Dive Brief:

- Nuclear power’s long-term role in the U.S. electricity generation mix depends on still-unresolved questions about plant economics, technology selection, federal policy and financial support, fuel availability, waste disposal and public attitudes, analysts for strategic consultancy ICF said in a whitepaper released Thursday.

- Despite interest from utilities and large electricity consumers that has led to multiple planned reactor restarts and several gigawatt-scale partnerships between nuclear companies and offtakers, the industry faces “significant challenges and limitations that will determine whether it will expand its role as a core technology underpinning the U.S. energy system,” the authors said.

- Despite higher revenue potential than most competing technologies, capital costs for new nuclear plants could range from $456/kW-year to $863/kW-year, significantly above those for wind, solar, gas combustion turbines and 4-hour battery energy storage systems, they said.

Dive Insight:

Since 2023, the owners of three recently retired nuclear power plants — the 800-MW Palisades plant in Michigan, 835-MW Crane Clean Energy Center in Pennsylvania and 601-MW Duane Arnold plant in Iowa — have announced plans to resume operations. The Pennsylvania restart is supported by a 20-year power purchase agreement between Microsoft and Constellation Energy.

Meanwhile, “hyperscale” tech companies like Amazon, Meta and Google have inked tentative partnerships with advanced nuclear technology developers. Data center operator Switch and steelmaker Nucor have shown interest in advanced nuclear as well.

In December, Switch and Oklo announced a 20-year, 12-GW nonbinding “master power agreement” through which the advanced nuclear company would develop, build and operate nuclear plants to power Switch facilities.

“Should these new investments in nuclear energy come to pass, they could make a dent in the growing electricity demand. But a nuclear renaissance isn’t written in stone,” whitepaper authors Ian Bowen, Dino Vivanco, Vinay Gupta, George Katsigiannakis and Shanthi Muthiah said.

Technology selection and design standardization are vital considerations for the industry, whose operating commercial fleet features more than 50 different reactor designs, the authors said.

“For nuclear costs to decline in the United States, the nuclear industry needs to pick a design and stick to it,” they said.

The advice echoes similar guidance in the U.S. Department of Energy’s September update to its Pathways to Commercial Liftoff: Advanced Nuclear report. DOE recommended a “consortium approach” similar to Boeing’s 787 Dreamliner development process, targeting “serial deployments” of five to 10 reactors of the same design.

DOE also suggested deploying a mix of large reactors, such as the 1,117-MW AP1000s commissioned earlier this decade at Georgia Power’s Plant Vogtle Units 3 and 4, and 50-MW to 300-MW small modular reactors, which experts say are easier to site and cheaper and faster to deploy.

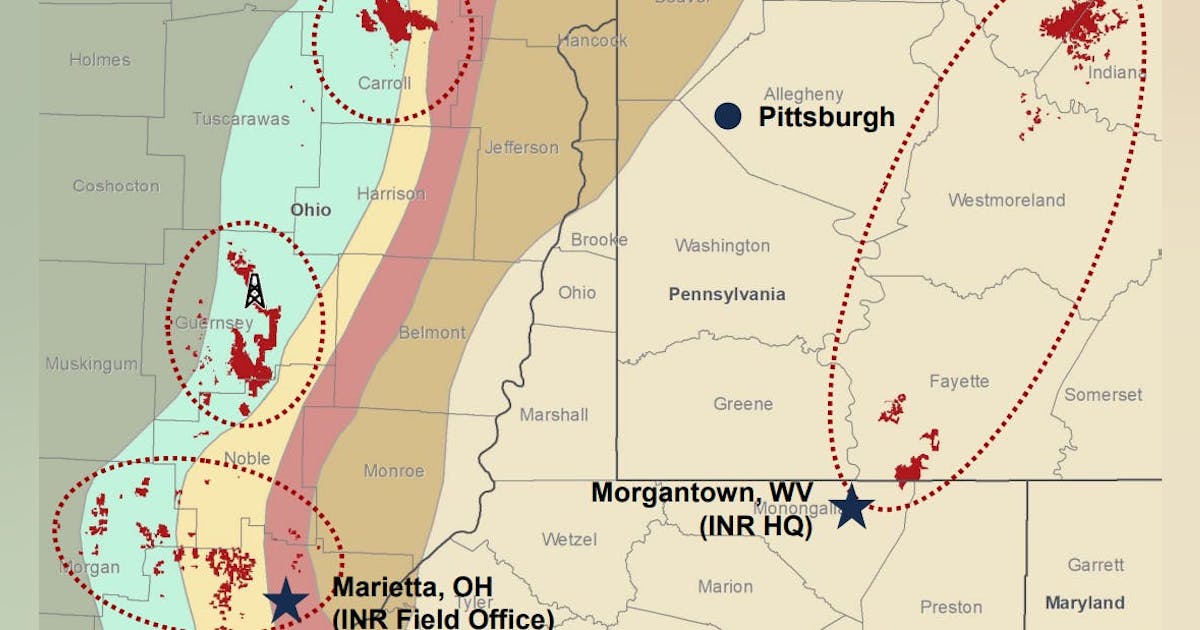

SMRs are better-suited to siting at retired coal-fired power plant sites, where they may take advantage of existing interconnection rights, the ICF authors said. In a report last year, DOE said the 145 coal power plant sites it examined could host as much as 174 GW of nuclear capacity, while 41 existing nuclear sites could host up to 95 MW of additional nuclear capacity.

Any “nuclear renaissance” likely depends on continued federal support for existing and new nuclear, the ICF authors said. Without the investment tax credit authorized by the Inflation Reduction Act of 2022, new SMRs are much less likely to pencil out and Congress may need to extend the credit beyond its 2032 expiration date to support larger-scale deployments following an initial group of demonstration projects in the early 2030s, they said.

Owners of restarted nuclear reactors are more likely to claim the production tax credit authorized by the IRA, the authors noted.

Both the investment tax credit and PTC face an uncertain future as Congress considers eliminating or sunsetting IRA tax credits to pay for a 10-year tax cut extension the U.S. Treasury Department expects to cost $4.2 trillion. Twenty-one House Republicans signed a letter this month urging GOP leadership to retain the IRA’s clean energy tax credits. But it’s unclear whether those legislators will hold the line when the final tax package comes up for a vote, Boundary Stone Partners co-founder Jeff Navin told E&E News on March 24.

“I think the clean energy industry and the people who are benefiting from the IRA are in a little bit of a state of delusion at the moment,” said Navin, who also serves as director of external affairs for advanced nuclear technology company TerraPower.