Perth-based SSE has shaved £3 billion from its plans to invest in its energy production and networks businesses due to a “changing macro environment” and delays to consent to phase in networks.

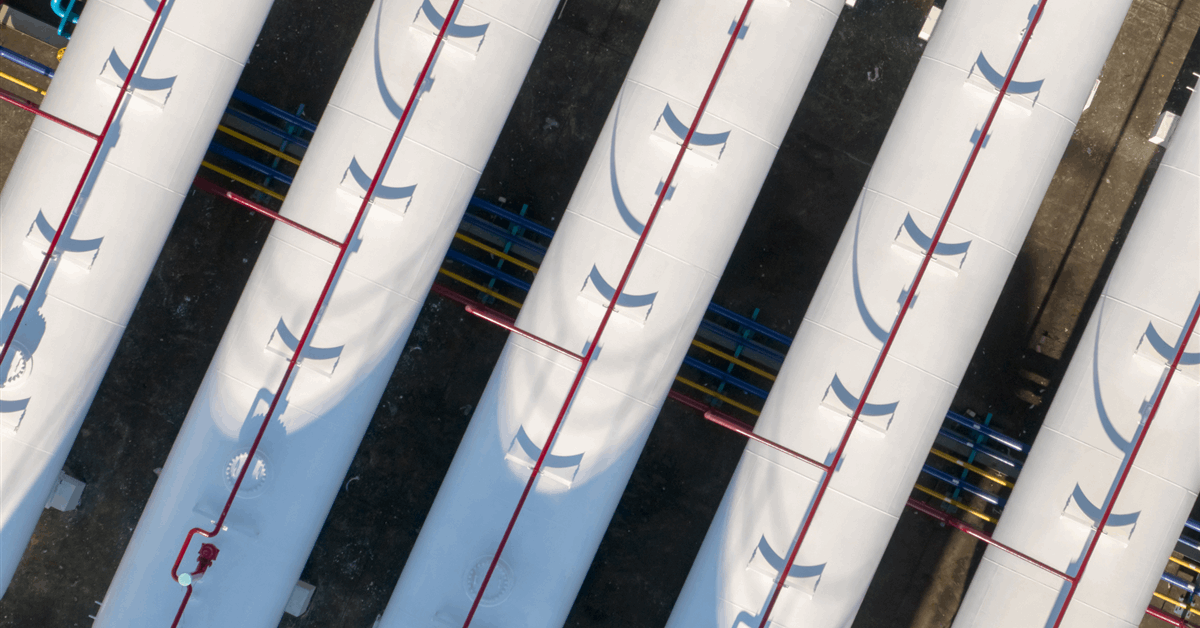

SSE, which is the UK distribution network operator (DNO) responsible for the electricity grid network across central southern England and the north of Scotland through its SSEN Transmission business, said it would instead invest around £17.5bn in the next five years in what it described as an “evolving investment programme delivering in complex operating environment”.

The adjustment came as the firm reported a £2.1bn profit for the year ending 31 March, which union leaders branded “obscene”.

SSE recently announced there were 300 jobs at risk in its renewables business in the UK and Ireland.

Chief executive Alistair Phillips-Davies said: “SSE continues to prove the benefits of a portfolio that is built to withstand risk and uncertainty and a strategy that is focused on creating sustainable value.

“We have met our financial goals for the year and evolved our investment plans to reflect the changing world around us – leaning into the opportunities presented in networks and redoubling our capital discipline across our energy businesses.

“We are particularly well placed to contribute to future energy systems in our home markets built on renewables, networks and flexibility. This opportunity, alongside our balance sheet strength and the increased proportion of index-linked revenue we anticipate, gives us every confidence in our FY27 target of 175-200p earnings per share and sustainable growth to 2030 and beyond.”#

More to follow.