A spike in energy prices has prompted developers to warn the UK is too reliant in imported gas as the government launches a new subsidy.

Energy regulator Ofgem has revealed an increase in the energy price cap for April-June 2025.

This will add £111 a year for many British households to £1,849 in April, the highest level in more than a year.

In response, the government has unveiled plans to expand a warm home discount, giving eligible households £150 off their energy bills. This would bring around 2.7 million households into the scheme – pushing the total number of households that would receive the discount next winter up to an estimated 6.1 million.

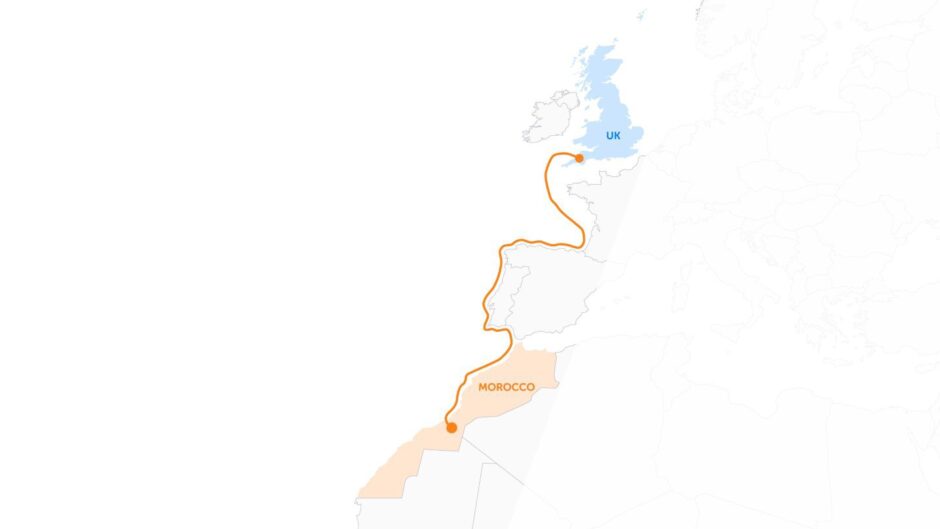

The move prompted the chair of a company planning to bring wind and solar power to the UK from Morocco via 2,500 mile (4,000km) subsea cable to say the spike showed the reason why the UK needs to diversify its energy system.

© Supplied by Xlinks

© Supplied by XlinksSir Dave Lewis, chair of Xlinks and former Tesco boss said: “The UK already has amongst the highest energy prices in Europe and this latest hike will pile further pressure on long-suffering consumers.

“This highlights the pressing need to further diversify our energy system and reduce this country’s reliance on expensive imported gas, particularly during periods of high demand and low domestic renewables production.”

The firm has said its Xlinks Morocco-UK power project could help balance the UK grid and improve resiliency when it launches in the early 2030. It is currently in discussions with the UK government for a contract for difference (CfD) to help fund the scheme.

Worrying

Launching the subsidy, energy Secretary Ed Miliband said: “This is worrying news for many families.

“This government is determined to do everything we can to protect people from the grip of fossil fuel markets. Expanding the warm home discount can help protect millions of families from rising energy bills, offering support to consumers across the country.

“Alongside this, the way to deliver energy security and bring down bills for good is to deliver our mission to make Britain a clean energy superpower- with homegrown clean power that we in Britain control.”

Residents in England and Wales qualify for the warm home discount if they get the guarantee credit element of Pension Credit or receive a means tested benefit and have high energy costs.

Those living in Scotland qualify if they meet those criteria or meet an energy supplier’s criteria for the scheme.

The government will also look to accelerate proposals on a potential debt relief scheme to target unsustainable debt built up during the energy crisis.

Department for Energy Security and Net Zero (DESNZ) said this would be an “important first step” to cut the costs of servicing bad debt, which is currently contributing to higher bills for all billpayers.

Ofgem CEO Jonathan Brearley said: “Energy debts that began during the energy crisis have reached record levels and without intervention will continue to grow. This puts families under huge stress and increases costs for all customers.

“We’re developing plans that could give households with unmanageable debt the clean slate they need to move forward. We welcome the government’s support for these plans, and their plans to expand the warm home discount, which will also offer financial help to nearly three million more households that need it most.”

Recommended for you

Hydrogen boiler trial yet to receive safety approvals amid ‘explosion’ fears