Dive Brief:

-

Capacity prices in the PJM Interconnection’s latest capacity auction hit a $329.17/MW-day price cap across its region, up 22% from a year ago for most of PJM, the grid operator said Tuesday.

-

PJM expects the increase to record-high capacity prices for the 12-month period that starts in June 2026 could lead to 1.5% to 5% bill increases for some ratepayers, depending on what state they are in.

-

PJM estimates that without a price cap that was established in an agreement with Pennsylvania Gov. Josh Shapiro, D, the capacity price for the 2026-27 delivery year would have been nearly $389/MW-day, or about 18% higher.

Dive Insight:

A year ago, PJM’s capacity auction sent shockwaves through its 13-state region when prices for the delivery year that started June 1 soared to $269.92/MW-day for most of its footprint, up from $28.92/MW-day. Prices in that auction hit zonal caps of $466.35/MW-day for the Baltimore Gas and Electric zone in Maryland, and $444.26/MW-day for the Dominion zone in Virginia and North Carolina.

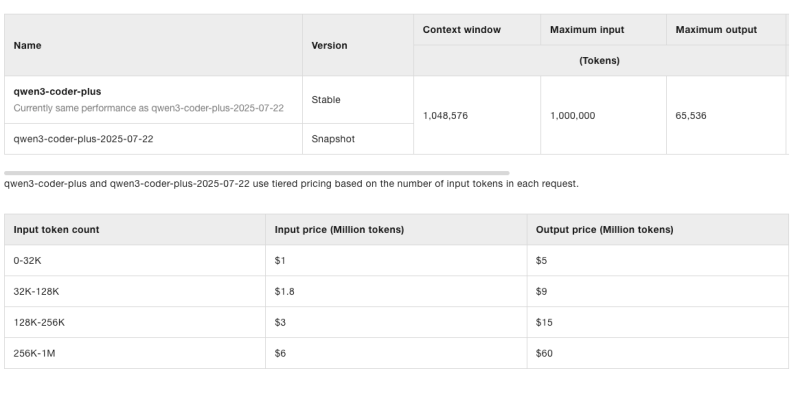

The 2024 auction’s total cost jumped to $14.7 billion from $2.2 billion. The cost of this year’s auction, which opened July 9 and closed July 15, climbed even higher to $16.1 billion, up 9.5% from a year ago. Capacity costs make up a relatively small part of electric bills, according to PJM.

PJM capacity costs hit a record high

The cost of PJM’s capacity auction in billions of dollars.

In the auction, PJM bought 134,311 MW for the capacity year that starts June 1, according to the grid operator’s auction report. About 135,192 MW was offered in the auction, a decline from last year. PJM secured enough capacity to have an 18.9% reserve margin as forecast peak load grew by about 5,500 MW, mainly from data centers.

Gas-fired generation accounted for 45% of the cleared capacity, followed by nuclear at 21%, coal at 22%, hydroelectric at 4%, wind at 3% and solar at 1%, according to PJM. Demand response offered in the auction was essentially flat at 8,010 MW, PJM said.

The auction’s high capacity prices are signs that supply and demand conditions in PJM are tight, according to Stu Bresler, executive vice president for market services and strategy at PJM.

However, there are signs that the market is responding to PJM’s capacity auction last year when prices soared, up from $28.92/MW-day, Bresler said during a media briefing.

The latest auction included new generation and uprates of existing power plants totaling 2,669 MW of “unforced capacity,” a measure in a resource’s accredited value, according to Bresler. PJM’s last three auctions didn’t include new generation or uprates, according to the grid operator.

Also, 17 generating units with about 1,100 MW in interconnection rights have withdrawn retirement notices since the previous auction, Bresler said.

However, the pace of building generating resources isn’t keeping up with rising electric demand, according to Will Sauer, Exelon vice president of federal regulatory affairs. Instead of building power plants, there is ongoing consolidation in the power sector in PJM, he said in an interview.

The consolidation affecting PJM includes Constellation Energy’s plan to buy Calpine, NRG Energy’s pending deal to buy a fleet of LS Power power plants and Talen Energy’s proposed transaction to buy two gas-fired power plants in PJM.

With supply chains “out of whack” — partly because of import tariffs — power plant developers cannot get needed parts to build generating units, according to Tyson Slocum, director of Public Citizen’s Energy Program.

So instead, they “plow money into making big energy players even bigger through consolidating existing natural gas generation assets,” Slocum said. “It’s a mad rush right now, and I don’t think it’s over.”

Exelon and its utilities, which operate in states that bar utilities from owning generation, are considering “all options” for getting more power supplies into PJM, including getting back into rate-regulated generation, according to Sauer.

The Trump administration is likely to use the auction results to justify measures aimed at keeping thermal power plants, namely coal, in PJM from retiring, according to analysts with Capstone, a research firm. The U.S. Department of Energy cited an energy “emergency” in June when it ordered Constellation Energy to keep running generating units in Pennsylvania that the company planned to retire. Environmental groups and some states have challenged that order.

Hitting the price cap wasn’t a surprise, according to Molly Jerrard, head of flexibility at Enel North America. “This is what the load-growth era looks like for PJM, Jerrard said in an email. The supply-and-demand tightness adds urgency for large loads to implement flexibility strategies, according to Jerrard. Enel expects more demand response participants to “come off the sidelines” to take advantage of high capacity prices, she said.

The latest auction results are a boon to power plant owners such as Talen, Constellation, NRG, Vistra and Public Service Enterprise Group, according to Jefferies. Constellation cleared 18,025 MW in the auction, up from 17,500 MW a year ago, the independent power producer said in U.S. Securities and Exchange Commission filings. Vistra said it cleared 10,314 MW compared to 10,255 MW in the previous auction.

Power plant owners hailed the results even as consumer advocates decried the rising costs that will be passed on to the public.

“PJM is successfully meeting the record-setting demand for reliable electricity, adding more than 2,600 MW of new generation to power American families and business, new electric vehicles, AI and booming industrial growth, all while keeping prices steady for over 15-plus years,” Constellation said in a statement.

The PJM Power Providers Group, or P3, said the auction is a sign of progress in PJM.

“New generation is being added, existing generation retained, external capacity imported and retired capacity reactivated,” Glen Thomas, P3 president, said in a statement. “The resource mix remains diverse and it is important for the market to continue to send the signal that more capacity is needed.”

Ratepayer advocates, however, see the auction results as a sign of flawed PJM policies.

“The power grid operator’s policy decisions too often favor outdated, expensive power plants and needlessly block low-cost clean energy resources and battery projects from connecting to the grid and bringing down prices,” Sarah Moskowitz, executive director of Chicago-based Citizens Utility Board, said in a statement.

PJM plans to hold a base capacity auction for the 2027-28 delivery year in December, as the grid operator works toward returning to its three-year forward auction cycle.

“With little supply response likely for 2027/2028 and Effective Load Carrying Capability … further reducing eligible capacity, clearing at the cap is probable for the next auction,” Jefferies analysts said. However, political intervention could affect the pricing, they said.

“We think the market operator is likely to face persistent scrutiny from state policymakers that are considering options to reduce or even eliminate their reliance on the PJM capacity market,” ClearView Energy Partners analysts said.