Tamboran Resources Corp has appointed Todd Abbott, former chief operating officer (COO) of Seneca Resources Co LLC, as chief executive officer (CEO) effective January 15.

Abbott takes over from interim CEO Richard Stoneburner, who remains chair. Stoneburner assumed the role of interim CEO in the third quarter of 2025 following Joe Riddle’s resignation.

“Abbott has over 25 years’ upstream oil and gas experience spanning unconventional shale operations, business planning, corporate finance and strategy”, Tamboran said in an online statement.

Before becoming COO of Seneca Resources, where he gained Appalachian Basin experience, Abbott was part of Marathon Oil Corp and Pioneer Natural Resources Co. At Marathon and Pioneer, Abbott had oversight of Permian Basin, Eagle Ford and Alaskan operations, Tamboran noted.

“His background at Seneca, Marathon and Pioneer demonstrates an ability to improve productivity while lowering costs, which aligns with our focus on safe and efficient execution and delivering value for shareholders from our Beetaloo Basin development”, Stoneburner said.

Abbott said, “The scale and opportunity that Tamboran has in the Beetaloo Basin, supported by the quality of the board and management team, is what has attracted me to the CEO role”.

Abbott takes over what would be an enlarged Tamboran, which is in the process of completing the acquisition of Falcon Oil & Gas Ltd.

On September 30, 2025, Sydney-based Tamboran and British Columbia-incorporated Falcon announced a definitive merger agreement that they said would create a leading position of about 2.9 million net acres in the Beetaloo sub-basin onshore Australia’s Northern Territory.

“The acquisition is accretive to Tamboran stockholders given the implied acreage value of $169 per acre reflects a four percent discount to Tamboran’s current implied acreage value of $176 per acre”, a joint statement said.

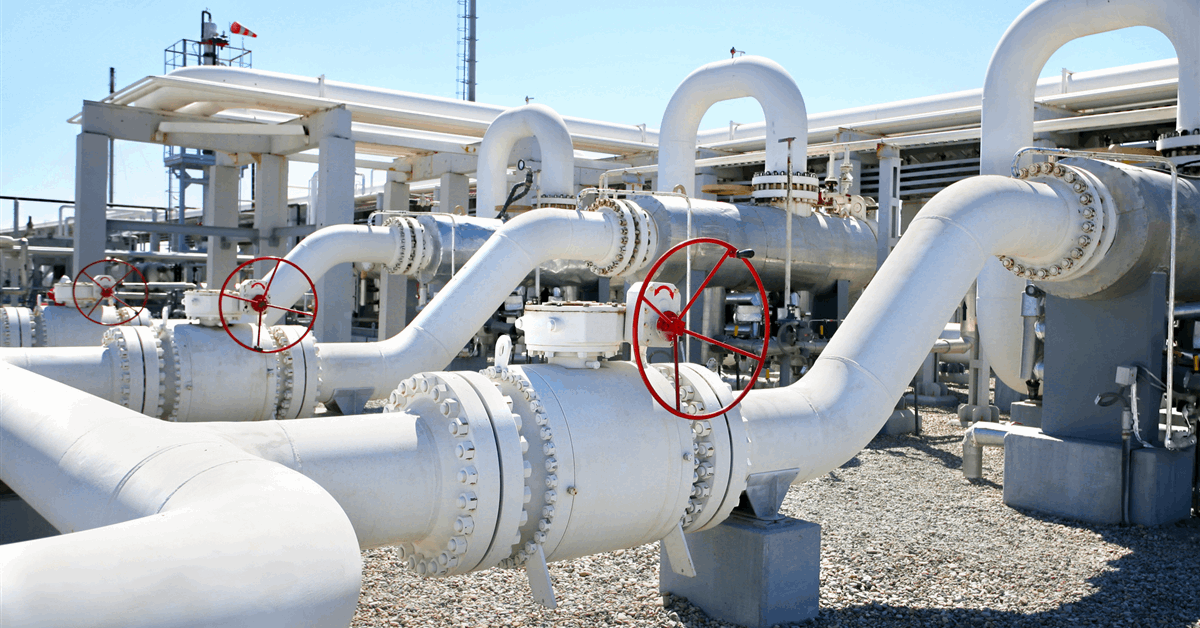

Tamboran and Falcon are already partners through the Beetaloo Joint Venture, which last year sanctioned the Shenandoah South Pilot Project. The natural gas project has a planned capacity of 40 million cubic feet a day.

Tamboran expects the vote by its shareholders and a separate vote by Falcon shareholders on the transaction to be held next month. Thereafter, within the same month, the merger would be consummated after Falcon obtains a final court order in British Columbia, Tamboran said in a regulatory filing January 6, 2026.

The filing said Falcon subsidiary Falcon Oil & Gas Australia Ltd had won shareholder approval for Tamboran’s takeover offer. Tamboran said the purchase of Falcon’s interest in Falcon Australia would give it “the option of compulsorily acquiring” the remaining ownership held by minority shareholders. Tamboran said it intends to acquire the remaining stake after completing the broader transaction to take over Falcon.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR