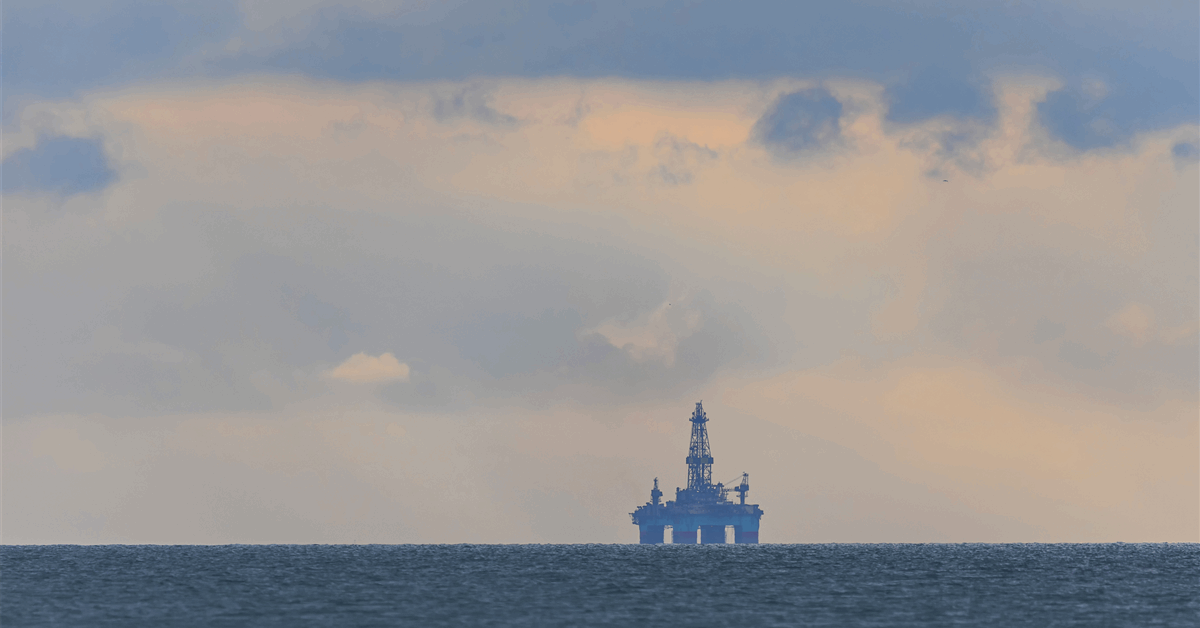

Reliance Industries Ltd saw revenue from its oil-to-chemicals segment for the quarter ended December 2025 (third quarter of financial year 2026) increase 8.4 percent from Q3 FY 2025 to $18 billion.

That was helped by a two percent increase in refining throughput with 20.6 million metric tons of crude processed in the three-month period, despite challenges in procuring oil, according to an online statement by the diversified Indian conglomerate.

“Agile crude sourcing helped sustain throughput despite procurement challenges”, Reliance said. “Partial resumption of Red Sea route also benefitted operations”, it added.

Reliance operates what it says is the world’s biggest single-site refinery in Jamnagar, India. The facility has a declared processing capacity of 1.4 million barrels a day.

The Q3 FY2026 statement said refinery utilization was maximized “to capture high margins”. Reliance reported 18.2 million metric tons in production meant for sale, up 1.7 percent year-on-year.

Reliance’s fuel retailing network under the Reliance BP Mobility Ltd brand, a joint venture with BP PLC, expanded by 14 percent year-over-year to 2,125 outlets, driving volume growth of over 20 percent, according to the statement.

A “sharp increase in transportation fuel cracks and higher sulfur realization” drove a 14.6 percent year-on-year increase to $1.18 billion in petrochemicals EBITDA. The improvement in transport fuel cracks was aided by “continued disruptions in Russian supply and unplanned outages in other regions”, Reliance said. “US/EU sanctions on Russian refiners further tightened fuel markets”.

On the other hand, Reliance saw “weakness in downstream chemical margins and higher feedstock freight rates”.

However, it added, “Favorable ethane cracking economics and domestic market placements continued to support profitability”.

At the backdrop, both global and domestic demand for oil products grew year-on-year in Q3 FY2026, partially offset by a price decline, the statement noted. “Crude oil benchmarks declined y-o-y on expectations of a potential oil supply surplus in 2026 caused by higher OPEC+ output and moderate demand growth”, Reliance said. “Chinese stock builds supported prices”.

For its upstream oil and gas business Reliance recorded an 8.4 percent year-on-year drop in quarterly revenue to $649 million due to lower volumes and realized prices. Segment EBITDA fell 12.7 percent year-on-year to $540 million, with higher operating costs resulting from maintenance activities compounding the impact of lower revenue.

Across its operations, which also include polymers, textiles, diversified retail and digital services, Reliance collected $32.7 billion in revenue for Q3 FY2026, up 10 percent year-on-year. EBITDA totaled $5.7 billion, up 6.1 percent year-on-year.

“Reliance’s consolidated performance in 3Q FY26 reflects consistent financial delivery and operational resilience across businesses”, said chair and managing director Mukesh D. Ambani.

Looking forward, Ambani said, “Reliance is entering a new phase of value creation with its initiatives in the AI and new energy domains. I am confident that Reliance will play a pioneering role in the evolution of these epoch-defining technologies, providing sustainable solutions at scale for India and the world”.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR