Uniper SE on Tuesday reported EUR 82 million ($93.2 million) in net income for the first quarter (Q1), down about 83 percent from Q1 2024.

Adjusted for non-operating impacts, the bottom line is a net loss of EUR 143 million, compared to EUR 581 million in net profit for Q1 2024.

However, sales rose from EUR 17.98 billion for Q1 2024 to EUR 21.26 billion for Q1 2025.

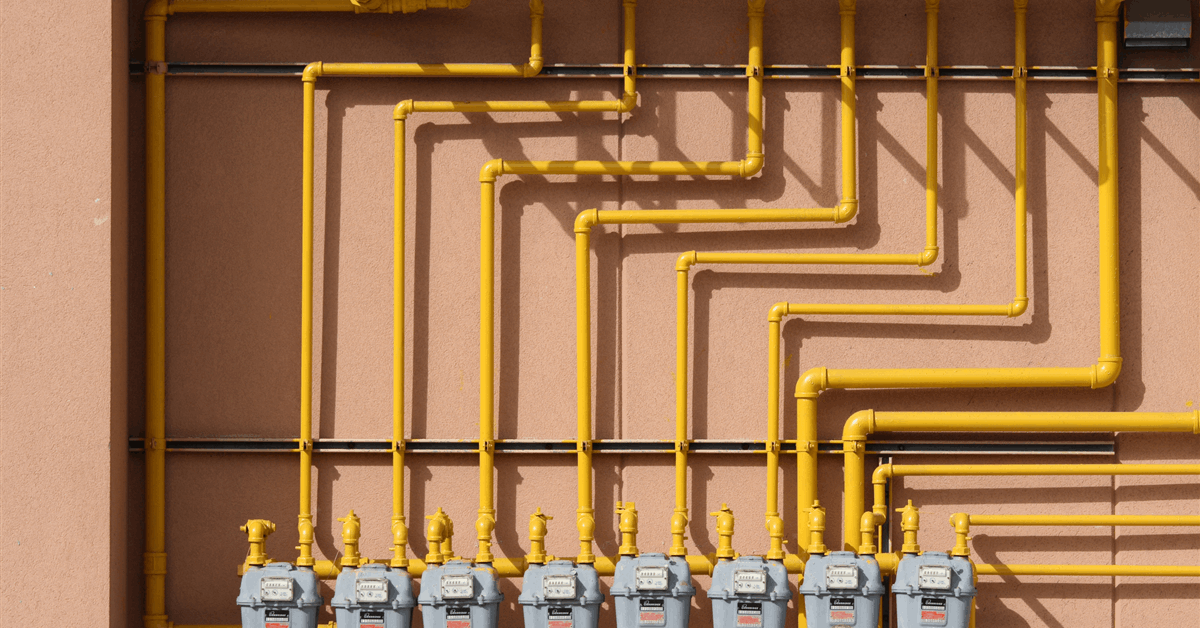

The Green Generation segment generated EUR 246 million in adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) for the January-March 2025 period, down from EUR 278 million for Q1 2024. “The continued decline in price levels in Sweden led to lower earnings at Uniper’s nuclear and hydropower businesses there”, the Düsseldorf-based gas and power utility said in an online statement. “Exceptionally high water levels in reservoirs, resulting from high inflow due to a mild winter, had a significantly adverse impact on price levels particularly in the northern regions of Sweden.

“However, the decline in earnings in Sweden was largely offset by Uniper’s hydropower portfolio in Germany, which delivered a positive earnings performance relative to the first quarter of the prior year thanks to a more favorable market environment”.

Flexible Generation logged EUR 161 million in adjusted EBITDA, compared to EUR 656 million for Q1 2024. “The decline is particularly attributable to a reduction in earnings on hedging transactions on the fossil trading margin due to the general decline in price levels”, Uniper said. “In addition, the decommissioning of Ratcliffe power plant in the United Kingdom and Heyden 4 in Germany, the sale of the Gönyu power plant in Hungary, and the transfer of Staudinger 5 and Scholven B and C power plants in Germany to grid reserve had a negative impact on earnings compared with the prior-year quarter”.

Greener Commodities registered negative EUR 492 million adjusted EBITDA, worse than the -EUR 13-million recorded for Q1 2024. “Past optimization activities in the gas portfolio had a negative impact”, Uniper said.

Chief financial officer Jutta Dönges said, “It was already foreseeable last year that the exceptionally good results of the prior two years would not be repeated at the same level this year or in the years ahead. As already announced, earnings still reflect significant effects in our gas business from the crisis year, but these should be overcome by the end of this year”.

Uniper affirmed its 2025 projections of EUR 900 million to EUR 1.3 billion in adjusted EBITDA and EUR 250 million to EUR 550 million in adjusted net profit.

It ended the quarter at a net cash position of EUR 2.56 billion, despite a EUR 2.6-billion compensation for Germany for the government’s bail-out of the company in 2022.

To contact the author, email [email protected]

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

MORE FROM THIS AUTHOR