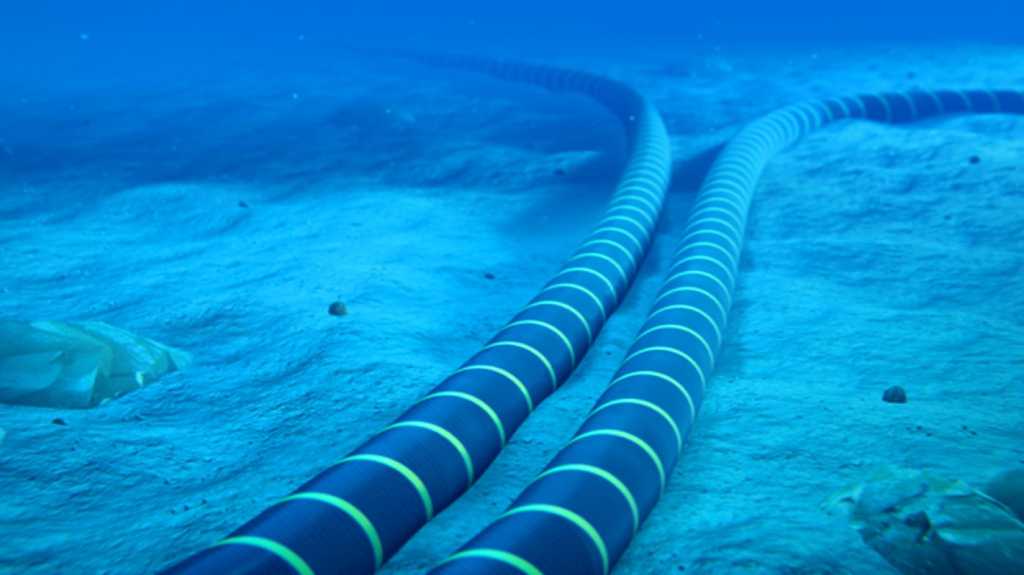

“The recent subsea cable cuts have forced traffic onto longer alternative routes, causing noticeable latency spikes for cloud-native applications sensitive to round-trip times, including real-time APIs, trading platforms, video conferencing, and ERP systems. Enterprises may face slower web apps, delayed database queries, longer file transfers, and lag in multi-region replication,” said Manish Rawat, analyst at TechInsights. He added operationally, cloud-dependent businesses, including logistics, e-commerce, and SaaS, could see temporary service disruptions affecting revenue, SLAs, and customer experience.

Such disruptions highlight the fragile dependency of global enterprises on undersea cables, where a single break in a chokepoint region can ripple into delayed services and missed business commitments worldwide.

“Latency and rerouting raise costs for both sides, providers and enterprises. Providers face higher OPEX from buying alternate transit, managing traffic overhead, and adding temporary long-route capacity, while enterprises absorb indirect costs from slower applications, lost productivity, reputational damage, and transaction losses,” said Pareekh Jain, CEO at EIIRTrend & Pareekh Consulting.

Beyond the immediate latency costs, outages of this scale trigger a chain reaction of hidden financial costs as well.

“The cost of repair is steep and slow: millions of dollars and weeks of downtime for each cable,” said Sanchit Vir Gogia, chief analyst and CEO at Greyhound Research. “Hidden costs pile up as well. Insurers raise premiums on infrastructure in conflict-prone waters. Regulators question the adequacy of resilience planning.”

In addition, reputational damage lingers when services appear unreliable.