discovered resources through a cost-effective, optimized development plan that leverages existing materials and equipment, using past insights to accelerate start-up, Petronas said.

As part of its initiatives to improve basin understanding and unlock future growth opportunities for Malaysia’s production, Petronas added that it is investing in seismic data acquisition programs, including in Sabah’s East Coast area.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR