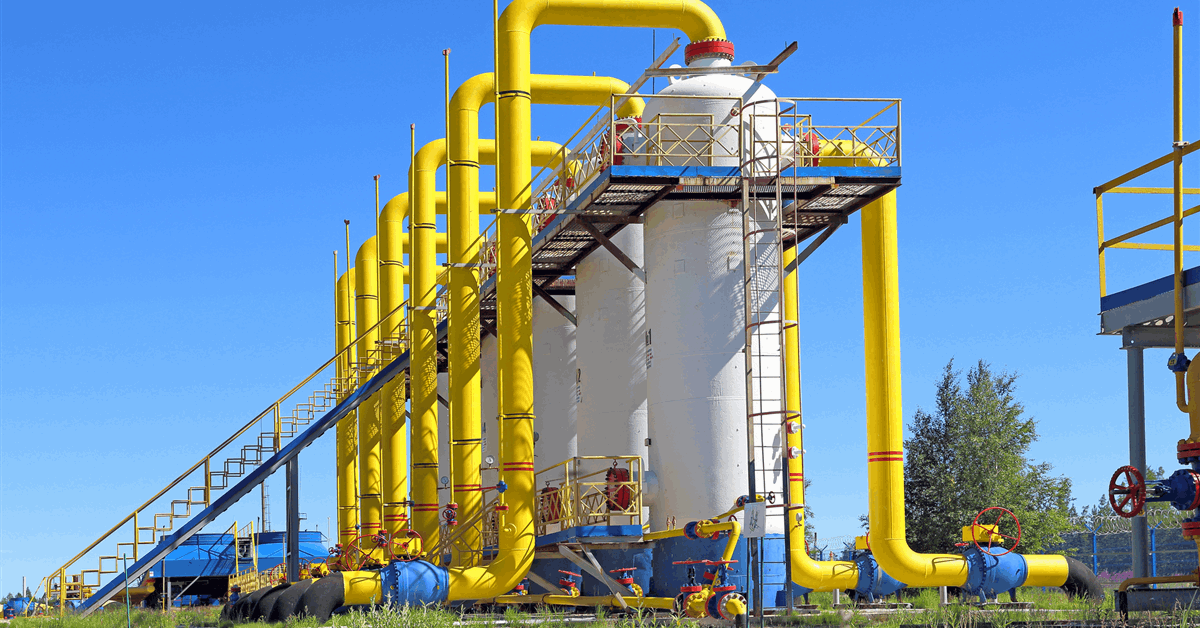

Tidewater Midstream and Infrastructure Ltd. said it has entered into a definitive agreement with Parallax Energy Operating Inc. for the sale of its Sylvan Lake gas plant and associated gas gathering infrastructure for total proceeds of approximately $4 million (CAD 5.5 million), subject to customary adjustments.

The Sylvan Lake Gas Processing Facility is a non-core asset of Tidewater located in central Alberta, the company said in a news release.

The transaction is expected to have an immaterial impact on Tidewater’s 2025 operating results, and the proceeds received therefrom are anticipated to be used to repay amounts outstanding on the company’s senior credit facility, Tidewater said.

The transaction is expected to close in the third quarter, subject to customary closing conditions and certain regulatory approvals, including the receipt of approval from the Alberta Energy Regulator, according to the release.

“The disposition of the Sylvan Lake Gas Processing Facility represents yet another milestone for Tidewater as we look to optimize our asset portfolio and improve financial flexibility. In the first half of 2025, Tidewater announced cumulative non-core asset sales of approximately CAD 30 million, at what we believe to be very healthy and attractive valuation ranges. We believe these sales highlight the strength of Tidewater’s asset base, and look forward to further advancing the remainder of our non-core asset sales program,” Tidewater CEO Jeremy Baines said.

First Quarter Net Loss Reported

In May, Tidewater reported a consolidated net loss attributable to shareholders of CAD 31.8 million for the first quarter, compared to $11.3 million a year ago. The increase in net loss was “due to lower refined product sales and lower product margins offset in part by lower depreciation, interest expense, favorable changes in the fair value of derivative contracts, and higher income from equity investments,” the company said in its most recent earnings release.

The company’s consolidated first-quarter adjusted EBITDA was a loss of CAD 3.7, compared to $39.8 million in the first quarter of 2024. The decrease in EBITDA is “primarily driven by lower refined product sales and lower product margins in the first quarter of 2025, offset in part by lower losses on realized derivative contracts and higher income from equity investments,” the company said.

“This has been a difficult quarter as a result of wider discounts on our refined product volumes and producer shut ins affecting our midstream operations,” Baines said.

“As we mentioned during our year end results conference call, we continue to progress our three key initiatives: maintaining safe and reliable operations, driving ongoing operational efficiencies, and optimizing our asset portfolio to ensure we have the right mix of assets that are generating appropriate returns. To this end, we continue to progress on non-core asset sales and will update the market as warranted. We remain focused on cash flow and improving operating results,” Baine continued.

“Our recently announced transaction to acquire the Western Pipeline is expected to yield cost improvements of approximately CAD 10.0 million to CAD 15.0 million annually. We also expect to take advantage of steadily improving refined product margins over the course of the year resulting from the BC Government’s changes to the Low Carbon Fuels Act,” he concluded.

On February 27, the Government of British Columbia announced changes to the Low Carbon Fuels Act, which increased the renewable fuel requirement for diesel from 4 percent to 8 percent for the 2025 compliance period. Effective April 1, 2025, the amendments also require such renewable fuel content to be produced within Canada, according to the release.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR