US oil production will likely decline next year, but the scale of the dropoff will be substantially reduced by an old source of new supplies: the Gulf of Mexico.

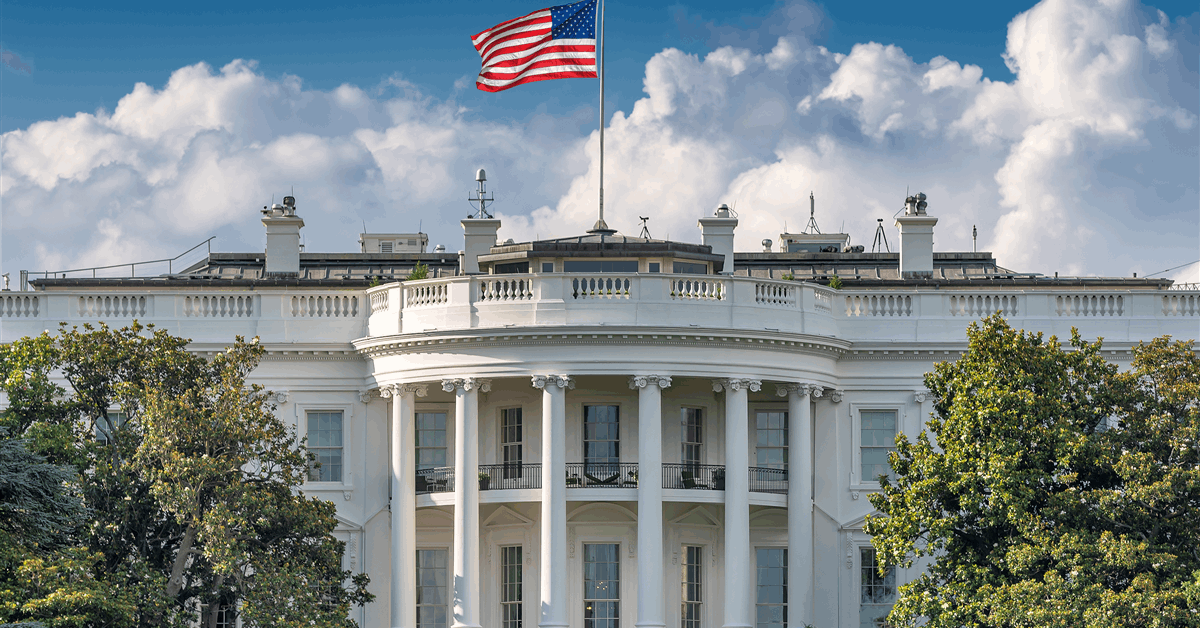

Producers in the body of water – which President Donald Trump renamed the Gulf of America – will bring on 300,000 barrels of new daily output this year and a further 250,000 barrels in 2026 due to projects many years in the making, according to forecaster Wood Mackenzie Ltd. These will increase production in the region to more than 2 million barrels a day, about 40 percent higher than in 2020.

The growth comes against a backdrop of slowing US shale production due to weaker oil prices, as onshore producers cut rigs and costs to counter rising supplies from OPEC and its allies. Overall US production will decline 0.4 percent to 13.37 million barrels a day next year, the first drop since 2021, according to the Energy Information Administration’s Short-Term Energy Outlook released Tuesday.

The Gulf’s rising importance represents a turnaround from the past two decades, when the region – tarnished by the Deepwater Horizon oil spill, spiraling costs and pandemic shutdowns – took a backseat to the shale boom that has made the US the world’s largest oil producer. But now tumbling crude prices are hurting shale drillers while major, longer-term Gulf projects are starting to come online.

“Most people are focused on onshore, when the real growth this year will come from offshore,” Miles Sasser, a senior research analyst at Wood Mackenzie, said in an interview. “The projects in the Gulf of America are ramping up nicely, and that should come as a surprise to many.”

Trump has promised to unleash US oil and gas production, and his administration is reworking policies to help boost flows, including from the Gulf. He has also created a National Energy Dominance Council to help expand production. But his global trade war and the OPEC+ supply increases that he has encouraged have hammered crude prices, spurring the pullback by shale drillers.

Chevron Corp. will grow Gulf production 50 percent from last year, to 300,000 barrels a day by 2026. Shell Plc has Sparta, a 90,000 barrel-a-day project coming online in 2028, while BP Plc has a series of projects through the end of the decade that will increase production capacity by about 20% to more than 400,000 barrels a day. These are all coming at a time when frackers are warning US shale production may have peaked.

Production growth in the Gulf has only outperformed shale in three of the past 10 years, and each of those instances came amid low oil prices and slowing demand, said Jesse Jones, a senior upstream analyst at Energy Aspects.

“Shale producers react more quickly to weaker prices,” he said.

Chevron’s most-recent developments break even at crude prices below $20 a barrel, making them among the lowest cost anywhere in the world, according to Bruce Niemeyer, the company’s president of production in the Americas. Brent crude settled at just above $67 a barrel Monday, down 10 percent since April 1.

“If you can drive breakevens down, you make your investments more resilient, you make the company more resilient,” Niemeyer said in an interview. “That’s the ultimate scorecard.”

The secret to the Gulf’s rebound is a fundamental change in the offshore business model.

When oil consistently traded at $100 a barrel between 2008 and 2015, producers designed large, complex and expensive production vessels. They’ve since focused on smaller, simpler structures. BP reduced the cost of its Mad Dog 2 project by more than half, to $9 billion, by the time it came online in 2023. Shell cut the expense of its Vito platform 70 percent from its initial design. Both companies say they their new approach is to “design one, build many.”

“Deepwater is no longer high-cost by default,” Colette Hirstius, Shell’s executive vice president for Gulf of America, said in response to questions. “It’s proving to be highly efficient, capital-lean and resilient” through the oil-price cycle.

Chevron is working to fill up old production platforms rather than building new ones, Niemeyer said. Ballymore began producing its 75,000 barrels a day in April, but doesn’t have a dedicated platform. Instead, the field is connected to its Blind Faith platform, which was built in 2008, through three miles of subsea pipelines, or “tiebacks.” About 80 percent of Chevron’s exploration leasehold is in tieback range of existing facilities.

“We begin with the end in mind,” Niemeyer said. “That sets us up to be very disciplined in the design choices and execution, and that ultimately turns into falling breakeven” costs.

Like all established oil fields, the Gulf faces limits. There haven’t been any big new discoveries since 2017, when Shell struck oil in the Whale field, Wood Mackenzie’s Sasser said. The region “lacks high-impact projects that will sustain growth in the years to come,” he said.

But Big Oil is demonstrating that technology can help overcome these obstacles.

Chevron made the Anchor discovery in the Paleogene geologic strata in 2015, but its 440 million barrels were located six miles under the seabed at ultra-high pressure and temperatures. After years of working with industry suppliers to safely access the oil, Chevron began producing Anchor’s oil in August at pressures of up to 20,000 pounds per square inch, among the highest in the world and equivalent to an elephant standing on a quarter.

BP has discovered about 10 billion barrels of resources in the Paleogene and will begin producing from it through its Kaskida project in 2029.

The Gulf is “a key strategic region for BP” due to its high volumes and low costs, Andy Krieger, senior vice president for the Gulf of America and Canada, said in response to questions.

“That’s a big reason why we’ve made significant investments in this region for many years,” he said, “and why we fully intend to keep investing there, in a disciplined way, for many more.”