Dive Brief:

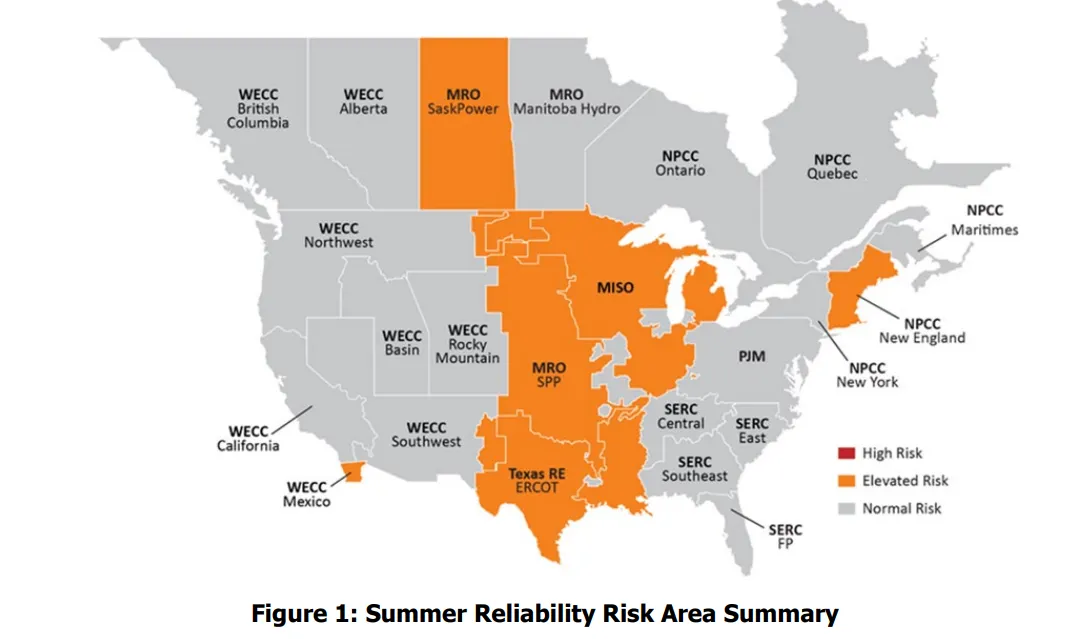

- All regions of the North American electric grid are expected to have sufficient resources under normal operating and weather conditions this summer, but some may face supply shortfall risks during periods of extreme heat, the North American Electric Reliability Corp. said Wednesday in its annual 2025 Summer Reliability Assessment.

- Peak demand across NERC’s 23 assessment areas is forecast to increase by 10 GW since summer 2024, “more than double the increase from 2023 to 2024,” NERC said in a news release. Data centers, electrification, and industrial growth are driving demand higher.

- The addition of solar, wind and battery resources, frequently referred to as inverter-based resources, or IBRs, is also creating risks, the assessment states, as they have been known to trip offline during grid disturbances. NERC plans to issue an alert in the next month regarding modeling deficiencies and technical requirements to integrate more IBRs into bulk power system, officials said.

Dive Insight:

New solar, wind and batteries resources are helping to meet rapidly increasing load growth. Those additions offset generator retirements, but the rise in variable IBRs also injects “complexity and energy limitations” into the system, NERC said.

“While we’re adding a lot more resources — solar, batteries and other emerging technologies — the pace and performance of that build-out doesn’t yet fully align with the reliability needs of a rapidly electrifying economy,” John Moura, NERC’s director of reliability assessments and performance analysis, told reporters during a discussion of the analysis.

“That said, there are some encouraging signs this summer. It’s a welcome contrast to what we’ve seen during winter seasons,” Moura added. He noted that solar and batteries tend to underperform during colder months, and fuel supply limitations, especially for natural gas, create “far more serious risks.”

The Midcontinent Independent System Operator region has less supply capacity than it did last summer due to generator retirements and less firm imports and “could face supply shortfalls during above-normal peak demand,” according to NERC’s assessment. MISO officials say they expect peak demand may reach nearly 123 GW, but they say there is about 138 GW of regularly available generation expected across the operating footprint.

Other grid areas facing an elevated risk during extreme heat this summer include the Southwest Power Pool, Electric Reliability Council of Texas and portions of New England, the assessment states.

In SPP, NERC warned that a wide-area heat wave could drive high electricity demand and force generators offline, “leaving operators with insufficient flexible resources to counter wind resource variability.” In Texas, growth of both solar and demand could leave the ERCOT system short of energy during ramping periods. And reserve capacity in NPCC New England has fallen from last season as demand rises and resources retire, it said.

MISO has seen 1,575 MW of gas and coal-fired generation retire since last summer, NERC noted, combined with a reduction in net firm capacity transfers due to some capacity outside the MISO market opting out of the MISO planning resource auction.

“With higher demand and less firm resources, MISO is at elevated risk of operating reserve shortfalls during periods of high demand or low resource output,” the report found.

MISO published its summer readiness assessment on May 8, saying it expects to have sufficient resources to meet anticipated demand but also acknowledging in a news release that “elevated risk remains due to the potential for extreme weather events and the continued decline in accredited capacity.”

Growing risk from inverter-based resources

Across its footprint, NERC has seen more than 7 GW of generator retirements since last year, said Mark Olson, manager of reliability assessments.

“These generator retirements are reducing the reserve capacity in some areas, they reduce some of the flexible generation that’s available for managing solar and wind variability. So that’s increasing the risk profile somewhat,” Olson said in the discussion.

New resource additions, particularly solar, are “generally effective in summer,” Olson said, but “we’re going to see differences when we get to the winter assessment.”

Those variable resources are also making the summer grid more complicated to manage, however, and they introduce risk through the use of more IBRs that can be unstable during grid disturbances. Olson called IBRs a “key risk that is escalating.”

About 5,200 MW of bulk electric system solar IBRs have voltage and frequency protection settings within NERC’s “no trip zones,” meaning they are at greater risk of going offline in the event of a grid disturbance, according to a 2023 report from the grid watchdog.

NERC and the electric power industry “are engaged in a comprehensive and long-term strategy to address IBR issues with new standards, requirements and guidelines for modeling and planning,” Olson said. “With more and more inverters on the system … we’re advising operators to be prepared for the potential for disconnects during grid disturbances, and to operate conservatively.”