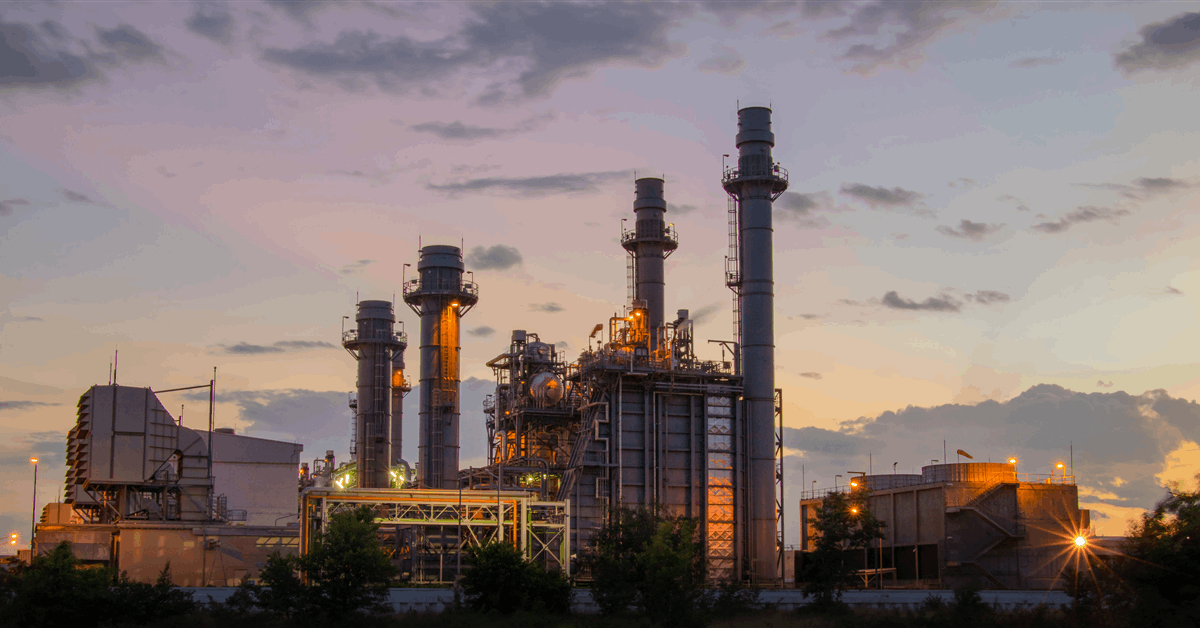

Shell plc subsidiary Shell Energy North America (US), L.P. (SENA) has completed the 100% equity stake acquisition of RISEC Holdings, LLC (RISEC), which owns a 609-megawatt (MW) two-unit combined-cycle gas turbine power plant in Rhode Island, USA.

RISEC’s two-unit combined-cycle gas turbine power plant has an average operating capacity of 594 MW. Serving the ISO New England market, the plant is located outside Providence, Rhode Island, and has been in operation since its completion in 2002.

Shell said in a news release that the acquisition “maintains SENA’s position in the deregulated Independent System Operator New England (ISO New England) power market, securing long-term supply and capacity offtake for Shell”.

Further, Shell noted that power demand is expected to increase in the ISO New England market due to growing decarbonization efforts in sectors such as home heating and transportation in the coming decades. The company will continue an energy supply agreement that has been in place since 2019.

The acquisition was absorbed within Shell’s cash capital expenditure guidance, which remains unchanged, according to the release. The acquisition, first announced in October 2024, is also projected to generate an internal rate of return well above the hurdle rate set for Shell’s Power business. The financial details were not disclosed.

“Shell has had a successful integrated gas and power business in the growing ISO New England market for over 20 years, and this acquisition secures valuable trading opportunities by guaranteeing SENA’s position in the market,” Huibert Vigeveno, Shell Downstream, Renewables and Energy Solutions Director, said in an earlier statement. “Our strong understanding of this plant’s performance positions Shell to capitalize on its value within our existing trading portfolio.”

Prior to the transaction, the parent company of RISEC was 51 percent owned by funds managed by global investment firm Carlyle. The remaining 49 percent owner of RISEC was EGCO RISEC II, LLC, a subsidiary of Electricity Generating Public Company Limited (EGCO), a Thai public limited company.

SENA describes itself as a full-service energy company providing energy solutions across all aspects of the market. SENA has been active in the North American wholesale energy markets for over 25 years and is a market leader in wholesale and retail power, natural gas, and environmental products.

Meanwhile, on the downstream front, Shell and China National Offshore Oil Corp. (CNOOC) are expanding their petrochemical complex in Daya Bay, Huizhou, south China, in order to meet domestic demand.

The expansion includes a third ethylene cracker with a planned capacity of 1.6 million metric tons a year and associated downstream derivatives units to produce chemicals including linear alpha olefins, according to an earlier news release. A new facility is also planned, aiming to produce 320,000 metric tons per annum of high-performance specialty chemicals such as polycarbonates and carbonate solvents. The two companies expect to finish construction in 2028.

The facility is operated by CNOOC and Shell Petrochemicals Co. Ltd, a 50-50 venture between Shell subsidiary Shell Nanhai BV and CNOOC subsidiary CNOOC Petrochemicals Investment Ltd.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR