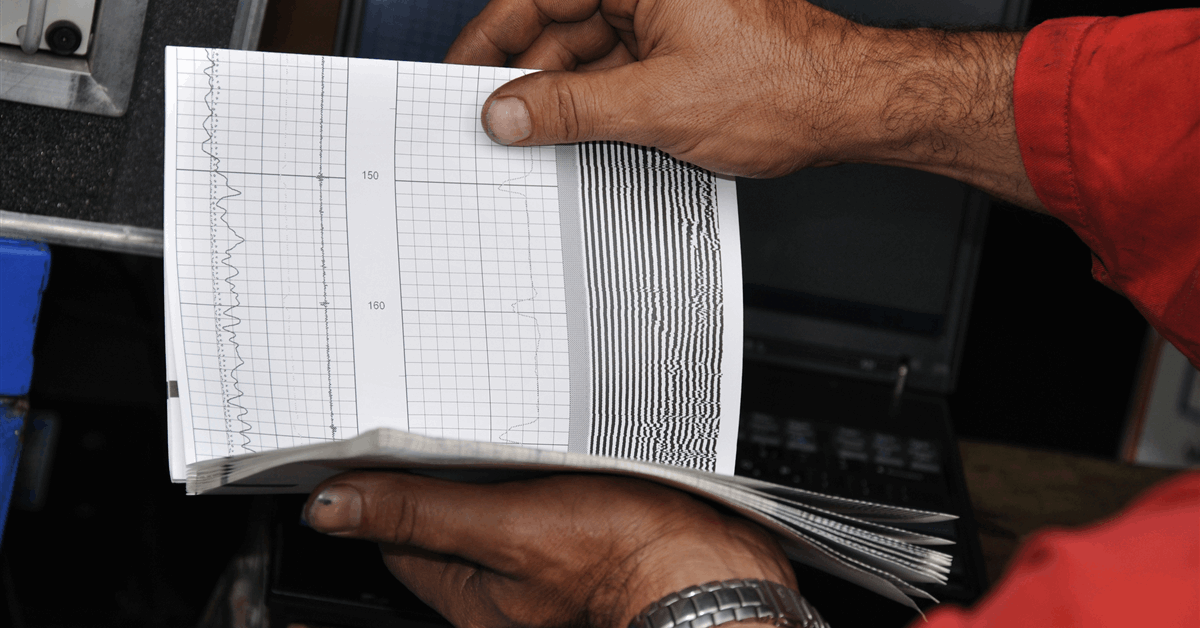

Shearwater Geoservices AS announced, in a statement sent to Rigzone recently, that it will undertake Ghana’s first deepwater Ocean Bottom Survey.

The company noted in the statement that it has been awarded a deepwater Ocean Bottom Node (OBN) seismic survey in Ghana’s Jubilee and TEN fields, which it pointed out is operated by Tullow and its partners.

“It will be the first deepwater OBN project offshore Ghana, following Shearwater’s successful recent deployment of the SW Tasman vessel and Pearl node OBN platform in Côte d’Ivoire and Angola,” Shearwater said in the statement.

The company added that the two-month survey is scheduled to begin in the last quarter of 2025. Shearwater went on to highlight that the SW Tasman and Pearl node platform have been continuously deployed offshore West Africa since late 2024, “first executing the inaugural OBN survey offshore Côte d’Ivoire before mobilizing to consecutive surveys offshore Angola”.

Shearwater CEO Irene Waage Basili said in the statement, “these projects demonstrate Shearwater’s role in pioneering new technology in new regions, delivering operational excellence and industry-leading survey efficiency and data quality”.

“By delivering the first OBN project in Ghana and other surveys across this part of Africa, we are opening new geophysical frontiers – combining precision, innovation and commitment to responsible resource exploration,” Basili added.

In the statement, Shearwater noted that the Jubilee and TEN fields have been central to Tullow’s operations for nearly two decades. It said this first OBN survey “is expected to further enhance reservoir imaging, helping unlock deeper insights to inform field development and production strategies”. It follows a streamer survey executed by Shearwater over the Jubilee and TEN fields in early 2025, Shearwater pointed out in the statement.

Rigzone has contacted Tullow for comment on Shearwater’s statement. At the time of writing, Tullow has not responded to Rigzone.

The majority of Tullow’s production comes from the Jubilee and TEN fields in Ghana, according to Tullow’s website, which outlined that the business produced 42,600 barrels of oil per day from the two sites back in 2023.

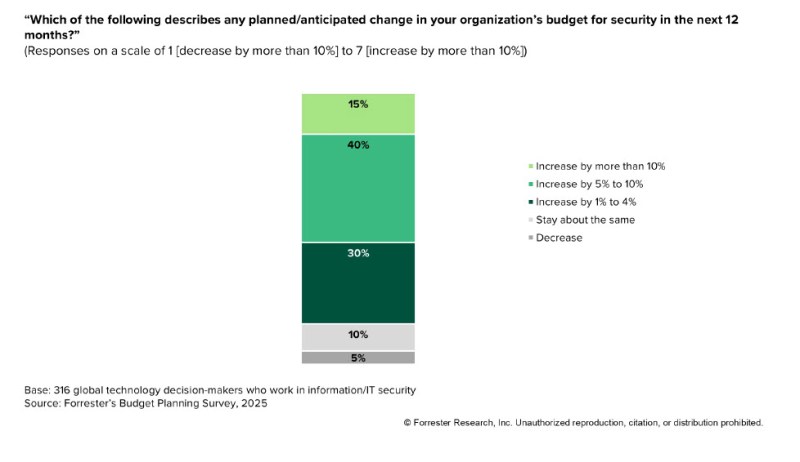

In a separate statement sent to Rigzone on August 29, Shearwater reported a revenue of $133.8 million and EBITDA of $11.9 million in the second quarter. Revenue came in at $214.2 million and EBITDA was $80.1 million in the second quarter of 2024, the statement highlighted.

“Lower activity impacted financial performance, as expected,” Shearwater said in that statement, highlighting a 78 percent utilization rate for its active fleet of eight vessels, “supported by projects initiated in earlier periods”. The company had a backlog of $319 million at end-June, the statement revealed.

“As expected, marine seismic activity declined during the second quarter,” Basili said in the statement.

“Still, we delivered robust fleet utilization of 78 percent, supported by projects starting in earlier periods with vessels rolling off contract towards quarter-end,” Basili added.

“Recent client contracts awarded in the third quarter are encouraging, confirming the market positioning Shearwater has achieved in the competitive OBN (ocean-bottom node) market,” Basili continued.

The Shearwater CEO warned, however, that year to date order intake has been muted.

“We continue to experience low visibility as clients remain cautious, affecting fleet scheduling,” Basili said in the statement.

“There are no clear indications of a step change in the marine seismic market, and we expect the flattish trend seen over the past three years to continue into next year, however with quarterly variations,” Basili added.

“Navigating this soft market outlook, we focus on optimizing operations and financial performance. We maintain a proactive and disciplined fleet management strategy, leveraging a flexible operating model to adjust the active fleet,” Basili continued.

Basili went on to note in the statement that, “longer-term, the oil and gas industry needs to rebuild reserves to sustain output and support energy security”.

“This will require increased investments in marine seismic data acquisition and imaging,” Basili said.

“Our active role as industry consolidator has strategically positioned us to scale with demand as client’s investments in seismic data increases, owning a fully invested fleet of high-end seismic acquisition vessels capable of serving all market segments,” Basili added.

To contact the author, email [email protected]