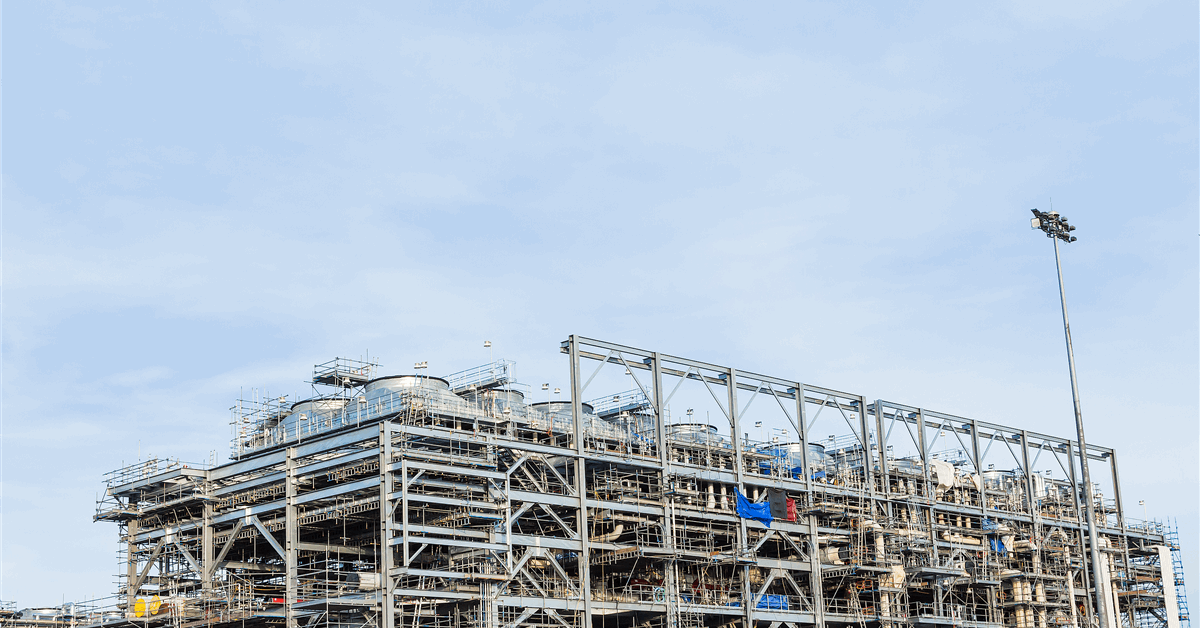

Sempra Infrastructure Partners has reached a final investment decision to advance the development, construction, and operation of phase 2 of the Port Arthur LNG project in Jefferson County, Texas.

The new phase will include two natural gas liquefaction trains, one liquefied natural gas (LNG) storage tank and associated facilities with a nameplate capacity of approximately 13 million metric tons per annum (mtpa) of U.S.-produced LNG, Sempra said in a news release.

Incremental project capital expenditures for the new phase are estimated at $12 billion, plus an approximate $2 billion payment for shared common facilities, the company said. Commercial operations are expected in 2030 and 2031 for Trains 3 and 4, respectively.

Funding for the new phase is supported by a $7 billion equity investment led by Blackstone Credit & Insurance, together with an investor consortium including KKR, Apollo-managed funds, and Private Credit at Goldman Sachs Alternatives, for a total of 49.9 percent minority equity interest, with Sempra Infrastructure Partners retaining a 50.1 percent majority stake in the project, according to the release.

Sempra Infrastructure Partners has entered into a contract with global engineering, construction and project management firm Bechtel Energy Inc., which has received full notice to proceed for the project. Bechtel’s continued involvement from the first phase is expected to “drive favorable economics and help mitigate execution risk by leveraging efficiencies and learnings across phases,” the release said.

Phase 2 is subscribed with long-term offtake under 20-year sales and purchase agreements with strategic partner ConocoPhillips as anchor, and counterparties EQT, JERA Co. Inc. and Sempra Infrastructure Partners, which said it expects to enter into additional offtake agreements from time to time to enhance the overall economic value of the project.

KKR Acquires Majority Interest in Sempra Infrastructure Partners

Meanwhile, Sempra said it has agreed to sell a 45 percent equity interest in Sempra Infrastructure Partners to affiliates of global investment firm KKR with Canada Pension Plan Investment Board (CPP Investments).

The transaction proceeds of $10 billion implies an equity value of $22.2 billion and an enterprise value of $31.7 billion for Sempra Infrastructure Partners, subject to adjustments, the company said.

Sempra said it expects to receive 47 percent of the cash at the closing of the transaction, 41 percent by the end of 2027 and the balance approximately seven years after closing. The transaction is expected to close in the second or third quarter of 2026, subject to necessary regulatory and other approvals and closing conditions.

Upon closing, a KKR-led consortium will become the majority owner of Sempra Infrastructure Partners, holding a 65 percent equity stake, while Sempra will retain a 25 percent interest alongside Abu Dhabi Investment Authority’s (ADIA) existing 10 percent stake. Under the terms of the agreement, Sempra and ADIA will have certain minority rights in Sempra Infrastructure Partners, according to the release.

“The transaction announced today underscores our commitment to extend our strategic partnership with KKR, with whom we have a shared vision of improving America’s position as a global leader in LNG exports,” Sempra Chairman and CEO Jeffrey Martin said. “It also directly supports our five value creation initiatives designed to simplify our business, efficiently fund strong utility growth in Texas and California and improve our financial strength”.

“Over the past four years, we have developed a close relationship with the Sempra Infrastructure Partners team and a deep understanding of their business,” Raj Agrawal, global head of real assets at KKR, said. “We are excited to grow this strategic partnership and are pleased to welcome CPP Investments alongside us as we work to expand Sempra Infrastructure Partners’ assets to help meet growing global demand for energy”.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR