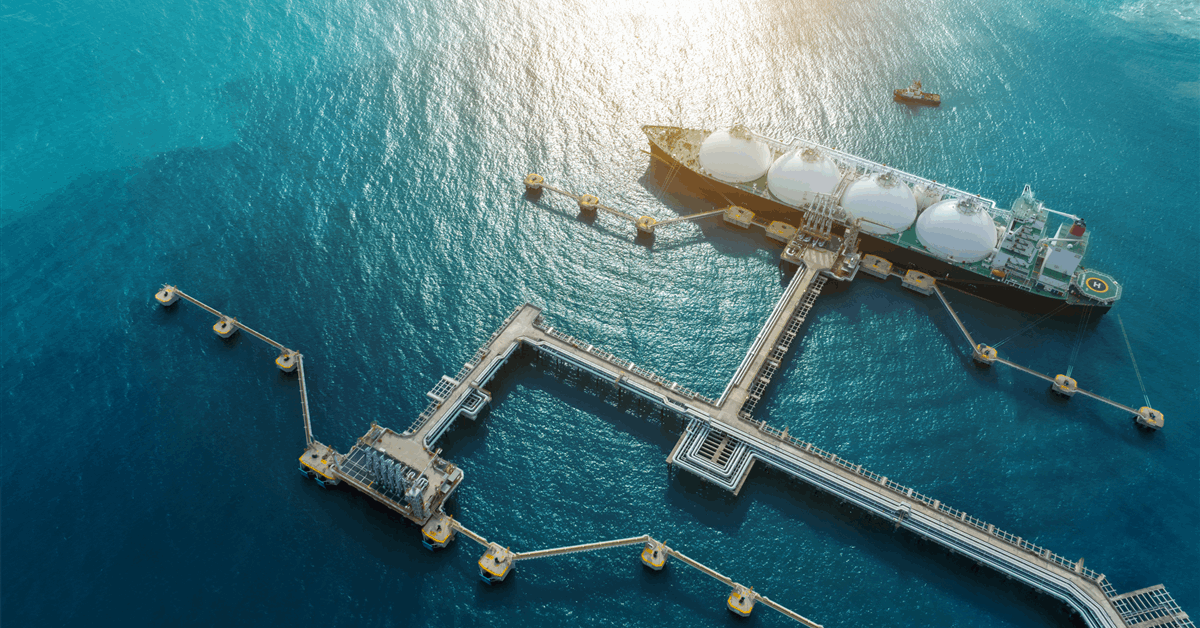

WASHINGTON— U.S. Secretary of Energy Chris Wright today announced the Department of Energy’s (DOE) final authorization for Commonwealth LNG, LLC to export up to 1.21 billion cubic feet per day (Bcf/d) of natural gas as liquefied natural gas (LNG) to non-free trade agreement (FTA) countries from its proposed project in Cameron Parish, Louisiana. Today’s action follows DOE’s conditional authorization to Commonwealth LNG, LLC in February 2025 and reflects the Federal Energy Regulatory Commission’s (FERC) June 2025 approval for the siting, construction, and operation of the facility. It also incorporates DOE’s May 2025 response to comments on the 2024 LNG Export Study that reaffirms that U.S. LNG exports strengthen America’s energy leadership, expand opportunities for American workers, and provide allies with secure access to reliable U.S. energy. “Finalizing this authorization moves us closer to delivering more American LNG to the world, advancing President Trump’s energy dominance agenda,” Secretary Wright said. “As DOE found earlier this year and affirms again in this order, expanding America’s LNG export capacity bolsters our economy, strengthens the energy security of our allies and trading partners and ensures the U.S. can continue to lead the world in the production of affordable, reliable and secure energy.” “We are glad to do our part in Commonwealth’s recent progress toward its final investment decision and look forward to its contribution to our nation’s success.” said Tala Goudarzi, Principal Deputy Assistant Secretary of the Office of Fossil Energy and Carbon Management. Commonwealth LNG, owned by Kimmeridge, has secured long-term off-take agreements for LNG with Malaysia’s PETRONAS, global energy commodities trading entity Glencore LTD, and Japan’s JERA, and recently announced an engineering, procurement, and construction contract with Technip Energies to advance the project. Background: The United States currently operates eight large-scale LNG export projects, with several more under construction or expansion. Under