Talos Energy Inc. said it encountered oil at the Daenerys exploration prospect located in the U.S. Gulf of America’s Walker Ridge blocks 106, 107, 150, and 151.

The discovery well was drilled to a total vertical depth of 33,228 feet utilizing the West Vela deepwater drillship and encountered oil pay in multiple high-quality, sub-salt Miocene sands, the company said in a news release.

Talos conducted a comprehensive wireline program, acquiring core, fluid, and log data to evaluate the reservoir.

The well was drilled approximately 12 days ahead of schedule and delivered approximately $16 million under budget, Talos said.

Planning is underway for an appraisal well to further define the discovered resource, and the discovery well has been temporarily suspended to preserve its future utility, the company said.

Talos President and CEO Paul Goodfellow said, “We are encouraged by the results of our Daenerys discovery well, which confirms the presence of hydrocarbons and validates our geologic and geophysical models. We believe these results support Talos’ pre-drill resource assumptions. We are now working closely with our partners to design an appraisal program that will further delineate this exciting discovery. We anticipate spudding the appraisal well in the second quarter of 2026”.

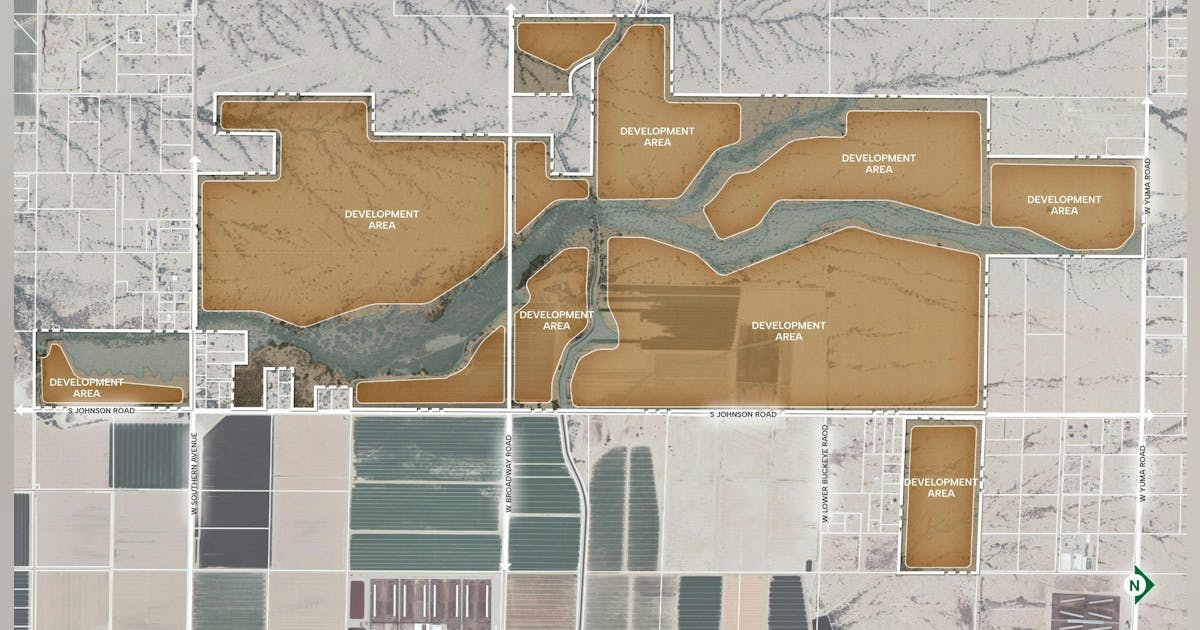

Talos, as operator, will hold a 27% percent working interest in the asset. Shell Offshore Inc. will hold a 22.5 percent working interest, Red Willow will hold 22.5 percent, Houston Energy, L.P. will hold 10 percent, Cathexis will hold nine percent, and HEQ II Daenerys LLC will hold nine percent, according to the release.

Daenerys is a high-impact subsalt prospect that carries an estimated pre-drill gross resource potential between 100 million to 300 million barrels of oil equivalent.

In June, Talos said it was implementing an “enhanced corporate strategy designed to position the company as a leading pure-play offshore exploration and production company”.

Talos said it is targeting approximately $100 million in increased annualized cash flow in 2026 through capital efficiency, margin enhancement, commercial opportunities, and general organizational improvements, according to its most recent earnings release.

The company said it plans to invest in high-margin organic projects, “complemented by disciplined, accretive bolt-on acquisitions in deepwater basins, which will enhance production and profitability”. Talos said it plans to “take a strategic and measured approach in assessing opportunities within the Gulf of America and other conventional offshore basins,” noting that a scaled portfolio will provide “significant production growth potential, and ultimately the ability to generate long-term consistent free cash flow”.

In January, Talos said it discovered commercial quantities of oil and gas at the Katmai West #2 well in the Ewing Bank area of the U.S. Gulf of America.

The Katmai West #2 well was drilled significantly under budget and ahead of schedule to a true vertical depth of approximately 27,000 feet, Talos said in an earlier statement. The well “encountered the primary target sand full-to-base with over 400 feet of gross hydrocarbon pay and excellent rock properties in line with pre-drill expectations,” the company stated.

Talos added that the strong performance from Katmai West #1 well, and the successful appraisal from Katmai West #2 well, have nearly doubled the proved estimated ultimate recovery of Katmai West field to approximately 50 million barrels of oil equivalent (MMBoe) gross, which further affirms its expected total resource potential of approximately 100 MMBoe gross.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR