Join our daily and weekly newsletters for the latest updates and exclusive content on industry-leading AI coverage. Learn More

The Stanford Institute for Human-Centered Artificial Intelligence (HAI) has released its 2025 AI Index Report, providing a data-driven analysis of AI’s global development. HAI has been developing a report on AI over the last several years, with its first benchmark coming in 2022. Needless to say, a lot has changed.

The 2025 report is loaded with statistics. Among some of the top findings:

- The U.S. produced 40 notable AI models in 2024, significantly ahead of China (15) and Europe (3).

- Training compute for AI models doubles approximately every five months, and dataset sizes every eight months.

- AI model inference costs have fallen dramatically – a 280-fold reduction from 2022 to 2024.

- Global private AI investment reached $252.3 billion in 2024, a 26% increase.

- 78% of organizations report using AI (up from 55% in 2023).

For enterprise IT leaders charting their AI strategy, the report offers critical insights into model performance, investment trends, implementation challenges and competitive dynamics reshaping the technology landscape.

Here are five key takeaways for enterprise IT leaders from the AI Index.

1. The democratization of AI power is accelerating

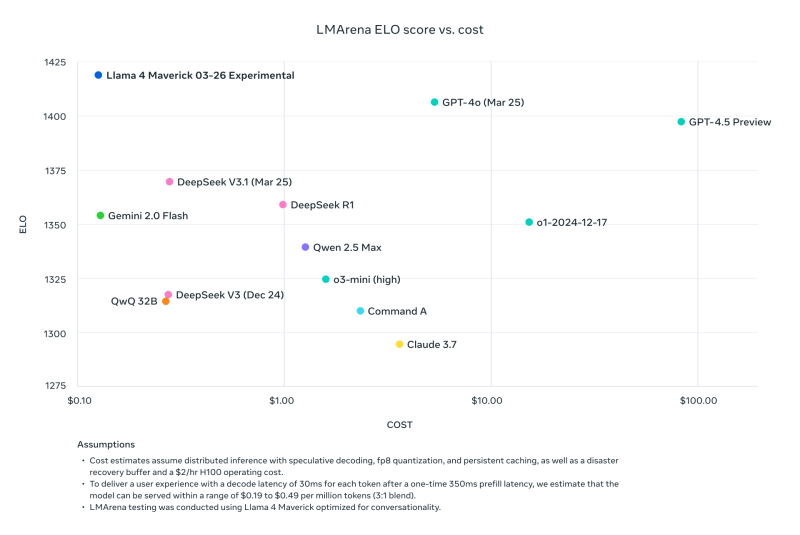

Perhaps the most striking finding is how rapidly high-quality AI has become more affordable and accessible. The cost barrier that once restricted advanced AI to tech giants is crumbling. The finding is in stark contrast to what the 2024 Stanford report found.

“I was struck by how much AI models have become cheaper, more open, and accessible over the past year,” Nestor Maslej, research manager for the AI Index at HAI told VentureBeat. “While training costs remain high, we’re now seeing a world where the cost of developing high-quality—though not frontier—models is plummeting.”

The report quantifies this shift dramatically: the inference cost for an AI model performing at GPT-3.5 levels dropped from $20.00 per million tokens in November 2022 to just $0.07 per million tokens by October 2024—a 280-fold reduction in 18 months.

Equally significant is the performance convergence between closed and open-weight models. The gap between top closed models (like GPT-4) and leading open models (like Llama) narrowed from 8.0% in Jan. 2024 to just 1.7% by Feb. 2025.

IT leader action item: Reassess your AI procurement strategy. Organizations previously priced out of cutting-edge AI capabilities now have viable options through open-weight models or significantly cheaper commercial APIs.

2. The gap between AI adoption and value realization remains substantial

While the report shows 78% of organizations now use AI in at least one business function (up from 55% in 2023), real business impact lags behind adoption.

When asked about meaningful ROI at scale, Maslej acknowledged: “We have limited data on what separates organizations that achieve massive returns to scale with AI from those that do not. This is a critical area of analysis we intend to explore further.”

The report indicates that most organizations using generative AI report modest financial improvements. For example, 47% of businesses using generative AI in strategy and corporate finance report revenue increases, but typically at levels below 5%.

IT leader action item: Focus on measurable use cases with clear ROI potential rather than broad implementation. Consider developing stronger AI governance and measurement frameworks to track value creation better.

3. Specific business functions show stronger financial returns from AI

The report provides granular insights into which business functions are seeing the most significant financial impact from AI implementation.

“On the cost side, AI appears to benefit supply chain and service operations functions the most,” Maslej noted. “On the revenue side, strategy, corporate finance, and supply chain functions see the greatest gains.”

Specifically, 61% of organizations using generative AI in supply chain and inventory management report cost savings, while 70% using it in strategy and corporate finance report revenue increases. Service operations and marketing/sales also show strong potential for value creation.

IT leader action item: Prioritize AI investments in functions showing the most substantial financial returns in the report. Supply chain optimization, service operations and strategic planning emerge as high-potential areas for initial or expanded AI deployment.

4. AI shows strong potential to equalize workforce performance

One of the most interesting findings concerns AI’s impact on workforce productivity across skill levels. Multiple studies cited in the report show AI tools disproportionately benefit lower-skilled workers.

In customer support contexts, low-skill workers experienced 34% productivity gains with AI assistance, while high-skill workers saw minimal improvement. Similar patterns appeared in consulting (43% vs. 16.5% gains) and software engineering (21-40% vs. 7-16% gains).

“Generally, these studies indicate that AI has strong positive impacts on productivity and tends to benefit lower-skilled workers more than higher-skilled ones, though not always,” Maslej explained.

IT leader action item: Consider AI deployment as a workforce development strategy. AI assistants can help level the playing field between junior and senior staff, potentially addressing skill gaps while improving overall team performance.

5. Responsible AI implementation remains an aspiration, not a reality

Despite growing awareness of AI risks, the report reveals a significant gap between risk recognition and mitigation. While 66% of organizations consider cybersecurity an AI-related risk, only 55% actively mitigate it. Similar gaps exist for regulatory compliance (63% vs. 38%) and intellectual property infringement (57% vs. 38%).

These findings come against a backdrop of increasing AI incidents, which rose 56.4% to a record 233 reported cases in 2024. Organizations face real consequences for failing to implement responsible AI practices.

IT leader action item: Don’t delay implementing robust responsible AI governance. While technical capabilities advance rapidly, the report suggests most organizations still lack effective risk mitigation strategies. Developing these frameworks now could be a competitive advantage rather than a compliance burden.

Looking ahead

The Stanford AI Index Report presents a picture of rapidly maturing AI technology becoming more accessible and capable, while organizations still struggle to capitalize on its potential fully.

For IT leaders, the strategic imperative is clear: focus on targeted implementations with measurable ROI, emphasize responsible governance and leverage AI to enhance workforce capabilities.

“This shift points toward greater accessibility and, I believe, suggests a wave of broader AI adoption may be on the horizon,” Maslej said.

Daily insights on business use cases with VB Daily

If you want to impress your boss, VB Daily has you covered. We give you the inside scoop on what companies are doing with generative AI, from regulatory shifts to practical deployments, so you can share insights for maximum ROI.

Read our Privacy Policy

Thanks for subscribing. Check out more VB newsletters here.

An error occured.