A $400 billion green bank for clean energy projects and a popular consumer tax credit for electric vehicles are among items being targeted for review under a government-wide spending freeze ordered by the Trump administration.

The initiatives are listed in a 52-page document from the White House Office of Management and Budget, seen by Bloomberg News, that details hundreds of programs whose funding is being scrutinized by the White House after it directed the government to temporarily pause spending.

The Office of Management and Budget issued the sweeping directive Monday as part of the new president’s aim to overhaul the federal government to align it with the incoming administration’s priorities, which have included halting foreign aid, promoting liquefied natural gas exports and shuttering diversity programs. A federal judge in Washington on Tuesday evening temporarily halted the administration from enforcing the directive.

The list includes the Energy Department’s Loan Programs Office, which swelled to $400 billion in financing power under President Joe Biden and his signature climate law, the Inflation Reduction Act. The lending program has nearly $47 billion in conditional commitments to companies in addition to $60.6 billion in loans and loan guarantees that have been granted, including to California utility PG&E Corp. and biofuel maker Calumet Inc.

Also being eyed is a program known as the Advanced Research Projects Agency- Energy, or ARPA-E that has spent billions funding projects meant to achieve technological breakthroughs.

An Energy Department spokesman confirmed Tuesday the agency is conducting a department-wide review of spending “to ensure all activities are consistent with President Trump’s executive orders and priorities.”

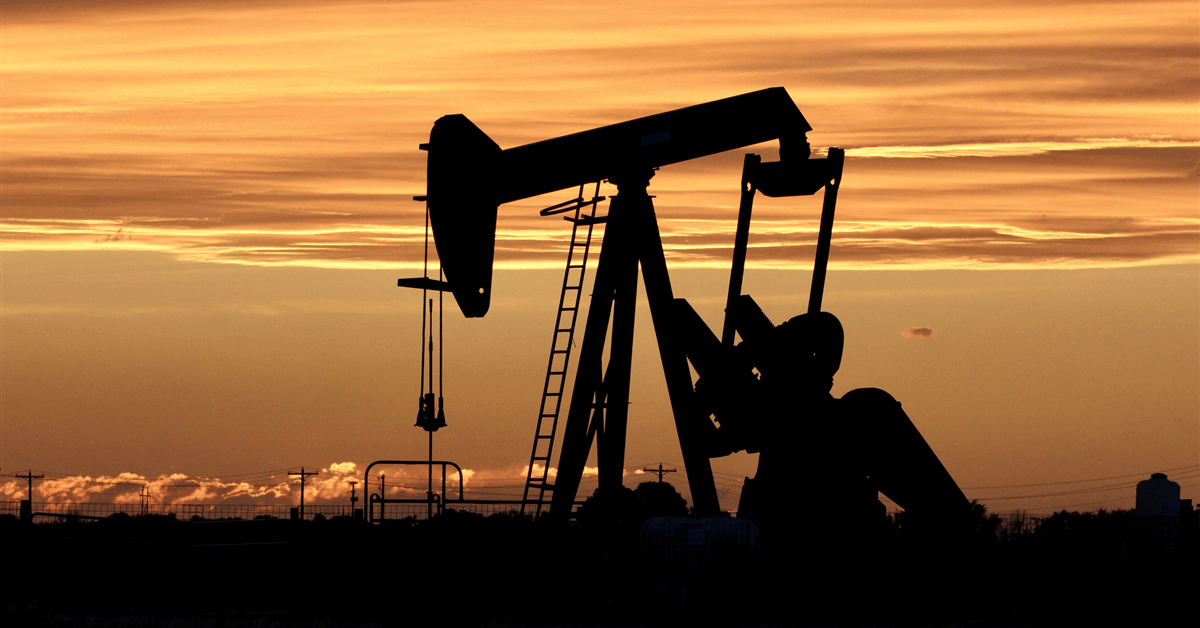

A slew of tax credits administered by the Treasury Department also made the list, including a $7,500 credit for the purchase of electric vehicles that has been targeted by Trump. But tax breaks for nuclear power as well as subsidies enjoyed by the oil industry, such for enhanced oil recovery and marginal wells, also made the list.

Firefighting programs at the Department of Agriculture, programs worth billions to shore up the US electric grid and several climate research programs at the National Oceanic and Atmospheric Administration were also targeted.

Just because a program was included on the list, doesn’t mean it will be permanently frozen or eliminated. The document specifies the government wants information about anticipated payouts through March 15.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

MORE FROM THIS AUTHOR

Bloomberg