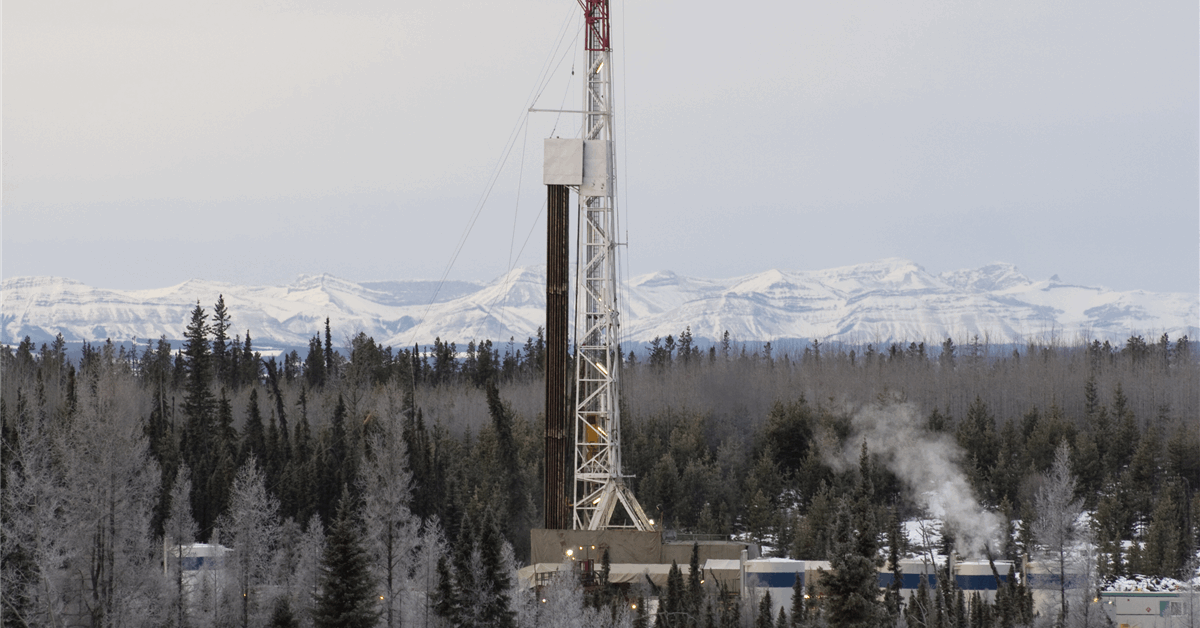

Calgary, Alberta-based Trican Well Service Ltd. said it has entered into an agreement to acquire privately owned fracturing and coiled tubing services provider Iron Horse Energy Services, which operates primarily in the Cardium, Charlie Lake, Mannville Stack, Viking, Montney and Shaunavon plays in the Western Canadian Sedimentary Basin (WCSB).

Trican aims to acquire all of the issued and outstanding shares of Iron Horse for approximately $56.6 million (CAD 77.35 million) in cash and approximately 33.76 million common shares of Trican, the company said in a news release.

Iron Horse “extends Trican’s fracturing footprint and adds industry-leading coiled tubing integrated fracturing expertise,” according to the release.

The acquisition will add over four fracturing spreads and 10 coiled tubing units, which will augment Trican’s services offering throughout the WCSB across the drilling, completion, and production lifecycles, the company said.

Following the acquisition, Iron Horse will operate as a wholly owned division of Trican, continuing to serve its existing customers while increasing its footprint with the support of Trican’s resources. Trican said it expects to retain all of the existing management and employees of Iron Horse.

The acquisition is expected to close in the second half. Iron Horse Chairman and CEO Tom Coolen will be appointed to the board of directors of Trican after closing, according to the release.

Other than Competition Act Approval, and TSX listing approval of the common shares of Trican to be issued pursuant to the Acquisition, no approval, order, consent of or filing with any government agency is required on the part of Iron Horse or Trican, in connection with the completion of the acquisition, Trican said.

“Iron Horse is one of [the] few North American fracturing companies that has consistently demonstrated operational and financial performance that aligns with Trican. The acquisition will provide significant EBITDA, free cash flow and earnings accretion to Trican shareholders. It will also expand Trican’s customer base into both conventional and unconventional plays in Alberta and Saskatchewan,” Trican President and CEO Brad Fedora said.

“Mr. Coolen and his partners have built their company into a trusted and innovative services provider, and we look forward to welcoming him to the Board and benefitting from his 20-plus years of industry experience to create incremental value for Trican shareholders,” Fedora added.

“Trican is widely considered among the top completions services providers in North America and has developed this reputation through a focus on the same core values that Iron Horse has demonstrated for two decades. Together, we will continue to deliver exceptional service to existing and prospective clients and create new career opportunities for both Iron Horse and Trican employees,” Coolen said.

Trican said it expects to use the additional free cash flow provided by the acquisition to execute strategic growth, repay the credit facility, and/or return to shareholders through share repurchases and future dividend growth.

Trican’s board also approved a 10 percent increase to Trican’s dividend following the closing of the acquisition. The dividend will be boosted to $0.055 per share from $0.050 per share, which equates to $0.220 per share on an annual basis.

The first distribution of the increased dividend will be made on September 30 to shareholders of record as of September 12. The increase in Trican’s base dividend will be funded by a portion of the free cash flow from the acquisition, the company said.

To contact the author, email [email protected]

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR