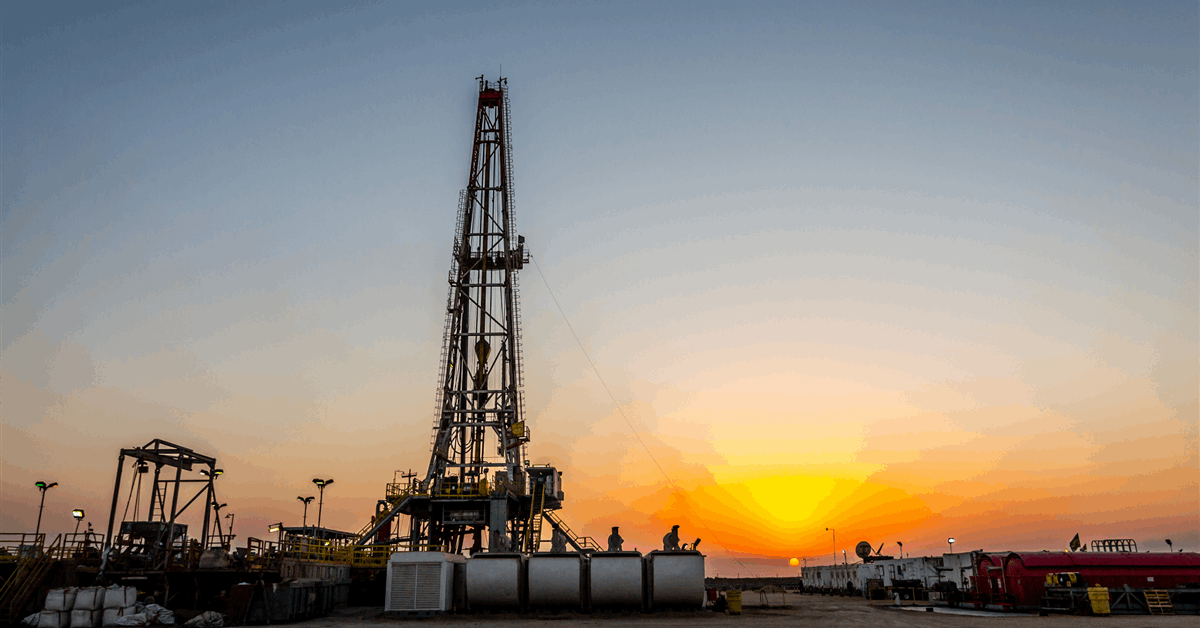

QatarEnergy said Monday it had completed the purchase of a 40 percent stake in the North Rafah exploration block offshore Egypt from Eni SpA.

The Italian state-backed energy major retains 60 percent as operator, state-owned QatarEnergy said in a press release.

North Rafah spans nearly 3,000 square kilometers (1,158.31 square miles) in the Mediterranean Sea off the northeastern coast of Egypt, QatarEnergy noted. The block has a water depth of up to 450 meters (1,476.38 feet), it said.

The acquisition “strengthens our presence in Egypt and marks another important step in advancing our ambitious international exploration strategy”, said QatarEnergy president and chief executive Saad Sherida Al-Kaabi, who is also Qatar’s energy minister.

Earlier this month QatarEnergy said it has entered into an agreement to buy a 27 percent ownership in the North Cleopatra exploration block on Egypt’s side of the Mediterranean Sea from operator Shell PLC.

Shell will retain 36 percent. The other partners are Chevron Corp with a 27 percent interest and Egypt’s state-owned Tharwa Petroleum Co with 10 percent, according to a QatarEnergy statement October 5.

North Cleopatra spans 3,400 square kilometers with waters up to 2,600 meters (8,530.18 feet) deep, QatarEnergy noted.

The license area is in the frontier Herodotus basin and adjacent to the northern portion of the North El-Dabaa block, where QatarEnergy holds 23 percent, QatarEnergy said.

QatarEnergy obtained its North El-Dabaa stake from United States oil and gas heavyweight Chevron, in an agreement announced November 11, 2024.

North El-Dabaa lies about 10 kilometers off Egypt’s Mediterranean shore. The block has a water depth of 100-3,000 meters, according to QatarEnergy.

On May 12, 2024, QatarEnergy announced a deal to acquire 40 percent each in the Cairo and Masry exploration blocks offshore Egypt from sole owner Exxon Mobil Corp. The blocks cover around 11,400 square kilometers with waters 2,000-3,000 meters deep, according to QatarEnergy.

On March 29, 2022, QatarEnergy announced an agreement to buy from U.S. energy major ExxonMobil 40 percent in the North Marakia exploration block in Egyptian waters in the Mediterranean.

Elsewhere in Egypt, QatarEnergy previously entered deals with Shell to buy a 17 percent stake each in Blocks 3 and 4 in the Red Sea, as announced by QatarEnergy December 13, 2021.

In 2023 Egypt awarded a consortium consisting of QatarEnergy, Eni and British energy major BP PLC exploration and production rights for the East Port Said block or EGY-MED-E8. QatarEnergy and BP each own 33 percent. Operator Eni has the remaining 34 percent, according to BP’s announcement of the award October 2, 2023.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR